SoftBank Investor Presentation November 2019

With all the talk about WeWork and its disastrous pulled IPO, founder shenanigans etc, it is interesting to read SoftBank’s latest investor update. SoftBank’s Vision Fund has, rightly, come under scrutiny for its investments in WeWork and other ‘punchy’ investments. Their shareholder update is at significant pains to point out that (a) the value of the the overall entity has risen in the past three months by some $13 billion USD and (b) they have a cunning plan for WeWork…

Quite an ‘interesting’ read. We thought it was a parody at first. Much of it reads like some sort of junior school project. It illustrates some very ‘high-level’ thinking and that putting some charts into a report solves everything. Don’t forget, there is over $200 billion value of market cap in SoftBank Holdings. That a company of that size and complexity can produce such an astonishingly simple report makes us think, if your share price is underpinned by some businesses that shell off money, you get a lot of leeway to play.

SoftBank Investor Presentation November 2019

Value of SoftBank Holdings

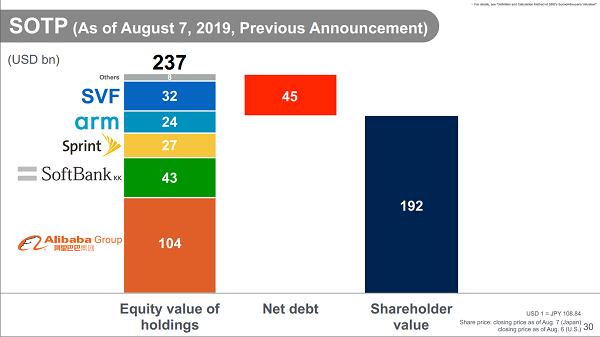

As of August 7 2019, SoftBank Holdings had a total value of $192 billion.

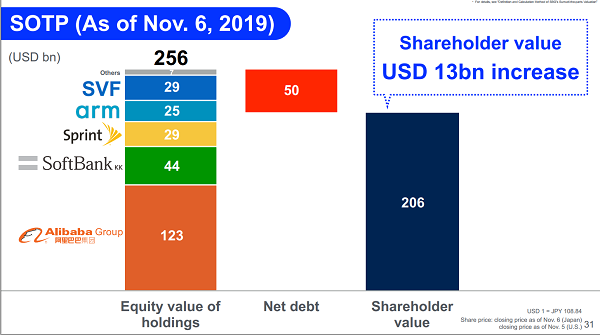

As of November 6 2019, SoftBank Holdings had a total value of $206 billion. An increase of $13 billion (USD).

Vision Fund Investments

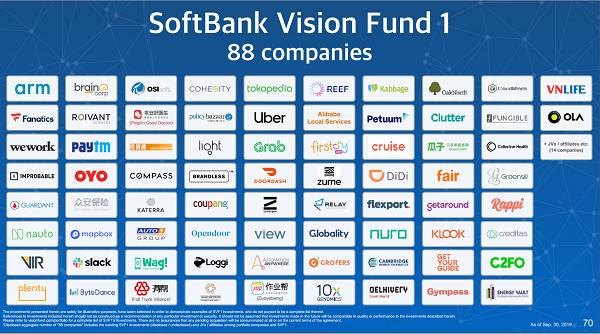

WeWork and some of SoftBank Vision Fund’s investments have been marked down over this three month period, though it is not clear which ones. In the past three months, 37 companies in the portfolio have been marked up (assigned higher valuations) and 22 have been marked down (valuation has fallen). All the valuations have been signed off by auditors and independent valuers including Deloitte so they must be legit…

It would be interesting to see some more detail about which companies in the portfolio are up (ARM obviously) and which ones down (WeWork obviously). Who knows whether the January 2018 investment of $300 million in the dog walking app Wag! for example, is performing as expected. Google, ‘Wag’, and it does not appear on the first page of Google results. The site can be found, WagWalking, offers dog walking services for, ‘Starting as low as $20 per walk’. Wow. Just wow. Sign me up today.

WeWork

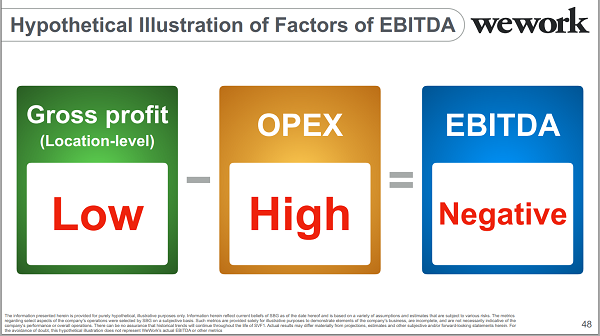

There is a lot of space in the ninety page update devoted to WeWork and the cunning new plan. I am simply not clever enough to understand it unfortunately, breaking the problem down into factors affecting the EBITDA of the business, both positive and negative, then showing the effect of the plan.

It all looks so complicated… 🙂

These things are factors that will lead to negative EBITDA.

These things are factors that will lead to positive EBITDA.

This is BAD OUTCOME!

This is GOOD OUTCOME!

Hope that is all clear.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.