Chasing (and finding) product-market fit

Insights from Tribe Capital, Founders Factory, Startup Grind, Mighty Capital, GrowthHackers, and more

- The problem with defining product-market fit

- In search of quantitative indicators of product-market fit

- 6 things about measuring product-market fit

- 1. Nothing matters more than retention

- 2. But there are other indicators along the way

- 3. With that in mind, product-market fit is a spectrum

- 4. Every business is unique, and metrics frameworks apply differently

- 5. Once you find product-market fit, it’s not static

- 6. Don’t invest in growth until you’ve found product-market fit

- Bonus advice we love

- Closing thoughts

It’s been a long-held notion in startup circles that lack of product-market fit will doom even the scrappiest of founders to fail. There’s a reason, after all, that Y Combinator coined the slogan “make something people want” shortly after they were founded in 2005.

And beyond the anecdotal, an often-cited 2019 study by CB Insights found that “no market need” was the leading reason most startups don’t succeed. Oof.

It makes sense intuitively. You can’t sell a product without delivering value to users who know they want your product to begin with. But as pervasive as product-market fit is as a concept, it’s notoriously hard to measure, track, and optimize with any degree of certainty (if such a thing even exists).

To find some answers, we asked some of the smartest people we know for fresh insights—experts on product-market fit across different industries and geographies who’ve seen it again and again. And this is what we heard.

The problem with defining product-market fit

Many definitions of product-market fit are murky, and the pathway to get there even murkier. And though “feeling” like you’ve found product-market fit can be both exciting, and convenient (i.e. you can finally do things like hire people, invest in growth, and create culture!), there are real risks of shifting your attention away from any startup’s true challenge: solving the problem.

Reflected Ilya Volodarsky, Co-founder of Segment, in a 2019 presentation:

“What I remember about our journey is that we deluded ourselves that we had product-market fit almost the entire time. If I had a good metric at that time that represented product-market fit, we’d probably have $500K more in our bank account and wouldn’t have spent two years in misery.”

It’s a common blunder—getting swept up in the dream of the product and what it symbolizes, rather than deeply understanding how your first customers are actually using it.

“I’ve made this mistake myself, focusing on the product and the need you perceive rather than what the market needs… Too many startups fail at this by attempting to run fast to achieve the ‘perfect’ product rather than the ‘right’ product,” admitted Israel-based startup advisor and former Sr. Product Manager at Viber, Idan Dadon, when we spoke to him.

But on the other hand, founders often describe finding true product-market fit as marked by a certain momentum they can just sense—a feeling. “Even though I’m more comfortable with numbers, I believe there is a feeling of product-market fit,” explained Reforge’s Brian Balfour in a recent post.

According to Raymond Doraisamy, COO of Singapore-based accelerator StartupX, one of the best descriptions of the feeling of finding product-market fit comes from Twitch co-founder Emmett Shear. “He says finding product-market fit is like pushing a boulder uphill,” explained Raymond when we spoke. “If you get distracted or stop working, the boulder might actually roll back down. When you’ve reached product-market fit, it’s where you crest the top of the hill. Suddenly, you’re pushing the boulder and it’s moving easily. Now, it takes only a little effort to make progress. Customers are coming to you, and you have more demand than you need and can handle.”

Can a feeling be measured?

In short, yes. Product-market fit can be defined by both a feeling and something more quantifiable.

Echoing Raymond’s thoughts above, Egan Montgomery, Director of Go-to-Market at Indianapolis-based venture studio (and GAN member) High Alpha—whose portfolio includes G2 and Lessonly—compares finding product-market fit to the forces of physics:

“In the early stages, pre-product-market fit, founders push their product into the market. But then, at some point, the best companies achieve product-market fit, which is characterized by a pull from the market. This pull manifests in several ways. Customers start to demand your product. They come to you. They tell their friends about it. Many who have experienced this will tell you it’s a feeling, but there are ways to quantify this pulling force.”

In search of quantitative indicators of product-market fit

Over the course of our conversations, we were pointed to several measurement frameworks for finding product-market fit, with differences depending on the product category, and industry.

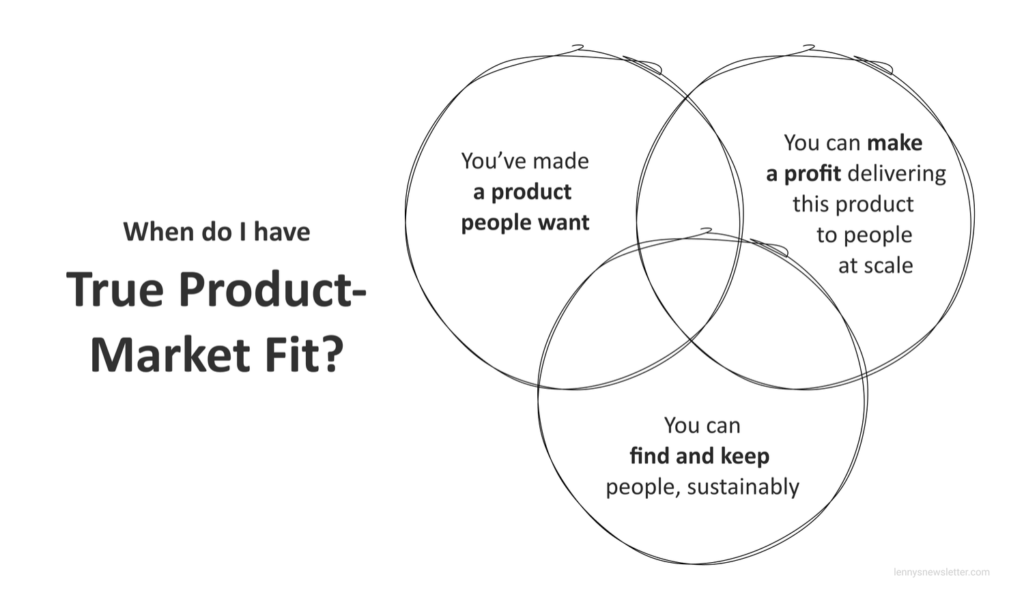

More than one expert we spoke to pointed to Lenny Rachitsky’s definition matrix, which optimizes for retention, growth, and profitability. When your product finds itself at the intersection of these three elements, you’ve got solid product-market fit.

A16Z General Partner Andrew Chen also offers some helpful quantitative indicators of product-market fit that sit within a similar framework. For a SaaS company, he looks for things like “less than 2% monthly churn” (the flipside of retention), a “clear path to $100k MRR” (growth), and a “5% conversion rate from free to paid” (profitability).

And San Francisco-based VC firm Tribe Capital takes an even more nuanced approach to objectively measuring product-market fit. They’ve developed numerous frameworks to apply across different industries, exercising and refining them hundreds of times across their investing history with companies like Facebook, Slack, and Carta. Taking a cue from corporate finance, their framework uses a series of measurements—growth accounting, cohort analysis, and customer distribution—to provide a quantitative view of a company’s level of product-market fit.

(Hey, we said product-market fit could be measured—we never said it was easy).

But, there are a few common themes, takeaways, and best practices for measuring product-market fit that almost every expert we spoke to agreed on. We’ll call them “6 things about measuring product-market fit”, and we’ve captured and categorized them below:

- Nothing matters more than retention.

- But, there are other indicators you should pay attention to along the way.

- Product-market fit is a spectrum, as opposed to something you definitely have or don’t.

- Every business is unique, and metrics frameworks apply differently. Focus on the metrics that matter for your product, and make sure they’re clearly defined.

- Once you find product-market fit, it’s not static—goal posts will change over time, and that’s okay. Retaining product-market fit requires constant iteration.

- Shifting your focus to growth too early, though tempting, will hurt you in the long run.

6 things about measuring product-market fit

1. Nothing matters more than retention

Over and over, we heard that retention—a key output metric that signals user value—is a more telling and definitive indicator than any other throughout the startup lifecycle.

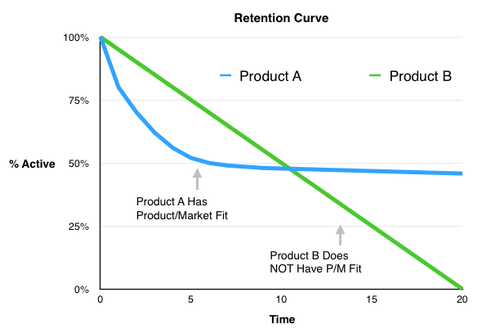

“Retention rate is the best measure of product-market fit, because it is a behavioral measure of repeat usage. Specifically, you want to focus on the “terminal value” of your retention curve. If your retention curve drops to zero, then you don’t have product-market fit. To achieve product-market fit, you want your retention curve to flatten out to a non-zero retention rate percentage. The higher the percentage, the stronger your level of product-market fit.”

“Validating product-market fit requires that users actually try your product and experience its core value. The best indicator of product-market fit is retaining the users that try your product.”

“While in order to reach product-market fit you must nail both retention and monetization, retention is the more important metric here. It’s a precondition for monetization—if users don’t see the value in your product, they won’t pay for it.”

“You haven’t found product-market fit on just a few hundred users… In the early days, user interviews are your main source of feedback, but eventually, you can leverage metrics such as usage growth, revenue, retention, customer referrals, churn, reviews, NPS scores, and PR, to name a few. Customer retention and referrals are the most important metrics to measure when finding product-market fit, as they indicate that customers are continuing to use your product over time and that they are willing to organically share your product with others.”

“Retention is the main metric that quantifies product-market fit. This is different from viability and indicates an inflection point in your company’s growth curve. This can vary from user persona subsegments and can be used to further define target customers early on, which may differ from your original hypothesis.”

Startup Grind

Jaclyn Allen, Partner Success Manager, and Daniel Reilly, Software Engineer, Startup Grind

Be sure to figure out how you’re defining retention for your product, and stick with it. To measure retention, you need to have a strong understanding of your product’s “value metric”. Gustaf Alstromer, Partner at Y Combinator, outlines the following steps:

- Identify the metric that represents the value users get from your product.

- Measure the repeat usage of that metric i.e. (how often should people be doing that).

- Now measure retention and aim for a flat retention curve—you’re trying to understand repeat usage.

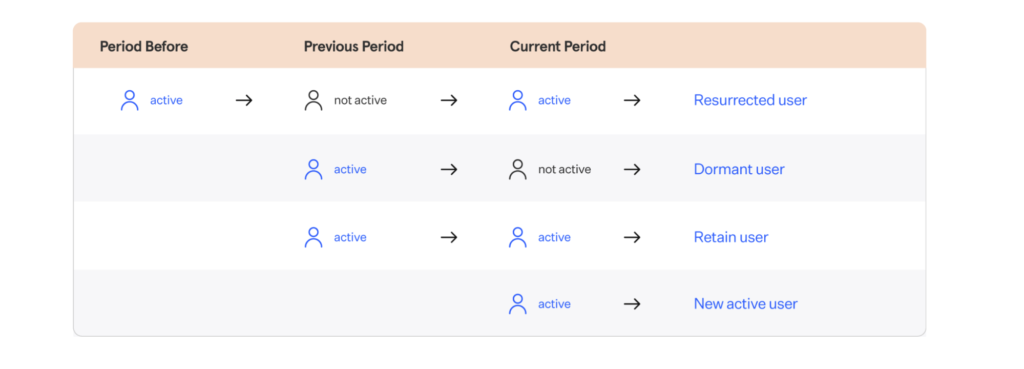

Once you’ve established a baseline for improvement, you can run tests to see what moves your retention metric—things like improving activation, scaling out more targeted acquisition strategies, and resurrecting users who’ve dropped off.

2. But, there are other indicators you should pay attention to along the way

Though retention is key, there are other indicators with different levels of confidence along the startup lifecycle. We broke these up into earlier, more squishy indicators (i.e. “I’m getting a good feeling about this…”), and later, more quantifiable indicators (i.e. “the numbers indicate that…”).

Earlier, squishy

Pre-product or in the early stages of your product, many startups find that qualitative data can be a valuable leading indicator.

In a framework that Sean Ellis developed, and Superhuman famously adopted, teams ask users “how would you feel if you could no longer use the product?”, and measure the percent who answer “very disappointed.” A more sophisticated cousin to traditional NPS surveys, at the core of this model is the idea of doubling down on what your most passionate users love, while addressing the objections of users who aren’t totally bought in yet.

And having completed this kind of customer discovery is in itself an indicator that product-market fit is on the right track.

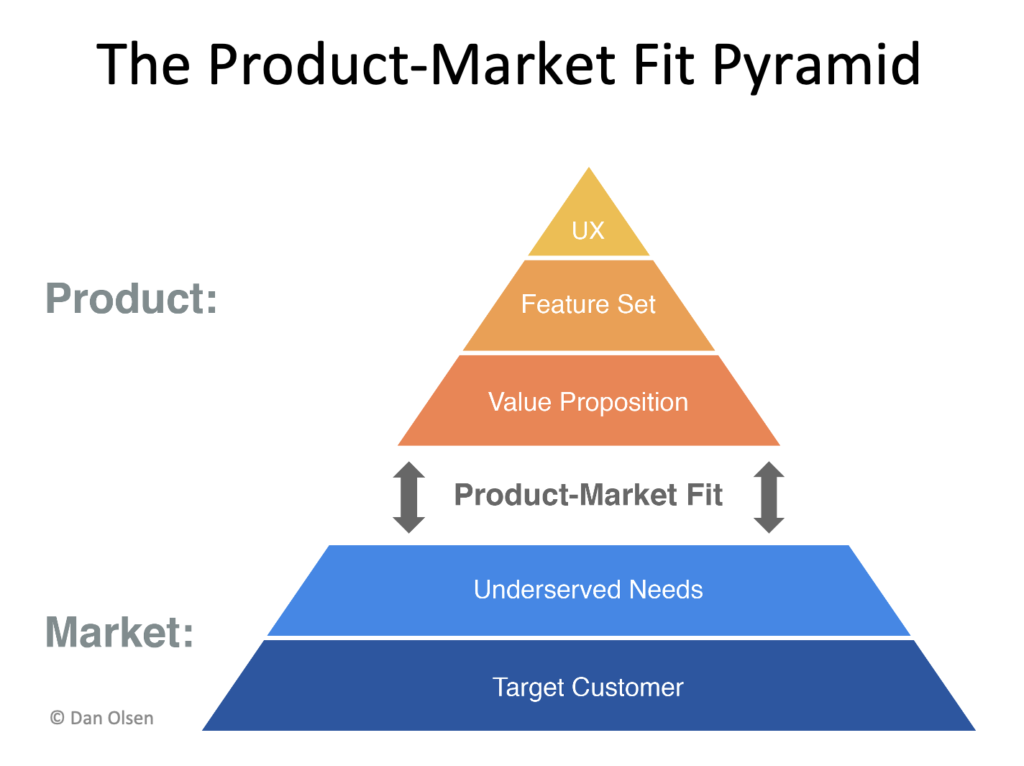

“Before launching a product, it is very valuable for companies to assess their level of product-market fit via qualitative user research. Post-launch, they can start to track their retention rate, but should continue to seek out qualitative insights to combine with their quantitative data. In my book, The Lean Product Playbook, I cover how to gain a sense for your product-market fit with qualitative user testing sessions.”

“A good early indicator is whether a significant number of customer discovery interviews have been done. You’ve spoken to hundreds of potential users and have built out a customer journey map, profiling each customer’s use case.”

Startup Grind

Jaclyn Allen, Partner Success Manager, and Daniel Reilly, Software Engineer, Startup Grind

Organic growth and acquisition metrics will also signal that product-market fit is on the right track early on. For SaaS companies, investor and entrepreneur Elad Gil likes when he sees major brands finding and using a product organically.

And a keyword here is organic. Don’t pay for friends at the party—earn them.

“On the acquisition side, you are looking for a significant uptick in free, earned, and organic customer interest. Pay specific attention to demand sourced from customer/word-of-mouth referrals, direct website or app traffic, and branded search. In the B2B space, if your company is old enough, see if customers bring you with them when they change jobs.”

“Really early on it’s better not to use paid channels and do things that don’t scale. There are exceptions to this advice, but you generally want to see if your friends and family will use [your product] first. This way you have as many attempts to get to product-market fit as possible. Also, you will find the customers that you paid for may not be good quality customers, or that you’re not making something differentiated enough.”

During the activation and user onboarding stages, you’ll also start to see signs that product-market fit is headed in the right direction (as well as opportunities to course-correct based on whether users are doing what you’d hope).

“The best founders I see define the beginning of onboarding (i.e. the first impression) at the very top of their marketing funnel. The end of onboarding (i.e. activation) is the moment you’ve provided enough value that you are likely to have gained a returning user. Analyze your usage data and find out what it takes to get there—that’s the end of your onboarding. In the case of Uber, it’s likely to be the first ride; in the case of Robinhood, it’s likely to be the first incoming money transfer.”

“I think early on it’s interesting and useful to pay attention to user onboarding in detail. Ask yourself the important questions. What are [users] doing that you didn’t expect? Where are they drawn to? What are they doing that makes them enjoy the product more or dislike it?”

Startup Grind

JACLYN ALLEN, PARTNER SUCCESS MANAGER, AND DANIEL REILLY, SOFTWARE ENGINEER, startup grind

Later, quantifiable

A much more quantitative indicator of product-market fit is user engagement, viewed in a distribution. It’s a helpful metric when your product is a little further along, but still in its infancy (before you have the user volume needed to plot your retention curve), and can also validate the results of surveys conducted pre-product.

“I like to see an engagement increase of 2-3X from first day, week, or month activity to the following period, monitoring buckets of usage in a distribution form (i.e. low active, medium active, high active, and referral/purchase). The goal should be growing the percentage of users who are in the fourth bucket. A good rule of thumb is reaching 5% of users retained for enough time to create momentum for growth.

“Given N monthly active users, we plot the fraction that was active only one day in the month, then two days, and so on. Such L28 distributions can be helpful even for just a handful of users. For example, we often see B2B SaaS companies that have perhaps a dozen paying customers but those customers have several hundred underlying users of the SaaS product. Inspecting the L28 distribution of those underlying users gives us a good sense of whether the users are actually using the product…”

After retention, monetization and profitability were the most frequently mentioned metrics categories for assessing product-market fit. As Reforge’s Brian Balfour outlines here, “true de-risking involves finding a way to get people to put their money where their mouth is.”

Elizabeth Yin of HustleFund further emphasizes the importance of reliable, sustainable revenue growth as an indicator of product-market fit, stating that, “the end goal is profitability at a high revenue level, so the holy grail is to find repeatable customer acquisition channels that can scale to the $100M per year level.”

“I’ve found that people who consider your product a “must-have” when it is free aren’t necessarily going to keep using it when it costs money. So, retained paying customers will be very important if you plan to charge for the product.”

“Out of the various stages of the customer journey with the product (acquisition, activation, retention, and monetization), only the last two are actually indicating that people want what you make…The acquisition phase is an indication that they have the problem or need, and activation is an indication that they think your product might help them. Retention is where they come back because they see the real value, and monetization is where they demonstrate their willingness to pay and put their money where their mouth is.”

“I’ve found that an early indicator is certainly whether or not users are willing to pay any amount of money for your product. If people won’t pay for your product, nothing else matters.”

3. With that mind, product-market fit is a spectrum, as opposed to something you definitely have or don’t

Even though things like strong retention are extremely important signals that you’ve found product-market fit, don’t expect fireworks to go off when you’ve reached a certain threshold. And, don’t be discouraged if your metric isn’t where it should be.

Instead, be vigilant in understanding the different product-market fit indicators that can be found in your data, and look for ways to proactively nudge them forward.

“Product-market fit is not binary, but rather a spectrum. Analyzing a company’s customer data helps us understand where a given company sits on that spectrum. If it has high growth with healthy cohorts and reasonably distributed demand, then it probably has strong product-market fit. If it has the cohorts and distribution but only tepid growth then it has weaker product-market fit. The purpose of this deeper analysis is to provide a more nuanced and actionable understanding of the company than a simple yes-or-no response.”

“Founders who are early in their company building journey have to constantly balance priorities in order to build a great product. The concept of product-market fit was invented to help them along this journey, but I like to think of it as a process, rather than a line in the sand.”

“We’re delighted when we see companies pitch using the benchmarks reports we’ve put together, but it’s also helpful to point out that not all businesses are absolutely perfect, or well-rounded. If you’re falling short on one SaaS metric and over performing on another, it’s important to be upfront about that, and even develop a plan of how you’d utilize capital to focus on improvement.”

“You can evaluate product-market fit at any stage of the funnel, but the trick is to be aware that there are different levels of confidence in your product-market fit indicators as you progress through it. Low cost of acquisition, for example, doesn’t yield as much product-market fit confidence as high activation rates, and so on. When you demonstrate superlative monetization, renewal, and referral metrics then you really know you’ve cemented product-market fit. Tackling all funnel metrics at once will be overwhelming. Focus singularly on each step of the funnel as your business or product progresses. When you’ve reached your benchmarks, move on to the next.”

“Validating product-market fit really requires that someone give your product a proper test. But you can gain helpful information from all steps of the funnel. For example, if it’s really tough to get people to even consider trying your product, there is a good chance you are solving a problem that doesn’t really exist (or your hypothesis about the problem is wrong). If people give up really quickly before giving your product a proper try, they probably don’t care much about solving the problem (or you lack the credibility that your solution will be effective).”

Ultimately, a startup’s priority should be on moving the metrics that drive product-market fit for your business as quickly as possible. Rapid experimentation and feedback loops that help you better understand the value your product provides for customers will get you there.

“Startups are looking for growth to bring about momentum. As an early-stage startup, you’re looking to make a lot of progress in a short amount of time. Progress has a direction. The best way to set up progress for an early-stage startup is using an experiment framework. Most of your experiments early on should be tailored towards growing your north star metric.”

“More often than not, product-market fit is less about a particular customer stage, and more about the entire customer journey and how customers feel about you and your product. Setting feedback loops at each stage is important to understand what the value-add is for the customer. As a product leader, we try to build products that users say they cannot live without.”

4. Every business is unique, and metrics frameworks apply differently. Focus on the metrics that matter, and make sure they’re clearly defined.

A common piece of advice we heard from experts was to resist the temptation to obsessively compare yourself against competitors. Instead, spend your energy figuring out what the “north star”, or focus metric for your product should be (often tied to retention), and how you can improve it. To stand out in a sea of startups, you’ve got to be really great at one thing.

And when you do look at competitors, use the data to inform your hypotheses about what activities will move the needle for you.

“We are looking for outliers. A company with top-decile customer retention and average customer lifetime value is always more compelling than a company that is above-average in both. The reason for this is simple: most startups fail. Playing it safe being just above-average is typically not good enough. The implications of this for an entrepreneur may seem counterintuitive. The temptation with instrumenting metrics is to track everything and start by fixing the weakest ones. However, the company’s focus should always start with its outliers: maintaining the positive ones that set the business apart from its competition, and if there are any negative ones getting them back up to average.”

“External benchmarks can be hard because different companies are measuring their metrics differently. It can be hard to know if a comparison is really apples-to-apples. The best approach is to compare against yourself over time. You want to increase your retention rate over time as you improve your product’s functionality and UX, fix bugs, better understand your customers, optimize pricing, and improve your value proposition.”

“The definition of acquisition, activation, retention, and monetization changes with every product. Not just categorically (e.g. B2B vs. B2C), but also between products of the same category, and even the same company. Some products are meant to be used daily (like Slack) so it makes sense to measure Daily Active Users (DAUs). But other products might look at Monthly Active Users (MAUs) instead. It’s not only the frequency that matters but also the definition of what ‘active’ means: if I’m a Slack user and only read messages but never send any, am I considered active? What if I only send one each day? Startups should discuss each and every metrics category in depth.”

“At my current company, Update.ai, our north star is to help Customer Experience teams drive the most value out of their meetings with clients and customers. So for us, it’s about measuring product indicators like meetings hosted, action items detected, and meeting summaries shared. We’re not overly concerned with benchmarking ourselves against our competition. For one, every productivity tool is slightly different so there’s no fair apples-to-apples comparison. But moreover, during the infancy of our company we have to stay singularly focused on continuing to drive our product-market fit, and being overly concerned about competition doesn’t help us to do that.”

“Data, especially retention, can help measure fun. Before, game makers would argue and have religious wars over what was “fun”, with no data. [At Kabam], we reasoned that if the game was not fun, a player would not return. We used retention to our advantage and were one of the first gaming companies, if not the first, to pioneer a cohorted retention model. Prior to this, game developers crudely used DAUs / MAUs to measure retention. Our focus on retention was incredibly important as it fed into our north star metric of revenue in the form of Lifetime Value (LTV) of a customer.”

High Alpha’s Egan Montgomery also outlines a nice benefit of finding product-market fit that goes beyond the metrics themselves: how easily and predictably you’re able to measure them.

While perhaps not always a reliable indicator in itself (for example, you could be seeing a high growth rate where DAU/MAU becomes consistent month over month—but you’re just accelerating top-of-funnel growth without retaining users), the stabilization of metrics can be a reward on the other side of the product-market fit hill.

“I’ve seen different metrics work differently for different companies. One thing that is always consistent is the idea that your metrics become more stable and predictable as you achieve product-market fit. Before product-market fit, everything is erratic. You might know how many users are active, or DAUs/MAUs, but there is no consistency from month to month. You might see some customers referring new users, but there’s no obvious reason why. The stabilization of metrics is a great early indicator of product-market fit. And it should shift your strategy from “mostly experimenting” to “mostly doubling down” on what’s working. By the way, stable doesn’t mean constant. It means predictable. Like a sine wave versus a steady upward curve.”

5. Once you find product-market fit, its not static—goal posts will change over time, and that’s okay.

Retaining product-market fit requires continuous iteration. Markets are changing (faster now than ever before), and as your company grows from a hundred users to a thousand, your product-market fit indicators will change too. As Arjun Sethi from Tribe Capital explains, “When a company grows, product-market fit typically gets worse as its customer base expands from true believers to slow adopters, holdouts and skeptics. Acquisition costs increase, revenue growth slows, and customer cohort retention decreases.”

The Segment team also talks extensively about finding product-market fit after initial success. For established companies like these, the challenge is finding post-product-market fit (e.g. for new products as the company grows its market share). Without the sense of urgency to optimize runway, it’s easy to lose focus and want to explore new areas, instead of ruthlessly prioritizing the most pressing customer problems and solutions.

Ultimately, product-market fit is a pulse you must constantly keep your thumb on, and establish tight, fact-based, data feedback loops to monitor. Once you have a strong indication of product-market fit, focus on user segmentation, and always be “launching”.

“As you grow, you’ll learn new things, build new features, possibly pivot, and continue your journey to finding product-market fit. The biggest thing is to remind yourself that you’re always on a journey to finding product-market fit and should never stop testing, asking questions and capturing feedback and data.”

“As you grow your user base past, say, 10,000 users, the concept of product-market fit becomes less and less relevant. Your user base becomes a mix of new and returning users and you need to start segmenting it. At that stage, your goal should be to evaluate as quickly as possible what segment your new users fall into so you can continue to serve them effectively. For instance, is your new user a social butterfly who will invite all their friends to join, or a whale who will buy all your upsells right off the bat? You need to make sure you treat these users differently (e.g. helping the social butterfly enroll their friends with viral loops, and offering compelling upsells to your whales).”

“Because founders are builders, we are often perfectionists. However, early on, it’s better to launch than get to perfect. If you don’t believe me, search for the launches of amazon.com and paypal.com. No one will like your first launch, so make sure you launch again and again. Many founders regret launching too late rather than too early. The best founders are always launching.”

OpenView’s Sam Richard offers a helpful retention indicator for SaaS companies that are further along:

“As you mature, logo retention should show founders whether or not they have product-market fit across a broad range of use cases, while Net Dollar Retention (NDR) [the percentage of first month revenue retained in future months] is what you should look at if you’re focused on performing well in a particular market. For expansion stage businesses, I’d be impressed if I saw logo retention above 80%, and NDR above 100%.”

6. It can’t be said too many times: don’t invest in growth until you’ve found product-market fit

In a now-famous blog post, former Y Combinator President Sam Altman writes, “We’ve said this before, but it’s worth repeating–many founders hurt their companies by focusing on growth too soon. I’m not saying don’t grow at all–getting people to use your product, even in its earliest form, will help you better understand what your customers want.” He continues,

“Focusing too heavily on growth before you’ve built something people love leads to the leaky bucket problem. You can get users to come in the door, but they don’t stay, and likely won’t return.”

(We could’ve tried to paraphrase this, but is there really a better way to say it? We think not).

“It’s essential to pre-define what measurable product-market fit will look like in your business and share this information with your investors. Get upfront alignment with investors about when you will try to grow your business and don’t just plan to fight this battle along the way. Of course, having clearly quantifiable indicators for your product-market fit will also help you and your team align on your progress.

Ultimately, sustainable growth is a function of converting people to a must-have experience with your product. Without a “must-have” experience, sustainable growth will be impossible. Amplifying your must-have experience is what leads to breakout growth that stays strong in the long term.”

“The mistake we’ve most commonly seen is confusing problem-solution fit with product-market fit. Problem-solution fit is typically found in the early days of a product (MVP), with a small group of early adopters, and we’ve seen early-stage startups often frame that as product-market fit which is a major downfall when they begin to turn on the growth engine.”

“It’s common for companies to focus on acquisition too early. One company I know had an iOS app that Apple was featuring regularly on the App Store. Each time the app was featured, they would see a huge spike in active users. However, when you looked at the retention curve, the retention rate was dropping to zero after just three days. So all that acquisition didn’t really matter because it didn’t result in any retained users. For most companies, it’s best to first focus on retention rate. Once the terminal retention rate is above zero, then it makes sense to move on to conversion rate optimization. Once retention and conversion have been improved, then it makes sense to move on to acquisition. By following this order, the ROI on your acquisition efforts will be much higher since any prospect you acquire will be more likely to convert and retain.”

And what’s more, not only will focusing on surface-level metrics come back to haunt you in the long run, but it’ll also hurt your credibility with investors.

“I’ve seen too many startups include vanity or downright misleading product metrics in their pitch. Good investors will be able to see through it and the startup will really hurt their chances of a successful fundraise as their credibility takes a hit. It’s important that founders use product metrics to paint a picture of where their journey has taken them since they started, and how it ties into their vision for the future.”

Bonus advice we love

Finally, here are some indicators of product-market fit from the experts that were just too good not to share.

“Really exciting and positive team morale is a great sign of product-market fit. Good teams know when they are winning and losing. It doesn’t mean product-market fit will or should happen overnight, but the energy totally changes once this important barrier is achieved.”

— Egan Montgomery, Director of Go-to-Market, High Alpha

“Team morale.”

— Sam Richard, Director of Growth, OpenView Ventures

“A sufficient volume of prospects providing ongoing feedback. If they care enough to keep providing feedback, the value proposition is generally attractive enough that they want to work with you to develop the right solution.”

—Sean Ellis, Founder & CEO, GrowthHackers

“Having your employees and closer circles convert to super active users.”

—Idan Dadon, Startup Advisor & Former Sr. Product Manager, Viber

“Finding product-market fit is a lot like falling in love. Your customers tell other people about it, your startup inbound requests are consuming you and you are not able to sleep at night. Above all else whatever you do, you can’t buy love.”

— Holly Liu, Founder, Kabam, and Visiting Partner, Y Combinator

Closing thoughts

No matter how far along you are in your journey to find product-market fit, start with a well-defined source of truth, build a framework that can scale with you, and be upfront with yourselves and your investors.

“If you don’t collect data, you’ll be in the dark when it comes to what to do next. As the saying goes, what gets measured, gets managed,” says Raymond Doraisamy of StartupX.

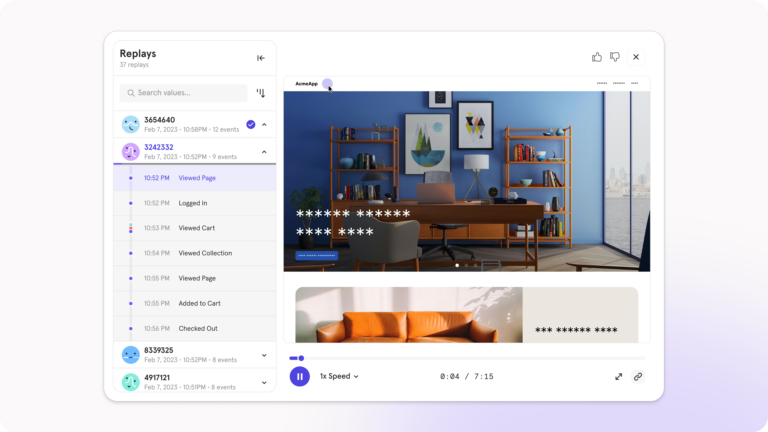

Along with taking the guesswork out of the business of building products, a product analytics tool can help make this possible, and easy (in fact, we recently removed the data history limits on our free plan to enable reporting on long-term metrics to employees and investors).

Remember, great product managers combine data on customer intent—what people say they do—with customer actions—what people actually do—to make products that are indispensable.

Thank you to the many experts who generously offered their time and insights for this piece:

- Arjun Sethi & Jonathan Hsu, Co-founders & General Partners, Tribe Capital

- Dan Olsen, Product Management Trainer, and Author of The Lean Product Playbook

- Josh Schachter, Founder & CEO, Update.ai

- SC Moatti, Founding Partner, Mighty Capital

- Sam Richard, Director of Growth, OpenView

- Egan Montgomery, Director of Go-to-Market, High Alpha

- Idan Dadon, Startup Advisor, and Former Sr. Product Manager, Viber

- Jaclyn Allen, Partner Success Manager and Daniel Reilly Software Engineer, Startup Grind

- Sean Ellis, Founder & CEO, GrowthHackers

- Noa Ganot, Product-Market Fit Coach, and Former Head of Product, eBay Israel

- Raymond Doraisamy, COO, StartupX

- Holly Liu, Co-founder, Kabam, Visiting Partner, Y Combinator, and Author, Founder Musings

- Jacob George, Global Product Coach, Founders Factory