Alex Osterwalder, Co-Founder Strategyzer

Alex Osterwalder is a leading author, entrepreneur, and renowned speaker whose work has changed the way companies do business and how new ventures get started. In this BoS Talk from 2019, Alex will discuss how you can manage a portfolio of products successfully. How can you invent a new business model, improve existing ones, and manage them all across the organization.

You will learn:

- how to map the exploration of new business ideas and test them in a simple and practical way

- how to manage and improve the businesses and products you already have

- how much profit existing business models generate

- how to point out any synergies/conflicts between your models.

Sketchnote, Video, Slides, Transcript, & Resources below

Sketchnote

Video

Slides

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Resources

Innovation Project Scorecard

Innovation Readiness Assessment

Portfolio Map

The Book “The Invincible Company” written by Alex, Yves Pigneur, Fred Etiemble, & Alan Smith is available now to buy or download.

Visit strategyzer.com/books/the-invicible-company for a 100 page free preview and access to 4 bonus webinars when you buy the book.

Transcript

Okay, so I’m going to talk about invincible companies; how to build an invincible company. Who you would like to build an invincible company? Everybody else you probably shouldn’t be in business because the point is that you don’t die, right. Okay, if you’re a serial entrepreneur – seems to be fashionable – you can just churn them out. I see my Swiss jokes are probably not the best of this conference cause I’m putting everybody at ease who wants to make jokes. I’m not going to talk about these two first books in the last couple of Business of Softwares I talked about the tools, business models, value propositions. But what intrigued my co-author myself each year is that somehow despite all of the efforts of the tools we build, others build, lean startup, etc it doesn’t seem like companies are getting better at innovation. So yesterday walking around I saw this wonderful old bridge – it’s beautiful right? – but that’s now a museum piece. Okay, so it had its function and it’s turning into a museum, so this is the design that apparently won for this bridge. And I think a lot of companies in particular in software are going to end up this way because what’s happening, it seems, that that this time compression between first success and having to reinvent yourself is getting shorter and shorter and it’s not just for large companies some of the examples I’m going to show a really huge companies. It starts with you know 20/30 people just to continue to reinvent yourself just to stay alive. Right. So, what I want us to do very quickly is discuss in groups of two with your seat neighbour. What do you think are the characteristics of an invincible company? How can you tell what an invincible company is? I’ll give you 30 seconds. Okay, let’s go discuss with your seat neighbour. How do you identify an invincible company?!

🔔[Rings bell]🔔

Okay, can we agree on something? I’m very Swiss, I’m from Switzerland. I like good timekeeping. Is it okay, if I’m very Swiss and run on timekeeping so when I ring the bell you put up your hand and you’re silent. Does that work? Let’s try.

🔔[Rings bell]🔔

Okay, good. And you’re silent.

So, we can move on because we’ll do a couple of exercises are going to try to keep it a little bit interactive. So, I believe there are three things that you can tell if you look at a company if these three things are going on. They are close to getting invincible, because you can’t be invincible what you can do is constantly reinvent yourself.

- Systematically get from idea to sustainable business

- Constantly Reinvent your business

- Compete on superior business models.

So, number one: systematically getting from idea to sustainable business more than once. Once is hard enough but more than once, that’s when you start to get invincible. Second one: constantly reinvent your business model not just products, services, maybe price. Try to reinvent your business and adapt without maybe looking to the left and to the right just figuring out what’s the right thing to do. And the third one is compete on superior business models. You ask yourself how can I build a stronger business model? Not just for me that’s just the ticket entry to compete not just a better product not just a better value proposition which you need. But it’s getting harder and harder to compete just on value propositions.

Okay, I’m going to talk about some of the stuff in our upcoming books which just we just handed it in ‘Testing Business Ideas’. The second one is an ongoing suffering called ‘The Invincible Company’ will be out next April. So, obviously when we talk about companies that can reinvent themselves. Amazon is a great example. Amazon can do a lot of things better but they’re really world class at one thing: constantly reinventing themselves. And we’ll see a little bit why they can do that. It’s not a miracle, it’s simply culture. Okay, it’s things you can weave into your organization. But my favourite example at the moment is Ping An, the Chinese and financial conglomerate which got really big as a banking and finance insurance company but they were able to turn themselves into a tech company because they followed a couple of things not taking things for granted on why they were successful reinventing themselves already. Okay, that’s the idea: while you’re successful reinvent yourself.

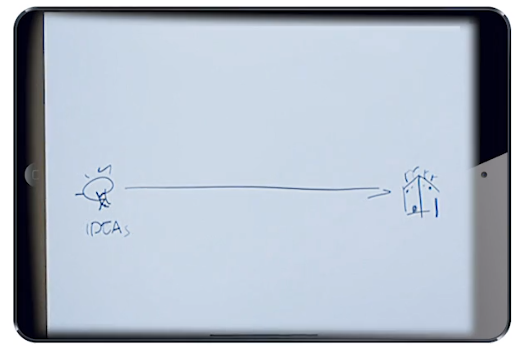

Let’s start with the first one systematically getting from idea to business. So, the whole lean startup movement with Steve Blank the grandfather of the lean startup movement has become very popular. But I do think we’re moving beyond the principles getting a little bit more professional. It’s not just high level things, ‘yeah we do build/measure/learn’. No. We’re starting to measure the reduction of risk and uncertainty. We’re starting to get sophisticated with the type of experiments we run. So, we’re going to look at that a little bit. So, I want to draw quickly see if I can master the technology here. I want to draw quickly what this means going from idea to business so basically it means having an idea and I think ideas are completely overrated. Ideas are easy. That’s the easy part. What’s hard – and many of you are entrepreneurs. You know it’s hard to get from idea to this, but you know what this is?

Maybe I’ve drawn this at the last BoS conference. A Swiss chalet?! It could be – you know my preferences. Any other guesses?

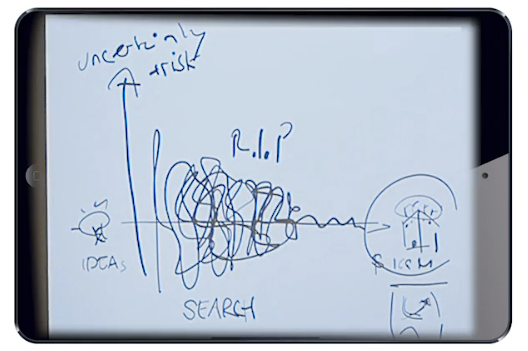

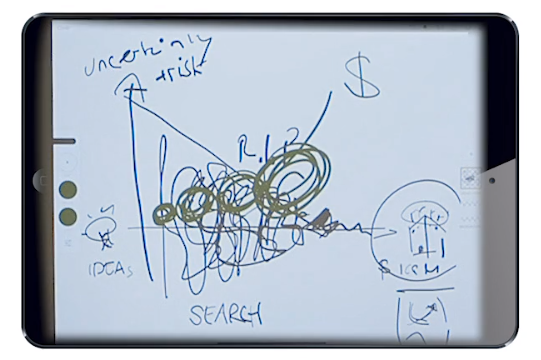

It’s a hundred million dollar company. Clearly because the four flags up here! So traditionally and obviously none of you have done that anymore. We draw up business plans to get from idea to business writing in groups. We make this wonderful curve always points upwards. So always steep. We know that entrepreneurship isn’t that way is like this. Ups and downs forward and then customers say your product stock value proposition is useless. Your investors want to pull your money or your boss. Eventually if you survive if say good ideas rest in peace, you create this kind of business. So basically, what we need to admit. Is that this search here is hard and what we want to admit is that uncertainty and risk is at its maximum uncertainty and risk is at its maximum.

So, what is the only task of the innovator and entrepreneur? The only task. Not to build something build measure learn rest in peace is not about building in particular in software everybody wants to build. No, it’s about reducing risk and uncertainty reducing risk and uncertainty.

So, what you really want to do is conduct small experiments first. The more you reduce risk and uncertainty the bigger the investments in your experiments. So, you increase the money while you reduce risk and uncertainty and of course many of you know how to do that. But we’ll get in some of the specifics just to warm up and move towards becoming an invincible company how do we do this systematically. So basically from idea to business looks like this messy process but we can orchestrate that and that’s what I want to quickly look at because one aspect I think we’re getting better at which is testing we’re not perfect yet. But the thing we underestimate is business design: thinking through great value propositions and thinking through great business models. So, basically, it’s a double loop if you want where you start with some ideas – ‘Hey we could do this business’, ‘we could do this value proposition’ – you shape it with some tools. My preference is obviously the business model canvas and then you assess the design of the potential business model of the potential value proposition.

But that’s still a fantasy. Nevertheless, it should be a good fantasy. We can actually design better business models. I’ll get to that at the end. And then if we think this is a good design then we start to test. How do we test? Not by building something per say but by asking what are the most important hypotheses? What needs to be true for this idea to work? We prioritize that, we’ll do that in a second. Then we experiment not just interviews and surveys and landing pages but a little bit more sophisticated. And then, again, we learn we decide was this good enough? What did I learn? Do I need to go back to the drawing board and redesign the business model and value proposition? Not just product, not just software? Or do we go to the next hypothesis so simple double loop, Okay. Now you’ll say, ‘Yeah but this is just the same old stuff packaged in a new way’. Well I still don’t see a lot of companies getting very very explicit about this designing and testing. Very detailed when it comes to all that we’re going to measure this, this is our funnel, but not very good when it comes back to connecting this with business.

So, let’s start with hypothesis quickly. So, we like to take this thing from ideal where you basically ask is this thing desirable in their case it came from industrial design, they make something. Do people want this? Can we build it? And should we build it? Can we make more money from it than we spent? So, if we map this over, I’m just going to assume many of you know the business model canvas, let me check. Have you ever used the business model canvas? A couple? The others can Google it: Business small canvas. This is basically what you need to test for any kind of new business idea.

- Do people want it?

- Can I acquire customers?

- Can I retain them?

- Can we manage the intellectual property/the assets/the technology/the software etc.

- Can we earn more money then we’re going to spend than it costs? The viability.

What needs to be true for this idea to work

Okay. So, we take that little idea that we sketched out. You can even sketch it out without this tool and then as – this is a really important question – what needs to be true for this idea to work you’re like a gambler. What are the variables here that I need to get right? What needs to be true. And you just brainstorm all the things that need to be true for this idea to work. This is actually a step that most people don’t take. They just say, ‘oh I had an idea I’m going to build something’. No. You just build it. You’re actually going to waste a lot of time and energy. Your first reflex should be what needs to be true. So, this idea could work. I’ll give an example of the hypothesis that the purchasing department has made this up is willing to pay for value not day rates. That’s actually pretty bold when anybody in B2B knows we’re not talking software if we’re talking services. They have a checklist. You need to know that checklist right. So, you have these hypotheses. You believe they’re true, but you don’t know, and you need to actually be very humble and really go back and say well I don’t know. These are all the things that I should validate I should find evidence. And then you prioritize this in terms of importance. If this is right, I can build my business, if it’s wrong everything else doesn’t matter. And in terms of I don’t have any evidence I don’t know or. Actually, I’ve worked with that customer segment, we know that customer etc. And then you just prioritize and the first thing you do is you going to focus on this- this is what you’re going to test. So, all I’m doing is making a little bit more explicit some of this stuff that a lot of you already do.

Who of you actually practices lean startup to test ideas? Wow, very few. Who of you have ever tried to turn an idea into a business? Oh my. There’s some reading to do there. Maybe am just assuming. Reading and practicing! Make sense? Who of you follow me so far? Hands up if you’ve followed me so far. Do you think that makes sense and you should maybe do a little bit more of that? Hands up. Good. Good. Good.

Experimentation

Next thing you experiment. Okay. You try to figure out; this was my hypothesis; how could I prove that’s true or false? A little bit like last week at – What was that business of sperm? Something like that – scientists/biologists trying to prove something right or wrong. So, in business we actually should act a little bit more like scientists. So, this is something we started with a guy called David Bland I’m just the co-author where we set out people are not sophisticated enough when it comes to experiments. We still do too many just interviews or surveys maybe landing pages we should get a lot better at designing experiments. So, we created an experiment library of 44 experiments. I’m going to go through a couple. 44 experiments to get better at testing ideas; not just you know building something a smaller version of what we want to build but experiment if our hypotheses are true. makes sense? Okay. Quick exercise: 30 seconds. Discuss in groups of two. Have you ever done an experiment going to reframe it because I assumed you do? But I’ve seen a lot of you may not have done that. What was your boldest business experiment to figure out if something was true or false? Okay, quick discussion 30 seconds. What’s an experiment that you’ve done. Which one was the boldest one? Let’s go 30 seconds. With your seat neighbour.

🔔[Rings bell]🔔

So that seems to work great.

So, let me go through just a couple and the principle here is that when you start an uncertainty is high at its maximum the bolder your idea the less you know the more incremental the more you know so the less you know you have to experiment probably you start with quick experiments that don’t cost a lot and the evidence might not be that scientific but it gives you some patterns. The more you know the more you invest.

So we call this first phase discovery in the second phase validation is that using Steve Bland’s terminology discovery and validation because you don’t start with validation you should actually start and assume you don’t know sh*t because validation means ‘I’m super smart I’m just going to get the evidence that I’m right’. That’s a very dangerous attitude. Confirmation bias. So, couple of these are going to go through some. In discovery so a whole list of different experiments you’re going to get the slides. You can have a look and a whole list of validation experiments that go beyond the usual suspects. So, what we did is – it is very important- we actually looked at for each experiment we looked at the cost. How much does it cost? Remember you start with cheap ones and then you spend more than more you know. So, building already costs money so you don’t start with that pretty obvious right. But then we look at the time how much time does it take to set up this experiment? How much time does it take to run this experiment? And here’s an important one. How strong is the evidence?

If people tell you something that’s some evidence but it’s usually pretty weak in particular opinions. Would you like this? Of course! Ask that in Sweden and everybody’s going to say yes as that in South Korea everybody’s going to say I love this. So, it’s misleading sometimes. Or if you ask me or you know if you have this great new product that you can take when you travel and you’re going to work out every day: for sure. And then I wake up and I need to run to Business of Software and give a talk in the evening I’m not going to work out. So, what we say and what we do are completely different things seems obvious, but our experiments don’t always reflect that enough, so we need to ask how strong is our evidence? How close is that to the truth? So, discovery experiments let’s go through that and you can choose based on this list.

So, the first one pretty basic customer interviews of course aren’t very expensive. Do them very fast and they’re a great start. Nothing wrong with that but usually not very strong evidence. So, you just kind of figure out if you’re on the right path. But what’s interesting is if you get more sophisticated you actually don’t do that as a first thing. Maybe you start with discussion forums, maybe you looked at the sales force feedback first, maybe you did some search trend analysis before even you start the customer interviews. So, you design your interview series by coming in with other evidence here that already exists. And then after the interview you go into different experiments, you follow on, because good experimentation is a series. It’s a sequence of maybe ten experiments. So, we’re usually happy too quickly. It needs to be a sequence. So let me show you how you can be a bit more sophisticated with interviewing and some of you may be seeing this stuff; Speed Boat for example comes from Luke Hohmann gave a talk here did some workshops on some of the methods. This is a cool thing. Very simple. Rather than just asking questions. You get your interviewees to define what one of the things you’re trying to get done with that software with that service. What are you trying to get done and what are the things that are holding you back from doing those things? Well those are the anchors the deeper the anchor the bigger the pain. And you know what happens by visualizing those things you have a much better conversation than if you just ask. Because all of a sudden, they’re going to see oh this one is a big pain needs to be down here. Oh, actually this one yeah. Not so important. Let me just actually move it up a bit and you start to really see the patterns in terms of priorities of pains and gains and that is crucial if you want to design better features for your software.

People are very good at quantifying speed and quality etc. They’re good at quantifying the solution but that doesn’t matter if you can’t qualify or quantify the jobs, pains, and gains. So, you need to have very very very strong evidence in terms of what is the biggest pain. Which seems like a trivial question not even my team can give me that information so I always have to push back and say you don’t know the customer, I don’t know the customer until we have that kind of information. Okay so now they do these kinds of exercises.

Another one is card sorting; pretty cool. So, what you do is you give them cards maybe of your features or jobs pains and gains to get them to sort them. Pretty straightforward. You have an idea of the customer profile you make some beautiful visual cards could do it for features, you could do it for jobs pains and gains and you get them to force rank. So, it’s not just the outcome that’s interesting but it’s the pattern you see in the conversations you have with your interview interviewees. So, give an example of a company I’m invested in called Shapescale. And the reason I invested is not the product. It’s actually because they follow these approaches.

[Shows video]

Okay, so what’s interesting is they actually did this, and they created some cards with the features of the software that goes into this hardware product. And you can see some of them are pretty cool. So here is if you watch too much football is the prediction algorithm. At the time lapse video if you really do work out a bit sexist, I must say for tracking muscle tracking fat tracking goals. So, they put that in front of a whole different series of customer segments and the tops and flops that came out were pretty big surprise for them. So, it’s a really substantial investment doing this not just as a startup. So, I see a lot of companies doing this the first time. And then when they reinvent themselves you know they say, ‘oh we know the customer’. Don’t assume you know the customer because things change you need to do these things over and over again. We should have some people who are professional at this. Who of you would say, ‘Alex this is so easy we already do this really really really really well’?

Hands up. I put the bar bit high right.

So then Product Box another cool once again from Luke Hohmann in his book Innovation Games. So, you get your customers not to design the ideal product but the ideal packaging for your product. And then they pitch it back to you. So, Luke Hohmann does this a lot with companies like Cisco etc. So pretty cool or SAP is a pretty cool thing to do create with your customer. So, a whole series of things.

Here is my favourite Wizard of Oz. Have you heard of the experiment called Wizard of Oz? It’s very simple but very powerful when you don’t want to build something and you want to test very quickly so who knows the story of Wizard of Oz in North America obviously that’s a bit of a trivial question Europe not so much. So, you have this wizard who says you don’t see is what’s going on behind right. And the same thing with this experiment where the customer thinks this is a real product either a real software or real automated product. But you know what behind the curtain. Everything is manual. Everything is manual. But the customer doesn’t know that, and it feels real. So, you get really strong evidence because it’s a real world situation. And the example that is used for this a lot is Zappos when they started the company they put up a web page and then behind that the founders would get an email, run to the shoe store, buy the shoes, send the shoes. Not very scalable but a really really strong experiment. So, you can see here the evidence strength is insanely strong because it’s for the customer a real world situation. Obviously didn’t test feasibility. We’re talking about you know difficult software that you want to put together. You don’t know if you can do it, but you definitely knew know if you should do it from a desirability point of view. And then if you don’t want to use some you know simulate a product you can actually replace somewhere sometimes what software would do with people because you will get a feel for do they care about that kind of service or not. So pretty cool way to do things. Good.

So that was a series of experiments. Let me quickly show you how you pick these kinds of experiments. First one obvious go cheap and fast. Early on in your journey because you admit you don’t know. You don’t want to waste time building stuff.

Second one you increase the strength of evidence with multiple experiments for the same hypothesis. You don’t believe your interviews; you get stronger evidence. You don’t believe the pre-purchasing because it’s pre-purchasing is not real. Go further and further and further.

The third one you always pick the experiment that produces the strongest evidence. Given the constraints you’re a startup running out of money, you’re going to pitch to the investors. Well that’s your constraint or as a company your bosses want you to move faster that’s your constraint.

But here’s the fourth one that I really want to emphasize in particular for software companies reduce uncertainty as much as you can before you build anything. A data sheet in a brochure is almost as powerful as a real piece of software I’m saying almost because obviously you know it’s not the same thing but with data sheets respect sheets you can get pretty far, make sense? So, then you design these testing sequences. So that’s what world class companies do to experiment and to radically reduce the risk and uncertainty of new ideas because new ideas are not risky if you do it this way. And then you have a whole series of experiment ceremonies. This is becoming a profession is not just an ideology with principles it’s getting really serious. And now we can even measure the reduction of risk and uncertainty. But I won’t go into that.

What I want to go into is how do you constantly reinvent your business? What’s the logic behind that? So, another quick buzz group: why is innovation so hard for a company that went from idea to business? Once you’re established you survived more than three years, why is it hard to reinvent yourself. 30 seconds let’s go and then you’re going to win some chocolate later on. I’m going to actually get you to do a real thing.

🔔[Rings bell]🔔

So basically, I get you to do these buzz groups because it’s really hard for the brain to follow anybody for longer than eight minutes. Just if you’re a speaker eight to 12 minutes is kind of the you know a free brain. So what’s hard is there are two worlds in every company. As soon as your once established you’re beyond startup stage they’re two worlds one is running a business – I call this exploit – and the other one is exploring new ideas and the focus is completely different. Even if you’re a young company this will happen inevitably over here. It’s about efficiency over here it’s about growth and new things. As soon as you are established that’s what happened. Investment philosophy VC Investments as a beginning for new ideas. Guaranteed dividends secure return is what happens afterwards. And the culture is different. You start to put in place processes as soon as you grow. As soon as you grow.

Guess what happens to the creativity and innovation and iteration? You really iron it out. And that’s what you’re supposed to do over here. You want to make operations better, if you don’t, you’re going to stay a chaotic company all your life. So, you need this, but you need to remember that you’re going to need this pretty soon again. See how this is both together it’s not either or it’s end. And in the last one if you’re not fired as an entrepreneur – CEOs that get kicked out by their VCs you know – happens every now and then. Here you want to be process and detail oriented but you want to keep people that are fresh and that explore but you want to keep them in the exploratory role because that’s what they do well. So, this is what sometimes the academics call the ambidextrous organization world class of both. Okay, so what we did is we created this thing. It starts for small companies all the way to large companies we use it at Stragizer, you look at your existing portfolio what are the products. If you have more than one or business models that make money high return low return. So, you kind of place it on this axis. But here’s the other one that you really want to start thinking of very quickly. Death and disruption risk. How likely is your product or business to get killed, to get disrupted by a bigger competitor by a new technology? So, remember Kodak kind of started out you know the usual suspect. They didn’t reinvent themselves or invest seriously enough in new stuff. They were actually invested in Facebook funny enough but then they got killed playing bankrupt. So, you want to look at this and this starts for small companies don’t think this is just for big ones this starts for small companies.

And then you want to look at your exploratory portfolio where we also have a thing here that’s called return or revenues or profit but it’s expected return because it’s a fantasy/an idea. ‘Oh, if I launch this new software or this new feature’ I could boost the revenues but that is a hope that’s a dream. And as long as it’s on the left hand side here, it’s just a dream and that’s okay, because we just learned how do we decrease the risk of innovation. So, your idea is going to move over here. So, let me give you a quick example. Anybody know the Anglo-Swiss condensed milk company? Nobody?! Course you do it’s Nestlé with you who’s ever heard of anything. So, let’s look at this Nespresso example that we can learn from. So, when they started out it was actually business to business company Nestlé creating a business to consumer companies. So if we look at our explore portfolio what happened this wonderful nice gentleman here and a scientist – Eric Fava – he invented the machine and he came up with the first business model which was selling to business offices and companies didn’t work. They gently moved him back to research and – you got the joke – and they hired a new guy. John-Paul Gaia who came up with experimentation actually this was pre-lean startup but that’s what he did. He came up with this new business model which was selling pods directly to consumers with the recurring revenue model. They saw that that got traction. This guy actually ran to the post office to send boxes. And once they saw this got traction kind of moved up to the right lower risk, high potential return. So then Nestle said okay, this is now a real business that we need to scale. So, it went into the exploit portfolio and it started to become the biggest profit generator for Nestlé over decades. But then guess what happened. The patents expired and they kind of forgot to reinvent themselves because that’s not in their DNA. Nestlé is a company that’s world class at execution and pretty good at incremental innovation because they’re 150 years old. But what they’re not good at is creating new Nespresso.

So, if we can distribute now there’s little worksheet. So, in groups of two you’re going to get a worksheet and you’re going to compete for access to heaven which is also known as Swiss chocolate. Okay. So, some of you might have seen the results so I ask those of you who know the numbers to not compete. So, here’s the exercise look to the front. If you were Nestlé, like they came up with one espresso the last 33 years. If you were Nestlé how many projects would you need to invest in – Listen listen listen – how many projects would you need to invest in, $100,000 per project to produce a multi-billion dollar success? How many projects would you need to invest in – so what I want from you is three numbers.

How many hundred thousand dollar projects and this is just the first investment not the follow up investments. Then I want to know from you. So, let me just spell out the math. If you say 10, that’s $1million. 10 projects. From those 10 projects you’re going to tell me how many are going to fail as you say: 7. How many will know some success maybe $50-100 million success: let’s say 2. And then we have 1 which becomes a multibillion dollar business. So, I’m not talking about how many ideas you need to explore, how many projects do you need to invest in. If you say 100 projects that’s $10million. If you say 1,000 that’s $100million. If you say 10,000, you’re telling me I’m going to invest a $billion to get a $billion back. Okay just so you get the math who wants to win Swiss chocolate? I’m going to give you 30 seconds to write down the numbers. Let’s go.

🔔[Rings bell]🔔

Who wants to compete? Yes, how many?

Well if you didn’t write it down you can’t compete. Sorry for that. Too slow, too slow. How many? Ten. Hundred. One. So now it’s a thousand. You can’t compete. Disqualified. Sorry.

Okay. Here we have a real number 20. That sounds like Nestlé. How many are going to fail of those 20? 15. 3 are going to be low/some success. One somebody stole the money from one project – the math doesn’t add up.

Okay but again here 100. How many fail? 20. Okay. 80/20/1. So, you actually have … no. Mark can you do a math course also here?

Over the area 20,25,20… Any. Yeah. How many? 500? Okay. He shows me the evidence. Good. How many you going to fail? 500 are going to fail. How does that work out? [laughter] Oh 550 okay. So good good good. We’ll see we’ll see who wins.

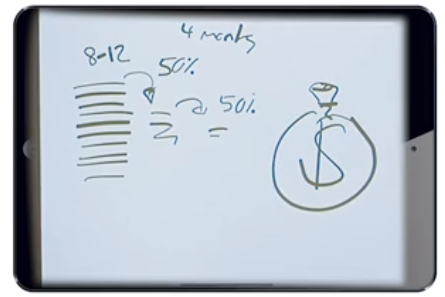

Okay. So, the exact number of course is. And you should have figured it out. It’s 250. Obvious? No? The question is of course where the heck did I get those numbers from. I didn’t make them up. I’m better than that. I have a scientific education, so I actually took the proxy number which probably comes pretty close. Which is the return in early stage venture capital. Early stage investments. And it turns out six out of 10 projects they fail. They don’t return capital zero to one. If you look at these here three out of 10 make some money somewhere between one and 50 times returning capital – is getting less and less. And then if you look at the outliers those that you know are an outsized return 50x or more is not even sure that that’s a multi-billion dollar revenue. I’m not talking unicorns which is multimillion dollar fantasy. I’m talking revenue and profit is one out of 250. So, think of it here’s the logic I want you to apply, here’s the lesson I want you to learn. You can’t pick the winner in innovation. You can’t. The more innovative it is the less you can pick the winner. If you want a really really big return, it’s probably something like 250 projects. You’re going to tell me Alex but this this is really worked for us. We’re a bit smaller. Well it’s the same logic you could start with 10 projects or ideas. You give people maybe in that first phase 20% of their time but then very quickly after 8 to 12 weeks you make follow up investments based on evidence. So, you only give the teams that show you evidence the second round of financing. Now you can spend 50% of your time on this and you get maybe another 10,000 bucks or 100,000 bucks depending on what you want to do. So, you have to follow a funnel approach in innovation and if you already know it’s going to work it’s probably not innovation.

Okay, so this goes for small companies as much as it goes for large companies depending on the return you’re looking for. Well that’s the ratio you need to think of. And this is something we don’t do. Even entrepreneurs who succeeded once they kind of forget that and they get really arrogant. I did it once I did it twice. Why shouldn’t I be able to do it a third time. Still pretty rare. Okay, so that is what companies like Amazon do extremely well. Jeff Bezos keeps this idea of a culture of day one: failure and invention are inseparable twins. Nobody wants to fail. It sucks to fail but it’s inevitable in innovation so you can kind of play with it. You can manage it. You can keep the costs low.

“to know where you already know it’s going to work, it’s not an experiment. And. Only through experimentation can you get real invention. The most important inventions come from trial and error”

Trial and error is super important. Here I did a little kind of Twitter thing. So, this is a lot less scientific where I asked well how much time does your CEO personally spend on innovation every week. And that goes for small and large companies and I think too few spend time on reinventing on trying out new things. Some do, some don’t. So, I think there’s a lot more space and those that I really like: take the CEO of Logitech Bracken Darrell who turned around Logitech the last six years. He spends over 50% of his time on innovation. You might tell me if some CEOs in the room might say I’m just trying to run my company efficiently. That’s good. But that also might mean you’re just going to more efficiently die when you get disrupted. So don’t forget that. So of course, you need to run your company well. You bet. But you also want to reinvent yourself. So just very quickly to show you kind of in a larger company context how this works out but it’s the same in smaller companies where you might just change the ratio.

See if I can fit it on here. So how this usually works is that you invest. Let’s just take 10. So, we don’t make it too big. You might have 10 projects running 10 different people or maybe even three different people you’re spending a little bit of their time. You give them maybe 8 to 12 weeks to experiment to play round gather some evidence after 12 weeks. You give 50% of the ideas so you kill 50% but that’s not very motivating. So Bracken Darryl told me Alex don’t you want to call it you ‘shelf the idea’ is it’s like a book; you got value from it, you put it away and you might actually take it back because sometimes it was a timing that was wrong. Okay so 50% get follow up investment and this might be four months. Then again after four months 50% get follow up investment. So, you get to something like one big success. How do we draw big success like this?

One success out of 10 ideas but you can’t pick the ideas. So, I think sometimes we still have this logic. We’re too arrogant and we think we can pick the winners is unlikely when it comes to innovation. If it’s a very clear market opportunity, you’ve been working with those customers, it’s probably not innovation. It’s just creating a new product and so clear that can happen as well. So, follow me on this logic? This is what really great innovators from small to big from small to big that they put in place. That’s the logic. And it will actually only happen if the CEO, the senior team, is involved in giving this whole thing legitimacy. So very quickly if we can distribute the second sheet. So, this is one for everybody. So, I thought I’ll give you a little present. Oh yeah.

Who won the chocolate? Sorry I was going to eat it myself. Who has 250? Who put 250? You just put your hand up because you wanted the chocolate! Was it 250 over there? Good! Catch it. Sorry you missed heaven. Okay.

So yeah, I’m giving you this. Just this is not an exercise with something we’ll quickly look at: when you judge ideas, you shouldn’t just judge the idea, you should also judge the idea but you should actually judge the evidence that people bring to the table. Remember I showed you there’s three types or four types of risk:

- desirability

- feasibility

- viability

- adaptability

Adaptability is related to the environment. Look to the front. So there are four questions that your team should answer regarding desirability and they shouldn’t just make a good case they should actually show you the evidence if they have no evidence to prove this right there is no evidence you give them a zero as a score.

This is a great idea. Customers have this problem. That’s a statement. How many experiments have you run if they’ve run more than two experiments you can start to give them a good score? Make sense?

So that’s for desirability. Same thing for feasibility around questions like key resources do we have the you know the development skills in-house can we actually manage that. Do we have enough people etc. If there’s no evidence, you give that team as a zero score if they’ve done two experiments in this case it good be stakeholder interviews etc you give it a 10. Make sense that gives it a high risk reduction score on feasibility.

And then the last one will go into his viability. Can you make more money than you spend? So, you actually need to test the revenues. That’s what a couple of people do. Pricing and revenues/revenue streams but you also need to test the cost structure. Don’t just tell me how much it’s going to cost. Show me the evidence that you know it’s going to cost that much. Makes sense? So, the team you’d give them a score. That’s what you should do as a leader for those of you in the room. Who are leading teams? That’s how you should look at new ideas. What’s the evidence? So, this is very formal you can keep it light, but you should score the evidence, not just the idea per say. We overvalue the idea, I think, of course there is creativity in vision but there’s a fine line between vision and hallucination. Okay, Steve Bland’s quote fine line between vision and hallucination. You want to have the evidence that backs up your vision. We’re not going to go into that adaptability too much. This is about the environment about competitors market timing etc.

Now you should also check if there’s a strategic fit with your company. So, you need to give your teams innovation guidelines. And of course, you’re going to say what’s the yardstick? How much money would we expect from a new idea? Is it $1million in recurring revenues, is it $5million, $10million whatever? So, give your team’s innovation guidelines so I don’t think that exists enough. So last portion this is just a little present. Don’t need to do any work. We are going to get to some more work. So you need to. You need to deserve the coffee break.

Business models

So, competing on business models. So, who have you has in a company that has been around for three years, so you survive kind of the death the valley of death? Good. Congratulations! Who is right now in the valley of death? Good luck with that. Great. No, it’s manageable. Yeah. If you do it the right way.

So, what we want to look at and I’d like this kind of mindset sometimes is oh the SaaS business model there is no SaaS business model is a good business model for a specific market specific country specific timing. I’d like us to get a lot more kind of business model agnostic. What’s the best business model for what you do? And that includes shifting from one to another. So, I’ll show you I’ll start with one that doesn’t really apply to you guys, most of you, is going from product to service. So, for manufacturing companies is a big shift going from product to service. But there are also companies that go from service back to product. It could be maybe you know you have some kind of a software service and you want to go back to certain products could be interesting but the one I’m going to show you just very quickly is Hilti. Have any of you heard of Hilti? Ever heard of Hilti? it’s funny they have a great brand because none of you are builders, but you all know Hilti. So, power tools that’s what it’s about. They went from a manufacturing model to a service model. So basically, this manufacturing business model if we take the exploit portfolio it grew grew grew. And then in 2009 there was a crisis, financial crisis, and they changed their business model substantially to move to something that would give them a competitive advantage again. And this business model was renting out a fleet of tools and becoming a lot more of a software company if you want – software as a service – to manage the fleet but backed up with real tools. So, these are some of the kind of things that might happen to some of you might get disrupted by a physical manufacturing company. Let’s say you were in fleet management just in the software of that. Well this is exactly what they did and they back it up basically with the tools themselves. So, what happened there with this shift they went from product from one business model to another. So, what I think you should do more of is question your business model regularly and see could you shift it from one to another. So, something, in this case, it helped them actually revive and rejuvenate their business and now they’re competitive again. And actually, now all of the manufacturing building companies they want them to manage the tools even from the competitors of Hilti. Pretty interesting.

Now one that might apply a little bit more to you is from sales to platform. Let’s say you’re selling some kind of software as a service, but you could build a platform around that the typical example here is the iPhone; when Apple moved from a manufacturing model then from a sales model selling through iTunes music – not a platform model it’s actually a sales model – they were buying the licenses from record companies and then selling on the licenses. They went towards a platform model. What did they do? They built the app store. And even Steve Jobs didn’t want to build the app store, but they did. And that’s what’s really making them hard to disrupt is not the technology iPhone phones are phones. They’re getting more similar by the day. What’s keeping them ahead – and that’s why they’re in court now – is the power you get through platform. So, I’m sure some of you are trying to move from a software as a service model more towards a platform what was tried to do that shift or has done that shift? Okay, if you haven’t. That’s a really really powerful way to build a competitive advantage. That’s what I what I call competing on superior business models not just on products services and price. Everybody’s focused on products and segments; that’s fine. But the way you stay ahead is superior business models. And I think there’s a huge opportunity there.

Now I want to do one last exercise with you individually. So, if we can distribute this. Wait wait wait wait wait wait wait wait wait. Sorry I was too fast. So, I’m going to explain first because you’re not going to listen if you get the sheet. The usual thing. I want you to score your company to see how innovation ready you are. Do you have the infrastructure in place? The culture and mindset to innovate? And many of you are young companies. So, if you don’t have this in place the alarm bells should start ringing. So, the first one is leadership support: who of you is in the leadership team in this room in a company? Great. So, there are three things you need to give teams if you want innovation to see innovation happen sometimes you don’t want innovation, you’re just saying ‘next three years we’re just going to execute in scale.’ Let’s fight but then you might you know execute efficiently and then die efficiently.

So, strategic guidance what’s in and what’s out when it comes to innovation? Resource allocation. Give people some money – doesn’t cost a lot innovation at the beginning of the early stages – and in particular some time; time is usually the bigger factor. And then portfolio management. Are you managing an explorer portfolio not just an execution portfolio? This is one of the things I don’t really see yet in many companies. Second category organizational design, legitimacy, and power. Do you give the innovators power and clout not just those that are world class at execution those that meet the plan that’s important but when you innovate it’s not about meeting the plan it’s about producing evidence. Bridging to the core. Do the innovators and execute us manage like a partnership? And do you reward experimentation.

And then the last one innovation practice. This one is the easiest one to use the most common innovation tools. So, when I asked about lean startup not that many of you actually practice lean startup so that might be a lower score potentially. Process Management do you measure the reduction of risk and uncertainty of new ideas or do you just build stuff? And then the last one’s skills development: how much do you invest in skills. If we can distribute but then don’t focus on the piece of paper you’re getting one per person. Focus on the screen. And then I’m going to show you how to score yourself. Good. So, we’ve got about six more minutes.

So, let’s start this you’re going to give yourself a score. Just make it X and we’re going to go through this together and I’m going to show you how to score. So, this is this scale. If you are a beginner, you have little experience or knowledge about the thing I’m asking you to score; first time you heard about it. Okay fine, that’s okay, be honest. Two you have some knowledge, but you lack the experience; you’ve heard about it. You’ve heard about it at Business of Software, but you’ve never done it. Three means you occasionally work this way, but you still lack some experience and then the last one would really be you’re an expert. You have profound experience, and this is deeply ingrained in your practice. It’s in the DNA of your company makes sense that score from 1 to 5.

Don’t read please look to the screen. In Japan when you say something people do it. In Brazil when you say something you say it again five times and they might do it. I just had that a couple months ago right from Japan to Brazil. It was an interesting cultural experience.

So, assess leadership support. First one I want you to score yourself on strategic guidance. Do you give your teams clear guidance? What is in and what is out for new ideas. Wait with scoring. Second when resource allocation did you design this into the DNA of your company so if somebody wants to innovate they know where to look, they get the budget they don’t have to ask you, you have this and the DNA of your company? And the last one portfolio management: do you manage a portfolio of exploration ideas like three or four ideas that you’re testing and you know that not all of them are going to succeed maybe one out of four or one out of ten are going to succeed. Give yourself a score. I’m going to give you 30 seconds okay. Let’s go. 30 seconds. Quick score. Individually. Even if you’re a team do it individually. If you came as a team do it individually and then you can fight afterwards.

And if you’re CEO is sitting beside you just look what he’s doing and then do the same.

Thanks for laughing I don’t get that a lot. So next one, look to the front. We are going to look at organizational design, legitimacy, and power. Do the innovators in your company have clout? Okay. Is it important to do innovation in your company? Or is everybody focused on execution? Again, it could be a choice right. Second one bridging to the core. Is it clear who executes who innovates and how they collaborate? And sometimes in a small company those might be the same people. But do you really have a good partnership? Because sometimes innovators call themselves pirates. You know in companies that grow beyond a hundred. That’s stupid! Because historically we kill pirates. Okay. So, it should be a partnership. Last one. Do you reward experimentation and evidence not good ideas but evidence? Give yourself a score. I’ll give you 30 seconds.

Last one. This one is the easiest one actually to put in place. Innovation tools: do your teams really know the tools of innovation? Do you have them ingrained in your DNA? You explain Business Model Canvas, value proposition canvas, Lean Startup innovation metrics, evidence experiment library etc. Second one processes do you measure you know the reduction of risk and uncertainty. You have different processes for experimentation than for execution. Maybe if you’re very young you have no process at all. That would be probably a more of a zero. And then the last one skills development. How much do you invest in skills development? Thirty seconds to score.

So, now what I’d like you to do is one more thing, individually I want you to identify three goals where you think this could be worth investing to improve in your organization. And if you think nothing – that’s fine as well – but if you think something’s worth you know give it one or two or three improvement goals where you would like to move from one score to superior score. And if you think this is not a concern for your company it’s fine to put nothing, right because you might be in a turnaround or something, so this wouldn’t be your concern. That’s okay define 2 or 3 improvement scores.

And now one last exercise I want you to share with somebody around you who is not from your team. You can share with your team later on, because that usually creates a little bit more… let’s leave the term open. So, share with somebody around you who is not from your team. Let’s go. Two minutes share with somebody around you what’s the score you gave yourself. Let’s go let’s go.

🔔[Rings bell]🔔

So, we had 60 minutes together. I hope you learned something from this talk. I’ll be sticking around for the next one and a half days so don’t hesitate to chat with me and tell me if you liked it or you didn’t. I’m always open for any kind of feedback. Thank you very much.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.