This is part 2 of 3 of our series of using ChatGPT in your day-to-day job as a product manager (PM). In this entry, we’ll explore ways PMs can leverage ChatGPT to help with product discovery. (Read Part 1, “Using ChatGPT as a Product Management Tool,” here).

TLDR

- Using the example of a new product manager at a challenger bank (a smaller and newer bank), Jake uses ChatGPT to do a competitive analysis quickly.

- Specifically, Jake uses ChatGPT and Porter’s Five Forces to build a framework for competitive analysis.

- Combining the concepts of Porter’s Five Forces and the power of ChatGPT, Jake builds out a quick competitive analysis far more quickly/efficiently.

Since our last write-up on ChatGPT, a lot has changed. GPT-4 was officially announced on March 12. GPT-4 is ten times more advanced than GPT-3.5. GPT-4 can better understand the context and distinguish nuances, resulting in more accurate and coherent responses. As you’ll see, I believe these improvements will enable PMs to use the tool more naturally and intuitively.

As our Optimal Product Management (OPM) and Digital Product Management classes describe, Porter’s Five Forces is a robust but straightforward framework that PMs can use to identify the primary sources of competition in their industry or sector. The five forces are:

- competition in the industry

- the potential of new entrants into the industry

- power of suppliers

- power of customers

- the threat of substitute products

For the remainder of this article, imagine we’re a new PM in a challenger bank. If you’re unfamiliar with the term, a challenger bank is a smaller, more unique bank aiming to directly compete and challenge traditional banks using modern financial practices. And let’s imagine that we’re using Porter’s Five Forces to frame our thinking around competition. And we’ll use ChatGPT to help us evaluate the Five Forces of products in a challenger bank.

Disclaimer: don’t get too hung up on the quality of the prompts I’m writing to elicit responses from ChatGPT. This is meant to serve as a guide on how we can use this tool to improve efficiency in our daily lives.

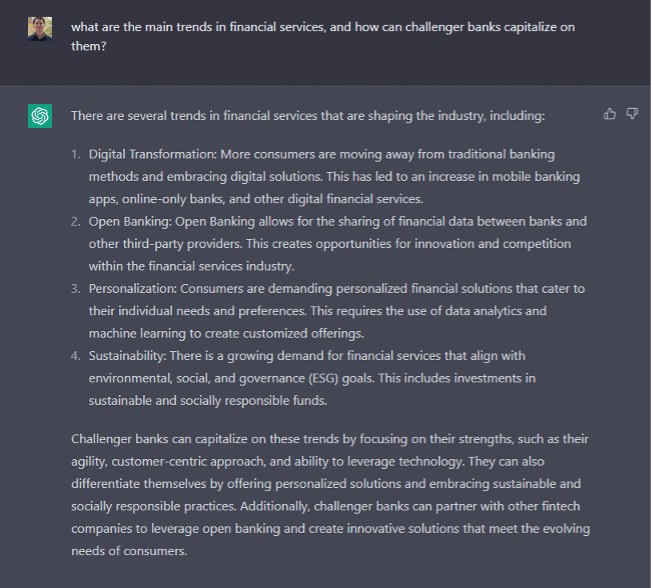

I asked ChatGPT, “What are the main trends in financial services, and how can challenger banks capitalize on them,” to understand the competitive advantage these new institutions may have when it comes to more traditional banks.

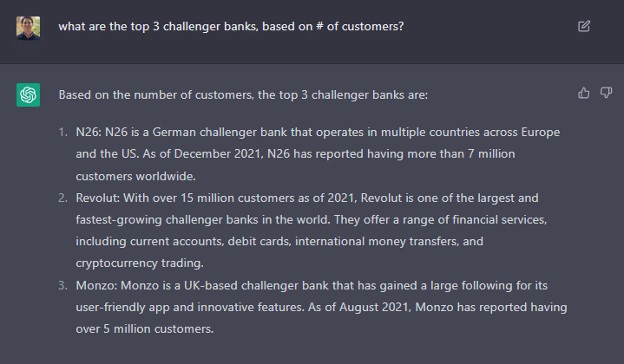

Competition in the Industry: The first of the five forces refers to the number of competitors and their ability to undercut a company. The larger the number of competitors, the lesser the company’s power. Immediately, we see the top 3 challenger banks are European. The customer base for challenger banks is expanding tremendously, thus creating the potential for market share. However, it also tells us the market is becoming increasingly crowded and competitive. At a high level, we can determine competition is high.

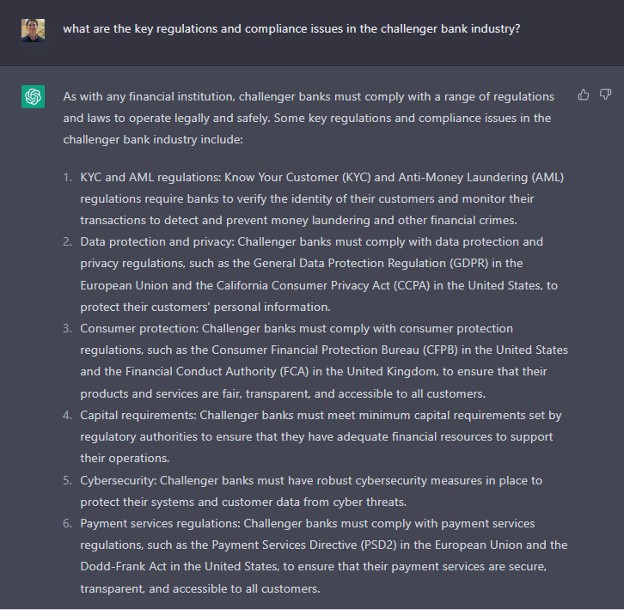

The Potential of New Entrants In the Industry, The force of new entrants also influences a company’s power in its market. The less time and money it costs for a competitor to enter a company’s market and be an effective competitor, the more an established company’s position could be weakened. Banking and financial services is a highly regulated environment with numerous risk and compliance controls. I asked ChatGPT, “What are the key regulations and compliance issues in the challenger bank industry to learn more about this:

Given the above, we can determine entering the market is challenging, expensive, and requires a considerable amount of subject matter expertise.

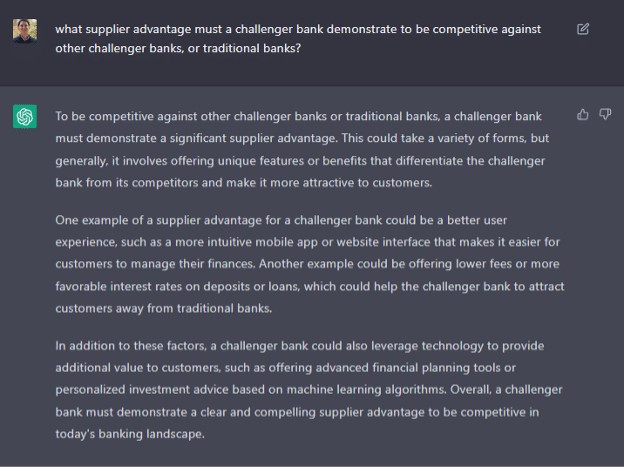

Power of Suppliers The next factor in the five forces model evaluates how easily suppliers can drive up prices. The banking industry (challenger or traditional bank) presented a unique case where suppliers and buyers are essentially the same pool of people – the clients! As a result, the bargaining power heavily favors the clients, given the low barriers to substitution and intense competition in the industry. For challenger banks to win, players in this industry must remain highly innovative and competitive in capturing market share. As a bank increases its client base and deposits, it also increases its leverage and bargaining power, which can be vital to maintaining a competitive edge.

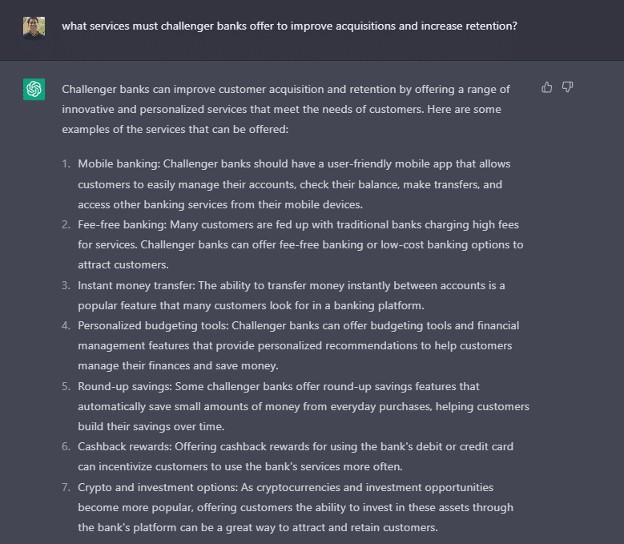

Power of Customers: without diving too far into important customer profiles, customers, and personas, the primary customers of challenger banks are millennials and younger generations who are comfortable using technology and underserved populations such as individuals with poor credit profiles or limited access to traditional banking services. In summary, these individuals may not have high net worth and therefore do not possess much leverage when negotiating with a new banking provider. However, challenger banks rely heavily on customer acquisition and retention to drive their growth and profitability. If customers are dissatisfied with the services a challenger bank provides, they can easily switch to another bank that better meets their needs. Many challenger banks offer seamless and hassle-free account switching services to make it easier for customers to switch to their platform.

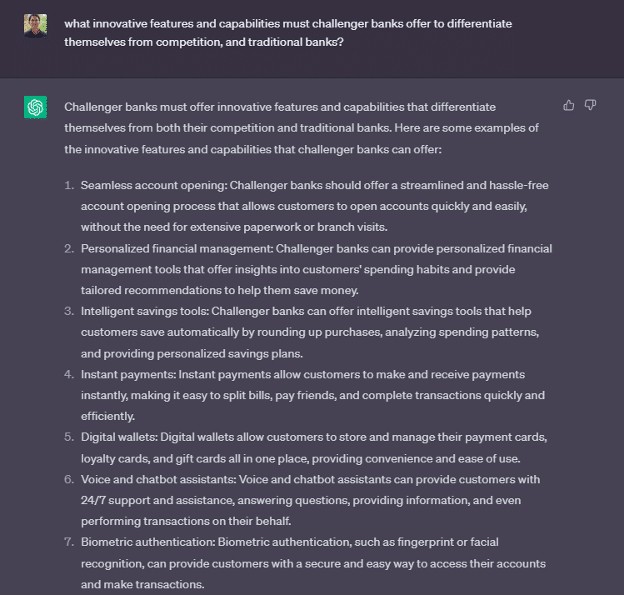

The threat of substitute products: Substitute products refer to alternative products or services that can fulfill the same need or provide similar benefits as those offered by challenger banks. Customers can use traditional banks or digital wallet services like PayPal and Venmo to execute essential banking functions. To mitigate the threat of substitute products, challenger banks must offer unique and differentiated products and services that other financial institutions cannot easily replicate. Let’s ask Chat GPT what those differentiated products and services might be:

With the help of ChatGPT, a product manager can rapidly and efficiently carry out fundamental competitive analysis using a proven approach such as Porter’s Five Forces. Enroll in an upcoming class to learn more about other ways to conduct competitive research and up your product management prowess.

Disclaimer: ChatGPT should not be used as a replacement for product discovery. It’s best suited as a digital assistant to augment and expedite discovery activities. It’s a great tool to help PMs frame problems, conduct high-level research, and spark creativity.