What Is Captive Product Pricing?

For instance, captive product pricing is a pricing strategy devised to attract a large volume of customers to a one-time purchase of a lower-priced core (or main) product that requires accessory (or captive) products for the main product to function. Consequently, companies might initially lose core product sales. For example, they may eventually enjoy increased revenue and sales through the recurring purchases of more expensive accessory products.

Therefore, this pricing strategy is one of five product mix pricing strategies. The other four include product line pricing, optional product pricing, by-product pricing, and product-bundle pricing.

Real-World Examples of the Pricing Strategy

Certainly, if you have a cell phone with a wireless plan, you’ve experienced the captive product pricing strategy firsthand. For example, the cell phone itself is the core product. Therefore, the phone’s wireless plan is the captive product. Similarly, other captive products include phone cases, earbuds, and other products created to increase functionality. Above all the goal is to encourage the use of the core product. Moreover, organizations feel the need to keep customers engaged with new products.

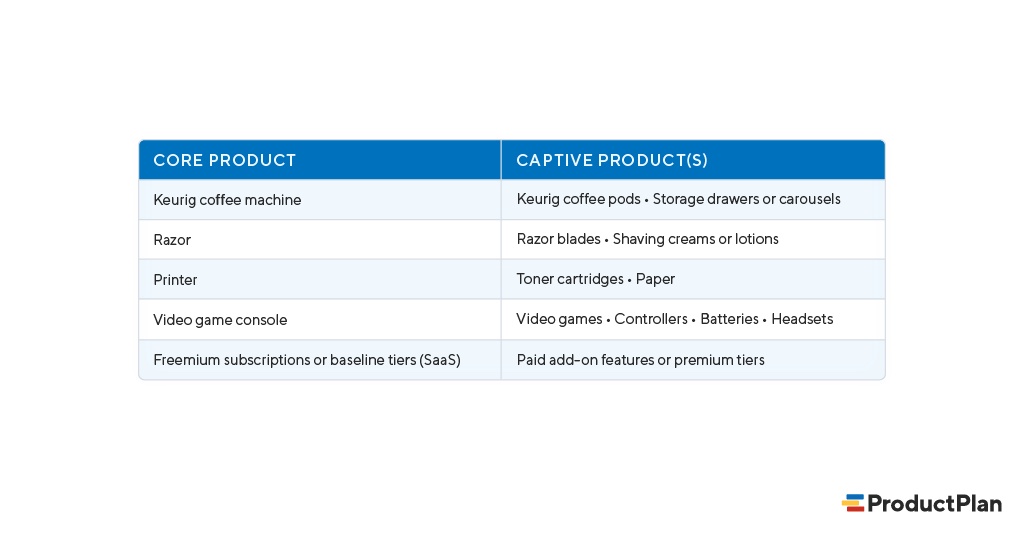

For example, here are some other examples of this pricing model:

“For car manufacturers, the attempt to corner the market with captive product pricing is more complicated than other industries, but they’re still a great example. The core product is the car purchased, and the captive product is any replacement parts or additional accessories (like GPS tools) required to keep the car running or improve user experience.”According to Flori Needle, writer at HubSpot, car manufacturers also leverage this product mix pricing strategy, but uniquely:

Pros and Cons of Captive Product Pricing

Above all, captive product pricing is a powerful strategy for companies that have a complementary product mix. Subsequently, advantages for these companies include increased sales, revenue, and long-term customer loyalty. In short, they achieve this by creating a cycle of demand. However, these companies also tend to enjoy more significant profit margins with accessory products, added value for being the sole provider of the accessory products, and valuable cross-selling opportunities to other products and services within the company.

In addition, this pricing strategy doesn’t suit all products, however, and it does have certain disadvantages. Therefore, there’s always the risk that customers will grow dissatisfied from spending more on accessory products over time or if they perceive the price of those captive products to be unreasonably high. And, the cost can potentially damage brand identity and deteriorate customer loyalty. Moreover, companies might also experience increased pressure to keep creating new accessory products to support core products.

In conclusion, as Needle at HubSpot explains: “When executed right, captive product pricing can increase sales and build a base of loyal customers that are ready and excited to purchase accessories to enhance the experiences they get from your products.”

Related terms: Prioritization, Weighted Scoring, Kano Model, Buy-a-Feature, Opportunity Scoring, Impact Mapping, Minimum Viable Product (MVP), Minimum Viable Experience (MVE), Value Proposition