The BusinessInsider article The evidence is piling up – Silicon Valley is being destroyed seems to have riled up a lot of people. People are at a loss to understand how could the fabled VCs of Silicon Valley invest $120 million in a company that makes a juicer. People are wondering incredulously, there’s an app for that?! Since when did we need an app to drink juice?

But, this is business as usual as far as I see it. Allow me to explain.

If you have one of these burning questions in your mind, you could just skip to that section, or read on:

Isn’t it just making juice? Hint: Jobs to be done

How is this different? Hint: Value Proposition Design

But $400? Hint: Business Model Innovation

What’s It Worth to You? Hint: Subjective & Objective Value

Still, $120 million in funding? Hint: Market Opportunity

Is Silicon Valley Really Being Destroyed?

ISN’T IT JUST MAKING JUICE?

People who buy juicers want to, well, drink juice. But that’s just the functional task they engage in.

The motivations to drink juice are all about having a healthy lifestyle, consuming fruits and vegetables, likely of the organic variety, and a juice is the best option for this quick nutrition instead of peeling fruits, cutting them up, and so on. A few gulps and you are on to your next thing. A juicer enables people to get the job done of living a healthy life by consuming more fruits and vegetables. If you are not familiar with jobs to be done, look here.

In the context of doing this job, people face a number of pain points. First we have to drive ourselves to get the specific type of organic fruits and vegetables we want to make juice with. We have to wash, peel, chop to feed them into the juicer. And make sure we don’t overload the juicer or the blades. Then it requires operating the juicer at the right speed, adding the right amount of water, making sure the fruit chunks are nicely blended, too many decisions! And then cleaning up all the mess. All of this for one glass of juice!

The traditional customer experience with drinking juice is a little involved now that we think about it. And nobody is addressing these pains. We have taken these pains for granted and are choosing to live with them because we do not know who can address them for us. This is what Juicero is attempting to do.

HOW IS THIS DIFFERENT?

So does Juicero have a value proposition that is sufficiently differentiated from the other juicers in the market? Is the Juicero better than other juicers at addressing these jobs?

Here’s a video that explains this better.

No need to go shopping – check.

Not have to worry about juicer settings – check.

Nothing to clean – check.

No mess to clear – check.

There is a clear before and after picture of the customer experience.

Perhaps one of the biggest problems the Juicero solves is that most people don’t end up drinking juice as regularly and frequently as they think they ought to.

BUT $400?

But still, $400 for a juicer? And how much extra do we pay for the juice packs? Whoa, you say! It all adds up.

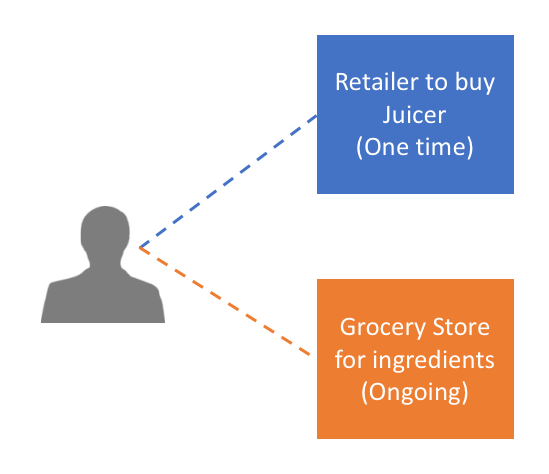

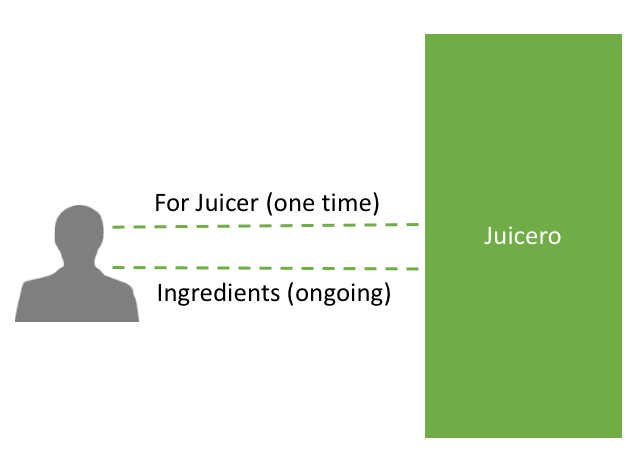

Let’s look at how the money flows today for us to have the juicing experience we want. The total cost of ownership for drinking juice, is the one time cost of the juicer, and the ongoing cost of buying fruits and vegetables, which today we pay to the grocer.

Juicero is doing business model innovation to capture all the value in this experience.

Juicers come at many different price points, all the way from a Black+Decker at $36.86 to a Breville at $600. What we pay for fruits and vegetables is relative based on individual preferences and habits.

But still, it’s just a juicer. I can squeeze fruit with my bare hands and the juice tastes the same. I can even squeeze the same juice packets with hand and the juice tastes the same. So what’s the big deal?

Good point. If that’s the thought in your mind, I request you to read on.

The real question is:

WHAT’S IT WORTH TO YOU?

The acceptance of a product is driven by:

- How badly do I want it?

- Does it deliver well on its promise?

- Is there net benefit to me by having it?

People answer these questions differently, based on how they perceive the product’s utility and value, and that drives what they are willing to pay for it.

You don’t have to have a resounding YES to all three of these questions. If you really truly badly want it, well, you will overlook the deficiencies in the product and also justify the net benefit to yourself 🙂 We’ve all been there (especially those of us who bought the very first Apple Watch ;-)! Nothing wrong with that.

Some elements of value are tangible and measurable, we call that objective value – 0 to 60 mph in 3 seconds. Objective value is verifiable, there is no room to debate it.

Some benefits are very personal, intangible, can’t be measured adequately. That is subjective value – people in India who buy a luxury car that goes 0 to 60 in 3 seconds, even though most times you can’t do that. Try going 0-60 in the picture below 🙂 – but people like to be seen in a car that can go that fast.

There is no rational explanation for this other than the fact that it is personal preference, a statement of style or quality of life. It’s different for you from the person next to you. We can debate about it, but there’s no point.

If you thought the iPhone is the premium smartphone in the world, rethink. The Vertu Signature Touch Phone starts at $9,000 and is specifically for “high net worth individuals”. It comes with access to a real-life personal assistant. According to Wikipedia, by the end of 2013, they had 350,000 customers. If that’s one of you, more power to you.

Back to Juicero. Perhaps you are someone who just likes going to the farmer’s market and picking out fruits and vegetables by your own hand – in other words, this is not worth that much to you. Perhaps you don’t, and would just like to have clean, organic produce somehow delivered to you to make juice with.

Perhaps it’s a conversation starter – a flashy new gadget in your swanky new kitchen. After all, Oprah likes it, so does Gwyneth Paltrow and Justin Timberlake too. You are no less either!

Every product and it’s value proposition is meaningful and relevant in the context of its target market and customer segment, and the value they perceive in the product.

STILL, $120 MILLION IN FUNDING?

Most people who are in disbelief about this juicer, are likely not in the target market. If the founder of Juicero has defined a target customer for his product, and if there are enough of them, more power to him for discovering his prospective customers. If the VCs believe in the market opportunity, more power to them too.

Indeed, this product is launched in an existing market. By some reports, global blenders and juicers market is growing at a 6.5% CAGR and will reach USD 3.3 billion by 2021. Now there are nuances here, home use vs commercial use, etc., but the point is that this is not an alien object.

Here is an entertaining read of competition in this market.

A Product and a Company are two different things. Investors don’t invest in a product, they invest in the company.

This product, the juicer, is just the first instantiation of the company’s vision. Who knows, their roadmap may have plans to go after the commercial market, selling to the juice bar and smoothie industry players like Jamba Juice and Nektar. And there’s always world domination to aspire for!

IS SILICON VALLEY REALLY BEING DESTROYED?

The author of the Business Insider article makes the argument that Silicon Valley, which was all about innovating to overthrow entrenched interests, is now housing monopolies. He claims that the poster children of Silicon Valley innovation – Apple, Google, Facebook – have all grown up, become too big and stifling innovation. He takes affront at Google “buying” innovation, and building cool technology that isn’t getting deployed. He claims that innovation is now only about waiting to find out if the iPhone will have a bigger screen. He takes issue with the $120 million investment in a juicer, of all things.

First, let’s take the matter of the $120 million investment in a juicer.

Silicon Valley investors like to think of themselves as contrarian. It’s their ability to be contrarian and take meaningful bets against conventional wisdom that actually makes Silicon Valley what it is.

Otherwise who in their right mind would invest in a company that asked if you’d like to spend three nights in a different city in a stranger’s spare bedroom? Against conventional wisdom of the day, but no longer.

It’s not just about the singular product called juicer, as we have said before, but about the shift in customer experience Juicero wants to create, tapping into the desire to live a more healthy life and consume more organic produce on a more regular basis. It’s worth a shot if you buy into that future.

Strike one against the article.

Second, let’s take the matter about monopolistic companies stifling innovation.

There have always been large companies that have loomed on the horizon. Elad Gil’s blog We Will Crush You provides a great perspective on this. It used to be Microsoft back in the day. Today it is Google or Facebook. But that did not stop two guys from figuring out how to solve the problem of communicating with family and friends on another continent a handful of time zones away.

So Google and Facebook acquire “innovation”. So what? Some companies decide to get acquired, some companies don’t. Snapchat didn’t. Market forces play out.

That’s strike two.

Third, let’s take the matter of Silicon Valley innovation being watered down to finding out whether the iPhone will have a bigger display.

This could not be further from the reality on the ground. There is sufficient ground breaking innovation being attempted in areas such as genomics, artificial intelligence, automation and robotics, machine and deep learning, bitcoin and blockchain, virtual and augmented reality. IoT and Big Data have given way to newer buzzwords.

So shall we say strike three?

I am not dismissing the author’s genuine concern about issues of competition, anti-trust, and monopolies. But the claim that Silicon Valley is being destroyed and his criticism of the Silicon Valley ethos of innovation and investment are, IMHO, unfounded.

What do you think?