Growth, Funding, Pivotal Moments and the Evolution of Adzerk to Kevel

BoS regulars will know James Avery, founder of Adzerk, recently renamed to be known forevermore as Kevel. We caught up with him following the announcement of an $11 million funding round for the 13 year old SaaS business which he describes as, ‘Seedstrapped’. We talk growth, funding, pivotal moments and the evolution of Adzerk to Kevel

We cover:

- The origin and growth of Adzerk

- His attitude and approach to taking outside funding and finding the right money at the right stage for him

- Some of the BoS talks that had an impact on his company, including changing its name to Kevel

- Why he doesn’t worry too much about what might happen in the future

Food for thought for anyone on the Long, Slow SaaS Ramp of Death…

Video, transcript and links to talks James has found particularly impactful as he built Kevel below…

Transcript

Welcome and Introductions

0:01 Mark: So, Hello, everybody. It’s Mark Littlewood, from Business of Software. delighted to be joined today by a very long term. attendee from Businesses of Software Conference, both US, Europe and online. It’s James Avery, who, six months ago would say he was from Adzerk, but now he’s from Kevel. So, let’s welcome James.

0:25 James Avery, Kevel: Hey, Mark, how’s it going?

0:26 Mark: It’s really good, James. And so nice to see your cheery face. And where are you? And how are you surviving lockdown?

0:35 James Avery, Kevel: Yeah, we’re actually we, we decided to take a little break of locked out, of course, like everybody else, we’ve been stuck in our house, working from home, kids are going to school from home. But we decided to rent a house down at the beach. We live in North Carolina. So, we’re down at a North Carolina Beach in the winter, which is actually surprisingly nice. It’s not as cold as you might think. And it’s pretty relaxing to work by work by the ocean. And if we had to be stuck at home, might as well be somewhere kind of kind of fun and interesting.

1:05 Mark: Yeah, well, I’m sure we’ll get the implications of remote working and working from home and where home is later on. But can you give us a little bit of background about yourself where you where you came from, and how you came to start Adzerk? And just talk us through what it’s been doing over the years? Because you’re one of those overnight sensations, right?

Starting Adzerk, an Overnight Sensation

1:33 James Avery, Kevel: Yeah, overnight, meaning I think, what did I start working on? It was 2007, which I realized is 13 years ago, which feels like a very long time. But it’s gone by pretty quickly. But back, but yeah, I mean, back-to-back in like 2007-2008 timeframe, I actually acquired a small ad network. So, this was focused on software developers, specifically, for dotnet software developers, this very small ad network, I ran those ad networks for a couple years, and realized that that was a terrible business. Like, it’s essentially just sales and a constant churn of sales, because you’re just, you sell this month, and then you got to sell the next month, and you got to sell the next month. And I realized I really didn’t want to run these businesses. And I was a software developer before. So, I had been building all my own software to run these ad networks. And I realized that software was so much more valuable than the ad networks I was running. So, I sold off the ad networks, not for a lot of money, but basically enough to like, be able to focus on the software.

2:43 Mark: Yeah.

2:44 James Avery, Kevel: And this around 2009 I started the company that became Adzerk right around when I went to my first business of software in San Francisco.

2:57 Mark: That’s very timely.

3:00 James Avery, Kevel: But yeah, so I started it started back in 2009, it took a little while to get a real customer of the ad network, the software to kind of run display advertising and things like that. And then in 2010, we got our first customer. In 2011 we raised money. We raised like a seed round. And really on the idea of like, Oh, we can really accelerate and, and be off to the races. And that wasn’t what happened.

We raised money and I thought once I can hire a salesperson, things will really just accelerate. But they really didn’t, they kind of, just started growing slowly and gradually. Right? And just a slow, gradual growth. And we also learned that kind of the market we’re in wasn’t the best. Like we were targeting people doing kind of traditional display advertising, which, is pretty much dominated by Google. And so, it took us years, like a couple years later, we realized that our API’s is why we were signing customers. So, we started to lean into that. And then that led to a couple more years of working on the APIs, getting more and more customers on the APIs. And then we realize we’ve been like underselling our product by 1000 times, like really selling it way too cheap. Which actually reminds me of a good like Joel Spolsky thing that I heard at BoS one year where he’s just like, just double your price, like everybody in the room, like he’s just doubling and, and you always there’s always so much fear around doing that. But then when you do it, it usually works out very well.

4:50 Mark: Patrick Mackenzie’s always saying that as well. Yeah, you have to increase the prices. until people scream.

5:02 James Avery, Kevel: And then so that, that gets up to like, 2016 17 we hadn’t raised any more money, we got back to profitability. I think BoS is always interesting, right? Because you have people who have raised money, but then you also have a really strong culture of, of bootstrappers, right, like the people who are very against raising money. And so, I started to feel more at home there, now we’re breakeven, we’re growing like, we’re growing profitably. And then we, we started to sell like big enterprises. So, like, in 2016 17, like, we closed like Ticketmaster and Bed Bath and Beyond, and wow, all these, like, large customers, and realize that we really had a big opportunity. How do we, how do we keep growing this? How do we keep scaling? And so, it’s about 2019, when I said, Hey, like, we should really, we should probably raise money, like, and I think, especially if like the BoS audience, where half of it is very anti raising money. I think, I think we raised money for the right reason, which was we couldn’t keep up with the growth and the people that wanted to use us. Yeah. Especially in like a SaaS business where it’s like, okay, we sign a customer. it’s probably it’s like, usually about three months or so for us to like, get a customer signed. And then there’s like, a couple months, where they’re like, on ramping and learning how to use the product and getting ready to launch, right? Then they launch and, maybe they and then we send their, their first invoice, maybe they’ve already had it, but then they maybe pay 30 days later. Yeah. And so, it’s like a six-month lag between when we make that first conversation, maybe you’re spending money on marketing, or whatever, and then six months until we get a check in the bank. And so, doing it profitably, it’s like you’re really always just six months behind.

The Good and the Bad of Taking Money

6:17 James Avery, Kevel: Yeah, it’s an interesting thing with the BoS crowd. Some people say it’s anti VC, or investment, and I think some people are, so it’s a broad church, but I think that most people understand the difference between raising money because you’ve got something that you couldn’t grow and scale and there’s a reason for doing it. And that that as opposed to starting a business where the principal driver is raising money, because then you kind of work out what you’re what you’re doing. And I think it’s a generally it’s a pretty business focused thing. It’s been quite entertaining over the years, actually, there been a lot of people. I mean, I remember Joel’s talks about never taking money, and what a terrible idea it was – until he until he took money…

8:02 James Avery, Kevel: It comes to like everything else, right? It’s like this. It’s this scenario of, there’s good reasons to take money, and there’s bad reasons to take money. I think the one thing I love about BoS is that they don’t, like I always, bugged me when there’s like, a big celebration around raising money. Because that doesn’t really do anything, right. I think BoS is much more, hey, let’s celebrate when you hit your first million, let’s celebrate when you hit 10 million. Let’s celebrate when you hit 50 million, let’s not, the fact that you raise 10 million doesn’t mean anything yet. Which is very true. Right? Like, it’s just, it just raises the expectations of what you’re going to do.

8:40 Mark: Yeah, I mean, there’s an adage that celebrating raising money is like a chef, celebrating being given the ingredients for cooking, but actually, it’s being given the money to go and buy the ingredients, you can still go and buy some terrible ingredients. And if you’re me, you can mess them up. So you said when you were raising money, first of all, not in the first tranche, because presumably, that was an angel. Round? Yes. friends and friends and family.

9:20 James Avery, Kevel: Well, my friends and family don’t have any money. So it was it was other people’s friends and family. So the first time we raised it was like $650,000, which was more than it is now because it was in 2011. Right? Like That was your average kind of seed round back then probably. And then we ended up raising a little bit more along the way, just from the same investors just basically to stay alive. Right? Like we took another million I think over the next like two or three years before we could get to profitability,

9:58 Mark: Were those difficult conversations going back to the investors?

10:02 James Avery, Kevel: They weren’t too bad. I mean, we kept showing traction, and we kept showing growth. And so for the current investors, like, for the most part, they were, they were pretty happy to write another check, I’d say some, some more than others. That’s the one thing people don’t realize, like I saw somebody recently do a round with like, 30 angels in it. And I’m like, they’re not going to move as one, right? Like, you can have one you can have a handful of angels are really upset that you’re raising more money or that you haven’t gotten to where you say you have some that are super excited about where you’re going. And so, it’s really a, they’re all unique individuals, and they’re all going to act independently.

Debt and Alternative Sources of Funding

10:41 Mark: Yeah. Interesting. So, you took some debt?

10:47 James Avery, Kevel: Yeah, we did. It was a couple years ago, we used that we worked with Lighter Capital. Actually, I think I’ve said before they should be sponsoring BoS. It was good for us, because it wasn’t a lot of debt. And really, it was to really help close that gap a little bit on the accounts receivable side. Yeah, when you look at it, you just say, oh, if we could access, a million dollars of this accounts receivable that we have sitting out there now, like that would help us grow a lot faster. And you can do it at a much better interest rate.

Thinking About Equity Investment

11:22 Mark: And were you considering equity finance at the same time? Did you weigh out the pros and pros and cons?

11:30 James Avery, Kevel: We weren’t. The thing for equity with me, another thing I think is interesting to talk about is, I think when you talk to some people at BoS, a big reason they’re not a fan of the VC model is, I don’t know if I stole this from somebody or if I came up with it, but they’re trying to launch rockets. They’re like, we’re going to launch 10 rockets, one of them’s going to get to the moon. And that’s great, because we’re on all 10 rockets. Yeah.

I’m on one rocket, right? That rocket blows up on the launch pad or whatever. Like, that’s, that doesn’t work for me. And so, that’s the the VC model that I think a lot of people with BoS have a hard time with. One of the things when I realized that we might raise money, again, is I realized I didn’t want to raise from that traditional kind of VC group. Like, there are other options, like once you get to a certain size. Yeah. And so, we were big enough that we were looking at other options. How do we use the debt to bridge us to the numbers we needed to raise from the more growth equity? They’re kind of between private equity and venture capitalists. Their goal is to make every company successful. Now, some are, some are 3X for them, and some are a 10X and some are 5X. But they don’t model it like VCs, where it’s like a bunch of zeros and a 100X.

13:03 Mark: That makes sense. So, for your debt, how was it structured? Was that something that you could pay down? Or do you still owe?

13:17 James Avery, Kevel: We paid it off. We paid it off as part of this fundraising. But I mean, we had we had, we did a couple things with Lighter, like, the first time we did more of a kind of a term loan, really. And so, you can kind of have a term loan, and just pay it back. I wouldn’t say it’s the interest rate you’re going to get buying a new house, but it’s not credit card interest rate either. Then we switched to a product that was a lot better, which I highly recommend, a line of credit. It’s just a line of credit we could use when we needed and, pay a lot less interest over time during that.

13:59 Mark: Right. So, tell me about the fundraising. Mr. Chef, how did you get the money? Yeah, those ingredients?

14:07 James Avery, Kevel: Yeah. So yeah, we start I started in kind of fall of 2019. So, I said, I realized, okay, I think I think we know we do want to raise money. He talked to the board, they agreed and started going out to the kind of investors we wanted.

14:23 Mark: Let me just back up a second. So, you just tell us where the business was at that point, because you’re based in in Raleigh, and that’s your headquarters, but you’ve expanded into other markets, how many people would ever company what were they doing?

14:41 James Avery, Kevel: Yeah, so it was so actually our headquarters is Durham, but I live in Raleigh, but they’re real close to each other. But people would correct me. Yeah, sorry. Yeah. So, I mean, so we had about 30 America. So, we had about 30. It’s about 30 people at the time. And we were we had kind of really started to already embrace remote working, like we had, we had the team in Durham, which is about half the team. The rest were, we had a hand with a three in San Francisco and like a small office there. We had three in London. And then we had a lot of people that are just remote, right, just working in random. US states and honestly, one of the guys in London lives, He lives far enough outside London that he never goes in, right? He doesn’t he doesn’t need you to do his job. So, while he’s quote unquote, London, he’s probably an hour away on the train.

15:38 Mark: That’s anywhere in London. Um, what was that? What were those people doing? What was the what was the kind of split of functions?

15:53 James Avery, Kevel: Yeah, so we we’ve usually been about half and half when we look at like product engineering, and then sales, marketing operations. And then overhead, which is what I call myself on the budget. We’ve always tried to be pretty engineering and product heavy, just because we are, we’re, we’re built for developers and product managers. And so, we have to really keep up with Yeah, with everything that’s going on, and making sure we can really support them. I always think there’s a couple different products, right? There’s like the sales driven product, and there’s like the product engineering German product. And we’ve always tried to be the product engineering driven product, just because that’s where I think I’m more skilled, and less so on the sales side, right? You can find some guys out there gals, like have a simple, simple tool that they just sell into the ground. Right? It’s like five engineers, 50. Salespeople. And it feels, maybe it’s a lot easier, but I guess the grass is always greener on the other side.

17:00 Mark: So, what was the thinking behind the fundraising?

The Goals of Funding

17:07 James Avery, Kevel: The goal, a couple goals were one was to raise money from a group who understood what we were doing, wasn’t looking for a zero or 100X, but was looking to help us really be successful. And then it was to accelerate what we were currently doing. We weren’t, looking to pivot, we weren’t looking to really dramatically change how we ran the business, we wanted to keep, I wanted to keep running the business. We wanted to keep the board, the people who had on the board for five years for them to be able to stay obviously, adding new people for the new investors. But the parameters were raising, it was between $5-10 million, raise enough for a couple years of runway to really accelerate with sales and marketing also continue to grow engineering and product.

SEEDSTRAPPED

17:26 James Avery, Kevel: We were, I like to call it, ‘Seedstrapped’.

It is a term I’m trying to get out there. We weren’t bootstrapped, that’s a very clear definition of what bootstrapped is. But we were seedstrapped – we raised the seed round, then got to profitability. When you do that, just like bootstrapping, you need more resources everywhere. You’re behind everywhere, right? And so, people asked, specifically, where do we want to invest? It’s like, everywhere, we need to invest everywhere. Because, when you’re running bootstrap, or seedstrapped, everything needs more resources.

18:36 Mark: I love the concept of seedstrapped. I shall steal it and credit myself. Yes. That’s great. I love it. I love it. Okay. So, you were looking $5-10 million? Was that a difficult number to raise? People always say that the hardest number to raise is what you’re actually raising when they talk about investment gaps.

Fundraising Strategy and Process

19:15 James Avery, Kevel: It wasn’t too bad. I mean, obviously, like we talked to, some like growth equity groups actually is a really good way to eliminate the ones we didn’t really want to work with right now. Because someone would say, oh, our minimum check size is 30 million. And I’m like, Yeah, like, that’s one that’s not the size company. We are like, it doesn’t make sense for us to raise money. And then to, those I think a lot of times, if they’re doing those kinds of checks in the size company, we are like they’re trying to buy a majority. They’re trying to control it. They’re trying to roll it up. They’re trying to do those sorts of things where, yeah, I would. I’d come join the team. I’d be that guy volunteering at the BoS Conferences there.

19:57 Mark: And what can you say about that, in terms of kind of finances of the business when you were raising? And what sort of revenue were you running? Was it profitable?

20:15 James Avery, Kevel: Yeah, we were we were I, I’d say breakeven, right, like profitable assumes, like, you’re actually like generating some sort of real profits. Our goal was always to run it at just breakeven and put every dollar we could back into growth. Yeah, of course, like, revenue wise, like, we’re like, close to 10 million a year in revenue. So, like, right in that range, where it’s also it’s interesting, because we didn’t, we don’t fit into like, the traditional VC route anymore, either right? Because like the, this is technically our A round, but nowadays in a round in VC is like somebody’s doing, a million in revenue. Yeah. And so, we kind of fit more with the traditional, like, be round, right? Like, like, be rounded VC, but then they’re usually invested in companies that raised 15 million series A, yeah. And so that company is like 4 million in revenue, but they grew from that, like, it was a year and a half ago, they were at zero. And that wasn’t it, right? Like we really did this, this long, slow kind of ramp over time. Yeah, that’s slow, but not but not like venture speed.

21:22 Mark: Right? Yeah, there are different measures that I mean, there are different metrics, I think that VCs will use for different types of companies and different markets. And revenue is a great metric, particularly if you’re running your own running your own thing. But there’s plenty of land grabs, and all sorts of other strategies.

21:49 James Avery, Kevel: So that’s they do is that I was going to say, growth rate is the more important metric right now to most people, like they care more. They would rather see you at a million dollars in revenue that you grew over the last six months, then to see you at 2 million that you grew over the last 18 months.

22:07 Mark: Yeah, yeah. So, you had, how did you how did you go about choosing the VCs? You talked a little bit about, then some of them are obviously too big, too early, that the wrong? Presumably, there’s like a pool of kind of Goldilocks people that are that are the right sort of right sort of people? How did you how did you decide who you wanted to work with? Yeah, so we went through tons of conversations, some people too big, some people too small, identified, I think it ended up about 10 or 12 ones that felt really good and are in the sweet spot, like investing in the type of companies who want we wanted to, see, right amount, it’s kind of the right approach, right, like minority stake, not majority. And so, we went like, pretty deep with those 10 or 12, right, like you share every bit of information you’ve ever had about your company and things like this and then ended up getting his two term sheets in q1 of 2020. Which is great, like, you want to get at least two right?

Fundraising in Times of COVID

Then COVID hit. So right, when we were at the finish line of our plan, fundraise, the, I think, watching the stock market, right drops, like 10% a day for like a period, everybody goes to lockdown. Essentially, everybody we’ve been talking to was kind of like, hey, like, let’s, let’s see what happens. Yeah, right. So, it was it wasn’t like I, like, we hadn’t, we hadn’t gotten to the point where it was kind of like the point of no return or, we like made a commitment. It was kind of like we could, there’s still a lot of options on the table. But every everybody was like, hey, let’s, let’s see what happens.

23:56 Mark: Yeah, we do business. Yes. What’s going to happen in marketing departments, right, advertising?

24:04 James Avery, Kevel: Like, most of the firms that, you talk to, like, there’s there was definitely like that one- or two-month period, where they were just, like, they were, I think some of them were unsure if, their investors were going to keep writing checks, right? Like, it was just really like, nobody knew like, it’s, it’s crazy now, like nine months later, whatever, how, how crazy the stock market and everything is gone. And then the sentiment of the world to remember that, like nine months ago, everybody was having these conversations of like, well, like, what if this is it? You know?

24:43 James Avery, Kevel: So, it was all iced, basically, everything just got slowed down. Right. So, it’s like, I think we were kind of marching towards the finish line of the process. Everything got slowed down, but we got lucky in that, after that first kind of couple months. period of where everything slowed down like things pick back up pretty quickly, we actually picked up another term sheet, and then we ended up doing the deal back in the summer. So, we just announced it, but we actually did the deal back in August. So, managed to get the deal done still, with the firm that we liked the best out of the one that we had multiple term sheets. And I think when it came down to was just, it wasn’t like raw terms. Like, I think we could have gotten the slightly better terms, potentially. are we actually yeah, we had some slightly better terms on the table. But it was funny, the group that we thought would really be like, good, like partner on the business. Now, there’s no illusions, are there still an investor, they still have to, they’re they have to make their return, but also really seem to understand what we’re trying to do. Yeah. And that was the key thing was just understand that we want to be this development platform, that we want to be an API that we’re going to make decisions that lean towards that, that may not be the decision that makes the most money in the next eight months, but it’s going to be the skin that makes the most money in the next eight years.

Plans for the Future

26:01 Mark: Yeah. And what’s their expectation? Or what they, what discussions have you had, in terms of them realizing the investment? I guess one of the things about going into growth capital is that there are a number of options open to new, traditional IPO routes, and potentially trade sales or being sold on to another. Another, another private equity firm, but right, they want to, they want to get a return at some point. But what’s the general strategy?

26:40 James Avery, Kevel: Yeah, I mean, like you said, they need to get a return at some point. One thing I love, too, is that the guys we raised with are more, they’re a little more patient than some in the growth equity world. Right? Like, they’re not, they don’t have a three-year horizon. it’s longer than that. But yeah, there’s tons of options, right? I mean, my preference would be IPO. Right? Like one day, one day we IPO. But then also, if it comes time to where they need to realize, their investment, and we’re not ready to do that, then you always can go, you just go to the next, the next person up the chain, right, you just go to the larger growth equity group, or the larger, or the smaller private equity group and you sell part of the business, we still have to sell all of that, but could provide a return on investment.

27:29 Mark: Yeah, very interesting. And at the point that the institutional investors came in, what happened to the angels? Are they still in were they putting more into it? They have an exit or partial exit today?

27:44 James Avery, Kevel: Yeah. So, we spent a long time not a long time, long time. For like, nine years. Yeah, we actually we did provide an exit for the people who wanted to. So, a lot of the angels like individuals were like, Hey, man, I’ll let it ride. Like you guys are doing good work. Like, why sell now I want to be there. When you, get huge. Some of the funds like this is where you got to get back into like, fun life and things like that. Some of them were like, hey, we went through this nine years ago, we’ve got to close out because our fund is 10 years old. So, they exited when they could. Then angels who put a lot of money in could sell some part of it, which I think is great, too, right? Like, they don’t realize some gains and not have to wait another five or 10 years?

Learning as a CEO and Founder

28:35 Mark: Yeah, that makes that makes perfect sense. So, you’ve been going for a long time. And we have this thing that we call a BoS number. And the higher someone’s BoS number, the more we like them, obviously. The BoS number correlates to the number of conferences you’ve been to and you’re in the teens, which is pretty cool. You’ve been coming very regular in that regularly to the US event and also to the European one. Thank you feel support, but I guess, you’re not like an investor, you’re not doing that just to be nice to me. What do you want to get out of the conference?

The Culture Map

29:24 James Avery, Kevel: Yeah, it’s like so I have to go, there’s some conferences I have to go to for work, right. Like they’re the ones where you’re going to meet people and things like that. And that’s, that’s work, right? And then BoS has always been the one conference I go to for kind of me. And I think there’s like a couple reasons, which is one, I always tell people that I never leave a conference without at least like one tactical thing. I’m going to go home, go back to the business and do right and a lot of times it’s two or three, but there’s always at least one where I’m like, that’s exactly what we should be doing. Like, I remember one good one was like the culture map that was a couple years back three or four years back probably. You got Alex Osterwalder to put everybody through this culture map – he always makes everybody work, right, which some people grumble about, but he always puts the audience to work.

Alex Osterwalder Culture Map Onstage BoS 2015

30:21 James Avery, Kevel: We did this culture map, and I realized, like, Eric, this is kind of earlier on in the ads, there were like, 15 people, I was like, I, I love where our culture is right now. But how do we keep that as we go, as we start to double and then continue to scale?

Using that culture map and working through it with the team, like we were, we were able to really, identify the things we loved about our culture that we wanted to keep, while we scaled, I think it’s gone pretty well. But then I think the other part is, there’s the tactical part of BoS, which is, part of how I, I justify paid for it for the business, right? Like, it always pays off as good ROI for the company.

Recharging and Inspiration

But then, the other part of BoS is, I feel like there’s a part that’s kind of, like motivation, and, like, therapy, right? Like, I feel like I always go to BoS. And when I leave, I’m always more excited than when I can, like, excited to go back and work on the company and continue to grow and continue to scale it. Like it’s recharging. And I think like for that a big part of it is, there’s the community like they’re seeing the same, a lot of the same people every year talking to people. But honestly, the thing that that really recharges me the most is hearing like founder stories. Right. Like when you know whether it’s like Peldi talking about the good or bad of what’s going on at Balsamiq, or it’s Dharmesh, talking about here’s how things have been going at HubSpot, or here’s the things we learned, like those stories really just recharge me, and inspire me more than anything. I think that’s the top off every year for the battery you need to keep doing this day in day out.

Peldi Sharing the Truth of Entrepreneurship BoS Conference

32:07 Mark: Yeah, it’s interesting. I mean, that’s something that a lot of people say. I think most conferences would claim that’s one of the things that they bring, but you can really feel that at BoS. That’s a very big part of why people find it valuable. I’ve been quite surprised this year, to be honest, how much people have enjoyed spending time with us online. We’re all working from home, spending time on zoom and doing things with family or work colleagues. Just spending some time and having a chat with people that are not directly impacting on your own business, perhaps have some things in common. I think it’s really powerful.

Virtual Events

33:06 James Avery, Kevel: Yes, so I love the I love the virtual conference this year, I’d still miss the in person. So, one day, I really hope to be back do it in person.

33:21 Mark: It’s a lot of work. It’s a lot of work, put it together, obviously. But it’s amazing how much how much energy we get out of it, and how nice it is to see people and just spend time with them. And I think that’s something that we’re all we’re all missing to a greater or lesser extent. But notice those times we’ll come back and like, honestly, I think probably not in 2021. I think there’s this sort of big thing around that we’ll see how long it takes to roll vaccines out. And how all of that how all of that goes. But there is something potentially risky about a an international gathering of people prepared to sit on an airplane for however many hours to get together and then hang out. So yeah, we’re very focused on making things work on work online. And yeah, can’t wait. I mean, it’s been horrible for us as conference organizers, but it’s also been a great opportunity. And I’d say that at the beginning of this, we took a pretty long-term view of it and I slightly tried to put a brave face on it, probably not very successfully. It’s is a great opportunity to rethink and develop and I think we’ll have a much stronger business as a result of it. I think we’ve been pretty lucky to maintain the quality of people in the network, and that has a value in and of itself. And we’ve also learned some that there are some things that just work really beautifully online in a way that you can’t get in a physical event, but like not lobsters, they don’t come jumping out there.

35:20 James Avery, Kevel: It’s a good point. Yeah. Because I think people who maybe wouldn’t take the leap to go to Boston or Cambridge will do an online event, and then they’re going to see how great it is. And yeah, 2022 can be the blowout BoS, you don’t want to make it huge, but I think it’d be great. It’ll be a lot of energy of people coming back for the first time. And, and people who maybe have done virtual for a year or two now and like, get to one go to one in person. I think it would be fun. But yeah, I remember at the beginning of COVID, I was signed up for the European BoS, what was supposed to be like the last week of March

36:00 Mark: 22-23rd of March. So, the difference between 22nd and 23rd of March is that on the 22nd, the UK wasn’t in lockdown. And on the 23rd it was.

36:12 James Avery, Kevel: Well, I kept saying, like, everything was happening, I kept telling my wife, I’m like, if Mark does it, like, I’ll be there. And she’s like, you can’t leave the country in the middle of a pandemic, I’m like, look like if I trust Mark, if he thinks it’s safe, I’ll put my life in his hands. But thankfully, I didn’t get stuck.

36:29 Mark: And that’s why I made the decision to pull!

36:34 James Avery, Kevel: I’m not living in I’m not living in your shed right now. Because I’m over there. I moved in and you’d have me there.

36:46 Mark: You’re always welcome in Motörshed. What are the big moments, not pivotal moments – because they’ve come to mean something else? But some of the big points in the growth of your company where you’ve had to make decisions? Obviously, raising funds is one but are there any particular kind of points in the in the development to the business where you’ve had to make big decisions? Bonus points if BoS helped to think them through?

37:25 James Avery, Kevel: Yeah, it’s funny, I thought about actually trying to like, I’ll do this one day, maybe on the plane to the next in person BoS event, but to like, map out the BoS Conferences versus like where the company was at a given time. And I can’t remember all the ones I’ve been to, I get to like dig through my Gmail and stuff and find like, the tickets and things like that, because they’ll say, the years blend together. But it was interesting, because it really was like the first Boston within 2009 was when I decided, like, I’ve got to get an offer ad network business. And I want to start this as a software company. And that was a really interesting conference, because it was the only one I went to in San Francisco, it was a very different crowd, right? Because the San Francisco crowd speakers were like Paul Graham and people like that. But it really shows. Yeah. and it made me want to, focus more on the software side of things, and not the ad network side of things really showed me the potential and like, and I already I knew it to some extent, but I think like, like seeing all the things reinforced.

38:26 James Avery, Kevel: But I remember one of the pivotal talks, I saw at BoS and kind of tied to where Adzerk was at the time, was, we raise money and 2011, like started scaling. And it was just going so slow. I know, it’s just like, and it’s like, this can’t be like, this can’t be normal, right? It should be doing something and the graph just shoots up and to the right!

38:50 James Avery, Kevel: It was Gail Goodman’s talk, which is probably one of your most watched, like, previous talks. Yeah. That kind of Long, Slow SaaS Ramp of Death.

Gail Goodman Long Slow SaaS Ramp of Death

The best thing she said in that was, she’s like, we all sit around, and we’d say, if we did x, it would like, cause that number to do it, we go like this, and then that wouldn’t work. So, we do y and y would make a go like this now and, like, make a note. And but she was like, every little thing was just a degree. And so that’s how I had to start thinking about the business was just nothing we do necessarily is going to like really to turn the curve from, 40% growth to, to 140% growth, right? But like, if we can do something to turn it from 40% to 42%, then 42% to 44% like those things just compound over time, and it’s a growth rate so if we can keep up that growth rate and keep growing then then that’s really the secret to think like a good SaaS business. And so that that was a that was a pretty pivotal one.

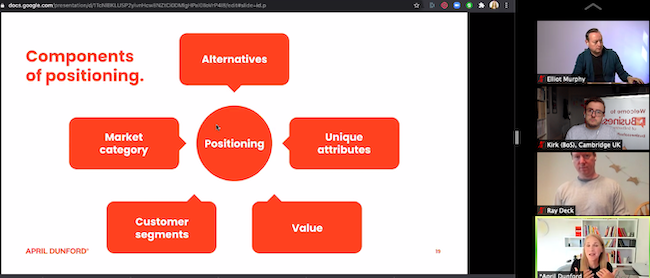

39:57 James Avery, Kevel: Over the years, this is a good it’s another good one… As part of this fundraise, we rebranded, like we rebranded as Kevel, so we’re no longer Adzerk, or now Kevel. And why did we do that? Well, a big part of it was around, Adzerk sounded like an ad network. And we started ourselves kind of behind of where, where we want to be in people’s minds. And I think, part of that comes from, I think one of the best speakers you’ve had in the last couple years is April Dunford, and her talks about positioning and where she talks about positioning, it’s not as much about the brand and your name, right, it’s like, where you’re positioning yourself in the market.

April Dunford Positioning BoS USA

40:38 James Avery, Kevel: But it really got myself and my VP of Marketing, thinking just about positioning a lot more, right, we both read the book, I saw her speak again, at the virtual conference. And when you start to think so much about like, Where, where, where does your company live in your customers mind? Then we realized that, hey, like this small thing, which is just the name of the company, which if you talk to a Fortune company, probably say, it doesn’t really matter. But like, the name of the company was just putting us in the, like, wrong quadrant to begin with, right. Like in their mind, they were thinking ad network ad tech. And what we’re trying to tell them is that no, we’re, we’re an API focused company, on, monetization, right, like in April speak, right? It’s like, we’re We are an ad server, but we’ve layered on the API and the developer tools is what differentiates us from all these other ad servers, right. And so, it was just starting out, starting this up on the wrong foot. And we thought we’re better off with a name that really doesn’t mean anything. But just gives us a blank slate so that we can, decide how, we’re trying to help our customers see us in a certain way, as opposed to them starting out kind of on this on this wrong. Wrong foot.

41:55 Mark: I think I think April’s got shares in KallQwik or something, the number ended up changing their name and changing their branding and as part of a much bigger as much, much bigger thing I think is, is scary. So, yeah, tell us tell us a little bit about the, the, the rebranding and how that’s been, because that’s quite a big thing for you. It’s not going to mean anything to the people that don’t know you. Yeah. Well, yeah. Hopefully, it will just make more sense to them. But has there been any pushback? Have there been any things you’ve been surprised about in in the company? How do you get people to refer to the company is the right company internally?

42:45 James Avery, Kevel: Yeah. Well, I’m still going to, I’m still going to do that for years called the wrong thing. But it’s also okay. Like I, I think it’s like one I’d say like, the effort of doing the rebrand was like this Herculean effort that my VP of Marketing Chris, who’s been to a couple BoS Conferences, he that he took on, right, like everything from, it’s just the amount of stuff you don’t think about that has your company name in it, right? Like every SaaS app you use, like, how do you switch over email? Like how do you do it in a way that doesn’t disrupt things communication to customers communication to investors communication to, all these different constituencies or partners that you have? It’s like, huge, huge effort. So, we’re glad to be on the other side of the valley. Still, of course, there’s always going to be little things that you have to like, clean up. Yeah. Now all of like, our old shirts are collector’s items, like, that’s the that’s the pitch to but yeah, I mean, it’s like, it’s a ton of work, but I think it’s gone really smoothly so far. So, like, we’re pretty happy with it. I think that the feedback we got in the market, nobody was like, Oh, I love the name Adzerk. Everybody was like, Oh, good. You know? Yeah, it was never, never the best name we’re going to come up with. Sometimes you get you get saddled with the name; you randomly register just because you’re lazy. You don’t want to call for that other name. Yeah. Did you say oh, well, my consulting company was called info zerk. And my, my networks were called Zerk media. And so just throw an ad in front of it. Right. But then 10 years later, you’re like, why did we do this?

44:34 Mark: I hear you. I hear you. Fantastic. Well look really nice to really nice to catch up. What are your hopes and fears for 2021? What’s the best thing that’s come out of 2020 for you?

44:56 James Avery, Kevel: I think closing the fundraise and things would be the big best thing for me in 2020.

46:58 James Avery, Kevel: For 2021, the thing I’m most excited about is getting back to any level of normalcy. There’s plenty of things that that worry me, but I don’t live a lot with fear. I kind of roll with the punches. And I know that there’s going to be bad stuff that happens in 2021. Whether it’s losing a deal or a customer or having somebody leave, but that’s just, it’s just part of it.

48:44 Mark: Well, that’s all part of being the CEO and the smiling entrepreneur, leader and all the rest of it. So yeah, I guess it goes with it goes with the territory.

49:01 James Avery, Kevel: Yeah, but it’s the resilience. I think BoS is a lot about that. When I talk about the difference with some conferences, they say they will motivate you and things like that, but they try to motivate you with the guy who comes up and says everything went great. And we sold for this much money. I don’t like it when everyone you hear speak makes it all too sunny. That isn’t right.

49:32 James Avery, Kevel: Something you really want is somebody out there saying, here’s all the terrible things that happened. Yeah, along the way, because it’s kind of its, it’s relatable, right? There are all these other talks, I remember one of Peldi’s, he was talking about that graph, the entrepreneur’s year. We’re down, then this high, then there’s medium. Then, the best part was he says if you zoom in, this graph is the same thing, right? Every day, every hour can be that and I think that’s the message.

One of the overriding messages from BoS that you can take away is that lots of bad shits going to happen, lots of good shits going to happen. At the end of the day, it’s persistence that will help you through.

[And at that point, the recording stopped, but a pretty good way to round it out. 🙂]

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.