Collecting In-App Feedback: Best Tactics and Tools for SaaS

In-app feedback is one of the most insightful and relevant types of data you can collect as a product marketer, while also being the cheapest.

But it all depends on how you approach users and the tactics you follow to get them to answer your surveys. So in this post, we’re giving away all our tactics for collecting in-app feedback and sharing the tools you can use to make the most out of it without coding.

But first, what’s in-app feedback?

TL;DR

- In-app feedback is all the customer opinions and feelings about your product that are gathered from in-app surveys (surveys that show up inside your app). And it includes both positive and negative customer feedback, user data, and more.

- User feedback can be general or contextual. General feedback measures overall satisfaction, loyalty, and experience with your product.

- You can collect contextual feedback through targeted questions after a customer interacts with your product. It helps understand their perspective on aspects such as onboarding, support, and new features.

- Five examples of general in-app feedback include:

- Programming NPS surveys to trigger in-app once every six months or annually so you can keep tabs on customer loyalty levels and find improvement opportunities.

- Leveraging CSAT surveys to measure how happy your users are with the product experience and highlight areas that need improving in your product and opportunities to add value.

- Using customer effort score (CES) to measure how easy it is for customers to engage with your products and services at every customer interaction.

- Validating your product with PMF surveys, assessing how successful your product is at satisfying a genuine market need based on Sean Ellis benchmark.

- Segmenting your customers and sending targeted customer preference surveys to get insights into what customers like and what they don’t.

- Six examples of contextual in-app feedback include:

- Triggering an in-app survey after the first-time user experience to identify where users are experiencing friction early and fix it.

- Measuring customer satisfaction after the onboarding process to gain valuable insights, remove any source of friction, and improve product adoption in the process.

- Adding a bug report widget so users can give you information about what type of bugs they’ve experienced.

- Collecting feature ideas from your users via feature request surveys, and learning how you could make the product more useful, engaging, and competitive.

- Validating new features by triggering in-app surveys to customers who are giving them an honest try.

- Triggering a microsurvey when a user is churning to learn more about what’s making them leave and fix those problems—preventing churn and even winning customers back.

- There are 12 product feedback tools you can use to follow in-app survey strategies:

- Userpilot, an onboarding tool that is best for creating contextual surveys and collecting actionable feedback from app users without coding.

- Hotjar, better used for collecting passive feedback from your website and analyzing user behavior with heat maps and session recordings.

- Survicate, for marketers who are collecting feedback across various channels for both mobile, web apps, email, in-product, etc.

- Qualaroo, for getting access to plenty of tools for collecting general feedback rather than contextual.

- Feedier, for integrating your existing feedback data and monitoring it in real-time.

- UserVoice, for streamlining, visualizing, and managing feedback from various sources.

- Delighted, for basic surveys and people who are just getting started with customer experience feedback.

- Canny, a platform that makes creating a product roadmap easy and seamless, while gathering feedback for that specific purpose.

- Instabug, which is designed to monitor mobile app performance, including bug reporting, crash reporting, feedback reporting, and of course in-app surveys.

- Usersnap, for letting users provide feedback with in-app screen captures, microsurveys, and feature request boards.

- Doorbell, for collecting basic feedback on mobile, interacting directly with users, and customizing your surveys as you please.

- Pullfish for building longer surveys with AI, obtaining real-time feedback on your product concept and purchasing survey responses.

- Given that you’ll need software to get feedback, why not try a Userpilot demo to see how quickly you can build in-app surveys that get responses?

What is in-app feedback?

In-app feedback is all the customer opinions and feelings about your product that are gathered from in-app surveys (surveys that show up inside your app). It includes both positive and negative customer feedback, user data, and more.

From all the types of customer feedback, in-app feedback tends to be more relevant and revolve around the product experience, such as its usability, learning curve, feature set, etc.

General vs. contextual user feedback

There isn’t just one way to collect in-app feedback. As it will all depend on the survey questions you ask and your purpose.

For instance, there’s general user feedback which represents the overall relationship between users and your product, such as their satisfaction, loyalty, and general experience with your product.

There’s also contextual user feedback which you can collect by triggering surveys when users go through a specific touchpoint during their journey. This may include onboarding, support, or new features.

But what are some examples of how to collect general and contextual feedback? Let’s go over them.

5 Examples of how to collect general in-app feedback

Collecting general in-app feedback is crucial for understanding your users’ overall satisfaction, loyalty, and experience with your product.

Let’s look at some examples for collecting general in-app feedback below!

Collect in-app feedback to measure customer loyalty

NPS surveys are great for keeping track of customer loyalty. They typically ask users to rate their likelihood of recommending the company or brand to a friend on a scale of 0-10 (like in the screenshot below).

Where scores of 9-10 are considered “promoters,” scores of 7-8 are considered “passives,” and scores of 0-6 are considered “detractors.”

What’s better, you can program NPS surveys to trigger in-app once every six months or annually so you can keep getting data and find improvement opportunities.

Evaluate user satisfaction with in-app rating feedback

CSAT surveys measure how happy your users are with the product experience and the value it offers. And they can highlight areas that need improving in your product and opportunities to add value and delight.

As a benchmark, 60% – 70% is a good CSAT score because it indicates that most respondents, or your customers, are happy (especially in SaaS).

We use a survey that is very similar to NPS (like in the example below), where you ask your users how satisfied they are with the experience and give them a Likert scale to rate it.

Collect customer experience feedback to measure product ease of use

Customer Effort Score (CES) measures how easy it is for customers to interact and engage with your products or services.

The survey basically asks users to rate how easy it was for them to fulfilling JTBDs.

Capture product viability feedback to measure product-market fit

PMF surveys assess how successful your product is at satisfying a genuine market need. It simply asks them how disappointed they’d be if they couldn’t use them again (like in the screenshot below).

And according to Sean Ellis, if 40% of your users respond ‘very disappointed’, you’ve got it. If not, you need to keep iterating on your MVP.

Send targeted surveys to collect customer preference feedback

Customer preference feedback gives you insights into what customers like and what they don’t (like the template below). As it can help you make more accurate product development decisions.

For example, if your users prefer one UI design or one feature over another, that’s what you should prioritize in your backlog.

For more representative responses, it’s ideal to segment your customers and send targeted in-app surveys, as they’re the cheaper and easier way to learn about customer preferences.

6 Examples of how to collect contextual feedback

Now, contextual in-app surveys are probably the best way to gather meaningful feedback for specific areas such as the onboarding experience, feature popularity, and bug reports.

Trigger in-app surveys after the first time user experience

The first time user experience is probably the most decisive part of the onboarding process.

When triggering an in-app survey after this phase (like in the screenshot), you can identify where users are experiencing friction early and fix it.

This way you can optimize the onboarding effectiveness and hopefully retain more customers.

Measure customer satisfaction at the end of the onboarding process

Although NPS programs are generally used for general feedback, you can also send NPS surveys contextually for more specific feedback.

For example, measuring customer satisfaction after the onboarding process.

By asking users to rate their onboarding experience, you can gain valuable insights, remove any source of friction, and improve product adoption in the process.

Use a feedback widget to capture in-app user feedback on bugs

Contextual feedback isn’t always about triggering a survey at random times, it also includes passive feedback.

For example, you can leave a bug report widget so users can give you information about what type of bugs they’ve experienced.

With how costly bugs are for product managers, it’s totally worth it to get bug reports passively so you can fix them as soon as possible.

Gather feature requests via in-app surveys

If you want contextual feedback on product features, start by collecting feature ideas from your users with feature request surveys.

Ask users how you could make the product more useful, engaging, and competitive, then learn from their perspective.

What’s better: you can freely choose between creating a feature request widget or simply sending surveys like the template below.

Collect in-app feedback to validate a new feature

On the other hand, if you’ve been launching features and need contextual feedback to validate features, then you can also trigger in-app surveys.

Look at usage frequency and feature interactions, for example, and collect feedback from the customers who are giving them an honest try.

If you’re using a product feedback tool, you should be able to easily create and trigger in-app surveys whenever a user finishes interacting with a feature that just launched. Just like this:

Trigger exit surveys to capture churn reasons

Another great context for collecting feedback is when the user is canceling their plan, or thinking about it.

Here, you can trigger a microsurvey to learn more about what’s making customers leave and fix those problems.

If you act on the insights you find, you’ll be able to prevent churn and even win customers back.

12 Best in-app feedback tools for SaaS

Even if you have great ideas for triggering surveys inside your product, what tools could you use to implement them?

Asking your dev team is possible, but do you really want to go through that process? That’s why we’ll show you 12 tools that can do this job for you without having to code:

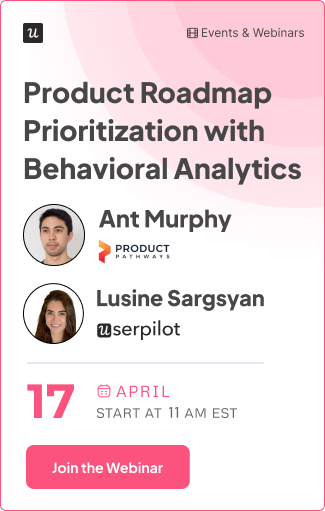

#1 Userpilot

Although Userpilot can perfectly create and trigger in-app surveys for you, it’s not the only use case it has. It can also:

- Create NPS surveys & trigger them contextually with different criteria including follow-up questions depending on what number your user chose.

- Create and trigger microsurveys to collect user data and feedback at any touchpoint.

- Analyze survey responses with a detailed dashboard like this one:

- Tag NPS response to find actionable insights, such as finding recurrent themes across detractors, or understanding what makes promoters love your brand.

If we were to review Userpilot in one sentence, it would be this: A no-code onboarding tool that is best for creating contextual surveys and collecting actionable feedback from app users.

#2 Hotjar

To gather in-app feedback, Hotjar is quite different from Userpilot. Some of its features include:

- The ability to create in-app widgets to gather passive feedback from both users and web visitors.

- A feature for publishing feedback polls and understanding user behavior better.

- Heatmaps and session recordings to check user behavior and correlate it when analyzing user feedback.

Thus, unlike Userpilot, Hotjar is better used for collecting feedback from your website and analyzing user behavior.

#3 Survicate

Survicate is an all-in-one customer feedback automation platform that can be used to send any type of survey for your app, your website, email, and even mobile.

This includes creating various microsurveys like NPS, CSAT, CES, etc. With a plethora of templates, you can customize them as needed.

It also comes with basic feedback analytics such as score breakdown.

For us, Survicate is best for marketers who are collecting user feedback across various channels for both mobile, web apps, email, in-product, etc. As it provides a wide range of tools and integrations for that purpose.

#4 Qualaroo

Qualaroo is specifically made for collecting customer insights. It allows you to create and distribute surveys of any type inside your product on both website and mobile.

It provides many useful features including question branching, A/B testing, AI sentiment analysis, and more—as well as templates for different types of surveys like exit surveys, confirmation page surveys, etc.

It’s also great for running many types of analysis, including statistical analysis, cross tabs, a nudge for prototypes, and so on.

Despite those tools, it’s still a tool that’s better used for general in-app feedback rather than contextual.

#5 Feedier

Feedier is made for centralizing your feedback data from any source in one place.

However, it does give you the tools as well to generate surveys with any type of questions, embed them inside your app, and complement the data you already have.

And although you can create data reports on the spot, it has limited reporting features when it comes to getting essential insights from customer responses.

So if you ask us, Feedier is a great tool for integrating your existing feedback data and monitoring it in real time.

#6 UserVoice

UserVoice can collect and organize feedback from multiple sources. It comes with a customizable feedback portal, in-app widgets, and direct integrations with your email client, CRM, or support tool.

This platform allows you to commit to continuous product research, validate features, and find ways to improve existing functionalities by analyzing your in-app data.

So due to its great data visualization capabilities, UserVoice is best used for streamlining and managing feedback from various sources.

#7 Delighted

With Delighted, you can gather real-time, actionable feedback from customers via email, website, and mobile.

You can choose any type of survey including NPS, CSAT, smiley surveys, CES, PMF surveys, and more. Plus they can be integrated with tools like Slack, Shopify, and Squarespace to automate surveys and follow-ups

Despite this, the reporting capabilities are limited and it lacks segmentation options to target your surveys. So, we think Delighted is better for companies that are just getting started with customer experience feedback.

#8 Canny

Canny is a unique customer feedback tool for product managers who want to build a public roadmap. As it lets you collect customer feedback, and analyze it while planning your product development process.

Basically, it lets you gather both public and private feedback from customers and team members. The platform makes creating a product roadmap easy and seamless, so it’s best used for gathering feedback for that specific purpose.

#9 Instabug

Instabug is designed to monitor mobile app performance, including bug reporting, crash reporting, feedback reporting, and of course in-app surveys.

It can automatically attach screenshots, device information, logs, as well as other critical insights that can help you solve problems as soon as possible.

However, although it can be used for collecting feedback, it’s not its only objective. So it’s only worth using for mobile apps.

#10 Usersnap

Usersnap makes it easy to add a feedback widget to your website. Here, users can provide more insightful feedback with in-app screen captures, microsurveys, and feature request boards.

It can include a feedback menu so users can choose what type of feedback to submit, screen captures with annotations (with automatic metadata like browser version, URL, screen size, etc), screen recordings, targeted in-app surveys (with segmentation), and even a public board to build a feedback-based product roadmap.

With its uniqueness, we believe Usersnap makes valuable customer feedback software for growing SaaS companies that need to analyze feedback trends and foster product improvements.

#11 Doorbell

Doorbell is a customizable feedback tool that can be manually installed on your mobile or website apps.

The fact that it’s customizable, means that you can tailor any aspect of your surveys to meet your needs. Plus you can work with your team to capture instant feedback, analyze the feedback you receive, and respond to the respondents from the same tool.

However, its reporting dashboard leaves a lot to be desired, so this tool is best used for collecting basic feedback on mobile, interacting directly with users, and customizing your surveys as you please.

#12 PollFish

PollFish is a tool that can quickly create surveys with AI. All you need to do is to type your survey goal and the AI will do the rest.

Of course, you can also create from scratch if you wish, as well as templates while getting access to plenty of advanced features for building your surveys.

Moreover, PollFish has an audience network, which means you can buy survey responses and target specific surveys to specific audiences for more relevant responses. So you can analyze responses based on various demographic contributors.

For us, Pullfish is great for building longer surveys, obtaining real-time feedback on your product concept, and using 3rd party survey distribution to get responses fast.

Conclusion

In-app feedback is essential for growing any SaaS business. And with the knowledge to add surveys inside your app, all you need to do is take action.

So choose a tool, design your in-app surveys, and start gathering customer feedback so you can stop guessing how users perceive your product.

And given that you’ll need software for this, why not try a Userpilot demo to see how quickly you can build in-app surveys that get responses?