Like an artist needs a brush, a UX researcher needs tools to get the job done. And according to the 2023 State of User Research Report, the average researcher has about 13 different tools in their belt.

But how are people actually using those tools in their research? And how do those tools work together to accomplish different outcomes?

We dug deeper into our 2023 State of User Research data to learn more about the most popular UX research software for different use cases and how recruiting habits compare between users of different recruiting tools. This info should give you a sense of which tools get the most bang for their buck and which tools are vetted, used, and loved by your peers in their day-to-day work.

Below, you’ll find an overview of the study methodology and key insights we found about the practicalities of UX research software and tooling today.

🔑 How to use this report

For our 2023 State of User Research Report, we collected 929 qualified survey responses in May of 2023 from User Researchers, ReOps Specialists, and people who do research (PwDRs) as part of their jobs. We had so much data that we decided to do two follow-up reports—the one you’re reading now and the 2023 UX Researcher Salary Report.

Throughout the survey, participants were asked to select all of the tools they use from a list of options. Unless otherwise specified, responses about which tools and use cases they used were not mutually exclusive.

Note that we treated UserTesting, UserZoom, and EnjoyHQ as individual platforms in our survey, so you’ll see them appear separately throughout this report. However, UserTesting recently acquired UserZoom and EnjoyHQ, so we will likely treat them as a single platform in future reports.

We’ve also included some data about AI tools from our recent AI in UX Research Report. This data is from a separate survey sent out in August of 2023 about the tools, habits, and sentiment of researchers regarding artificial intelligence. We received 1093 qualified responses from User Researchers, Research Ops Specialists, and people who do research (PwDRs).

Where applicable, we’ve supplemented our findings with data from the ReOps Tools Census, an ongoing community-based project highlighting the most popular UX research tools according to a survey of UX Research and Research Ops professionals. However, the ReOps Tools Census categorizes tools slightly differently than we do throughout this report, so it’s hard to make a 1-1 comparison between our data and theirs.

The 2023 UX Research Software Report was created by Product Education Manager Lizzy Burnam, Senior Data Scientist Hayley Johnson, and Head of Creative Content & Special Projects Katryna Balboni, with strategic guidance from Lead UX Researcher Morgan Mullen, and Career Coach & User Research Leader Roberta Dombrowski.

Our Senior Data Scientist Hayley did some extra slicing and dicing of the data to dive deeper into UX research tools and software for this report. The final report was authored by Lizzy and brought to life by illustrator Olivia Whitworth.

Below, you’ll find an overview of the most popular UX research software for various use cases, according to self-reported data from our 2023 State of User Research Survey. These categories include:

Later in this report, you’ll also find a deep-dive into recruiting/panel management tools and habits among researchers.

Every workplace has a set of general use tools that teams use to collaborate, communicate, and track progress.

For example, the marketing team at User Interviews makes daily use of Google Workspace, Slack, and Asana.

But of these general use tools, which ones do people use for research?

According to our survey, the three most popular general use tools that participants are using for research purposes are Google Workspace (57%), Microsoft Suite (51%), and Miro (51%). All three are used by more than 50% of our audience, and these are the only tools where that’s the case.

Two tools, in particular, stand out for having a big gap between general use and research use: Slack and Jira. Although 75% of our audience reported using Slack at work, only 33% reported using it for research purposes. Jira also had about a 41pt difference in reports of general use (60%) and research use (19%).

.jpeg)

At User Interviews, research recruiting is kind of our thing. It’s all we do, and we firmly believe we do it best.

But we understand that we’re not the only recruiting and panel management solution out there—and we were curious to know which recruiting and panel management software choices are most popular among researchers.

The top 3 in our audience:

✍️ Note: There’s almost certainly some selection bias happening here, since our survey was distributed primarily to a User Interviews audience via our weekly newsletter, Linkedin and Twitter accounts, and an in-product Appcues slideout.

For comparison, the ReOps Tools Census (not our research, not our audience) lists internal panels (39%), User Interviews (20%), and UserTesting (19%) as the most popular tools for recruiting and panel management.

For more in-depth insights on recruiting and panel management tools, keep scrolling to the Recruiting Deep-Dive section. 👇

However, it doesn’t seem like any one recruiting/panel management tool has a monopoly over the others. The majority (57%) of our audience reported using 2–3 tools for recruiting/panel management, with 27% saying they use 4 or more.

Of the 518 people for whom we had complete responses about tooling, only 2% of our audience reported using zero tools for recruiting and panel management. That might be because recruiting is one of the most painful aspects of UX research; in the 2023 State of User Research Report, 97% of researchers reported experiencing challenges during recruitment, the most common of which including finding enough participants who match their criteria (70%), slow recruitment times (45%) and too many no-shows/unreliable participants (41%).

User Interviews customers were less likely to say they experience these pain points than non-customers. If you’re struggling to find the right participants using your current recruitment tools, why not explore our in-depth Panel Report to learn more about our 3 million+ participant pool or sign up for free to try us out? We can help you access (Recruit) and manage (Research Hub) research participants quickly, reliably, and affordably.

Keep reading to learn more about recruiting tools and habits in the Recruiting Deep-Dive section. 👇

The 2023 State of User Research Report found that most people (87%) conduct a majority of their research remotely, regardless of their remote work status.

As any experienced remote worker knows, video conferencing software is an essential component of your remote work toolstack.

So, which video conferencing tools are most popular among researchers?

According to our survey, the most popular video conferencing tools are Zoom (66%), Google Meet (41%), and Microsoft Teams (34%). Less than 7% of our audience does not use at least one of these three.

Nearly half (49%) of folks are only using 1 tool for video conferencing—and of the big three, Zoom is the most likely to be used on its own without another video conferencing tool. So, while Zoom isn’t totally dominating the market here, it’s definitely the preferred video conferencing tool among researchers in our sample.

Prototyping is a critical step in the product development process. As Tom and David Kelly of IDEO said, “If a picture is worth 1,000 words, a prototype is worth 1,000 meetings.”

Researchers, UX designers, and product managers use prototypes to help stakeholders and participants visualize how the final product will look and collect early user feedback to hone designs before moving forward with development.

Among our survey audience, one prototyping tool stood out as a crowd favorite.

Figma is the most popular prototyping software—along with the company’s whiteboarding tool Figjam, it is used by a whopping 81% of our audience. This data seems to align with the ReOps Tools Census, which also lists Figma as the most popular prototyping tool, reportedly used by 84% of their census participants.

For the most part, it seems like folks are satisfied with their favorite prototyping tool; the majority of participants (64%) said they’re only using 1 tool for this use case.

📚 Related Reading: 128 Best Prototype Templates and Examples

If you’re on a team that strives to be “data-driven,” it’s likely that you have some kind of analytics tool at your disposal.

Product analytics (also called user or behavioral analytics) can be a great, low-effort way to continuously collect data about how users interact with your website and products.

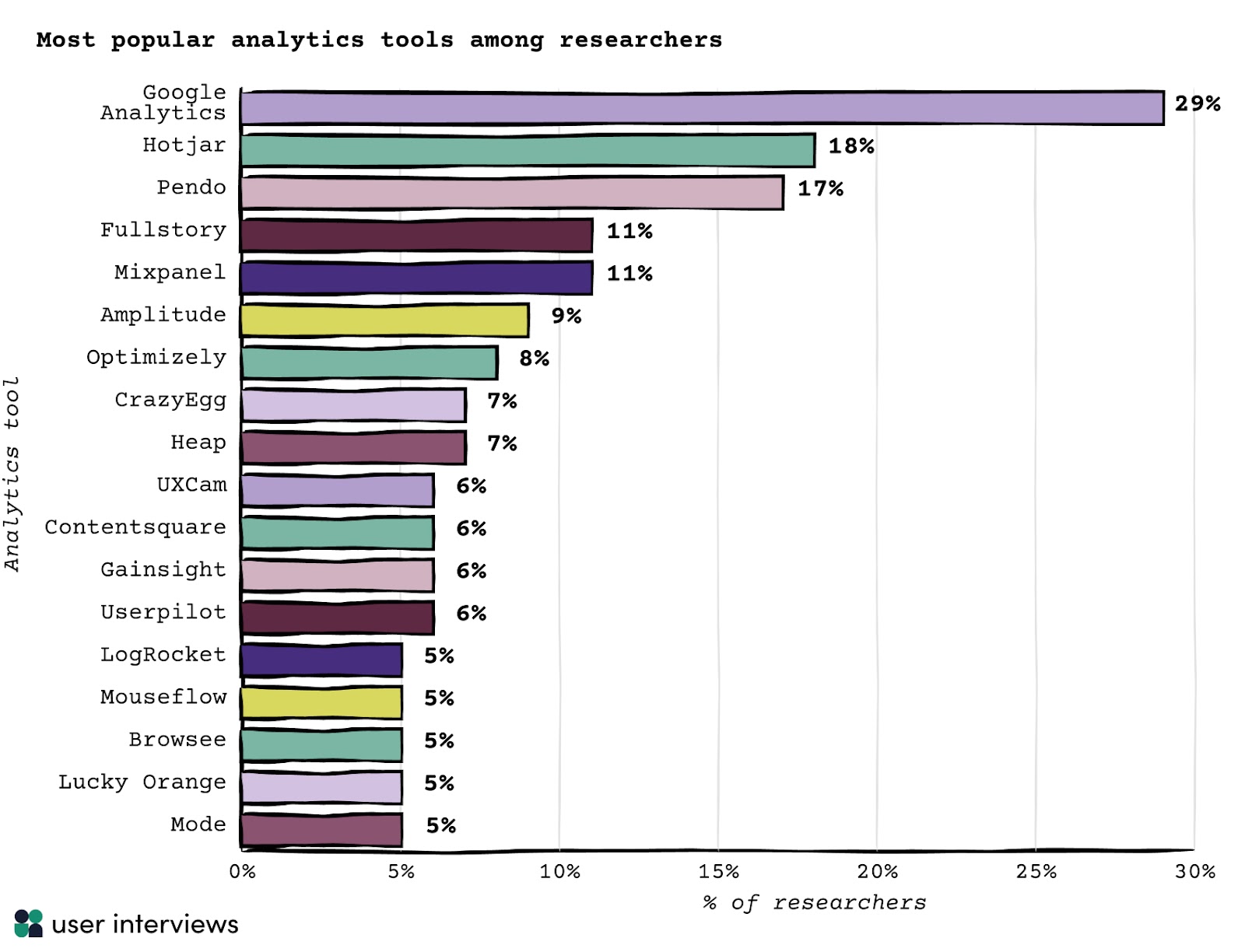

According to our survey, the most popular analytics tools are Google Analytics (29%), Hotjar (18%), and Pendo (17%).

For comparison, the ReOps Tools Census lists Dovetail as the most popular tool for sentiment analysis (13%); Hotjar as the most popular tool for heat mapping (32%); and internal tools as the most popular solution for A/B testing (14%). However, the ReOps Census segmented analytics tools by different types of analytics, whereas our survey grouped analytics tools into one segment. Because the categorization is not exact, it’s hard to make a 1-1 comparison between our data and theirs.

As you can see in the chart, there isn’t one (or a small handful) of tools that are dominating market share for analytics the same way that Figma is for prototyping or the big three for video conferencing (Zoom, Google Meet, and Microsoft Teams).

This observation seems to be backed up by the number of analytics tools researchers tend to use; a plurality (40%) report using multiple tools for this purpose (vs. 25% using only 1 and 35% using none at all).

Of the top 3 most popular analytics tools, Pendo has the highest percentage (35%) of folks who report using only 1 tool in this category. Hotjar users are more likely to use multiple tools for this purpose, with a plurality (38%) reporting using 4 or more tools for analytics. This could be because Pendo offers a more complete product analytics solution, while Hotjar has a more limited feature set.

However, of all the use cases we looked at, analytics has the highest percentage of people who are not using any tools for this, with 35% of our audience saying they use zero tools for analytics.

We didn’t segment this data by role, but this could be due to the large presence of UX Researchers in our audience; as we learned in the 2023 State of User Research Report, PwDRs (such as Designers and Product Managers) are more likely to use quantitative methods like product analytics than dedicated UXRs. And, in some cases, ownership of analytics tools might fall to the data science team instead.

A report on software for UX research wouldn’t be complete without a section on the top UXR tools among researchers.

In our sample, the most popular made-for-research tools are UserTesting (33%), Qualtrics (31%), and SurveyMonkey (28%).

As with analytics tools, there doesn’t seem to be one UXR tool dominating the market. The majority (81%) of folks reported using at least 2 made-for-research tools, most of whom (58%) are using between 2–4 tools.

🧙This data just scratches the surface of UXR software. Explore 200+ more tools in the 2022 UX Research Tools Map, a fantastical guide to the UX research tools landscape. And be sure to sign up for our newsletter to be the first to know when the 2023 Tools Map drops in October.

Unmoderated research isn’t what it used to be.

Unmoderated tooling has improved, research teams are facing greater demand with less bandwidth, and tools like User Interviews are providing more (and better) options for recruiting participants. When you have access to a reliably high-quality participant pool, you can run longer, more in-depth unmoderated studies with lower drop-off rates.

So what does the unmoderated software landscape look like for today’s researchers?

Among the researchers in our sample, the most popular tools for unmoderated studies were UserTesting (27%), Maze (13%), and Optimal Workshop (12%).

A plurality (34%) only use one tool for unmoderated studies. This tool type also had a relatively high rate of folks who weren’t using any tools for this use case; 28% of our audience reported using zero tools for this purpose. Again, this could be due to this audience’s large segment of UXRs, who are more likely to use moderated methods like 1-1 interviews, moderated usability tests, and surveys than PMs or Designers.

⭐ Learn more: Our Top 5 Features For Unmoderated Research

Moderated research—like 1:1 interviews, usability tests, and focus groups—comes with its own challenges.

Being an effective moderator requires active listening, flexibility, and balance between following your interview script and seizing in-the-moment opportunities to learn more.

And, of course, the tools you use to conduct moderated sessions can make a big difference in your success.

In our audience, the most popular UX research tools for moderated research are UserTesting (19%), UserZoom (9%), Lookback (7%), and Dscout (6%). Of these, UserTesting has the highest rate of folks (52%) using only 1 tool for moderated sessions, suggesting that UserTesting customers may be getting their moderated needs met with this tool alone.

In general, though, moderated research tools didn’t seem to be hugely popular with our audience—a plurality (42%) of researchers reported using zero UXR tools for this purpose. Perhaps our audience conducts their moderated sessions primarily over dedicated video conferencing tools instead!

👉 Great moderated research starts with great participants. Learn why User Interviews is the top-rated recruiting solution for moderated research.

Surveys are one of the easiest research methods to conduct, yet also one of the easiest methods to screw up. Using the right tools is one way to ensure you get this method right.

So which tools are researchers trusting to run their surveys?

Qualtrics (27%), SurveyMonkey (24%), and Typeform (12%) were the three most popular survey tools in our audience.

We also found that the majority of people who use Qualtrics or SurveyMonkey reported using the software on its own or with one other supplemental tool for surveys.

Our data seems to align well with the ReOps Tools Census, which lists Qualtrics (34%), SurveyMonkey (25%), Google Forms (19%), and Typeform (16%) as the most popular survey tools among researchers.

🌟 Need survey participants? We can help. Learn how (and why!) to recruit participants for usability tests and surveys with User Interviews.

Quantitative research methods are great for answering numerical questions like “how many?,” “how often?,” and “how much?”

Our 2023 State of User Research Report found that people who do research (non-UXRs, like UX Designers or Product Managers) are more likely to use quantitative methods than UX Researchers or ReOps Specialists, who seem to favor qualitative research instead.

Whichever method you prefer, it’s likely that you’ll need to perform some type of quantitative analysis at some point in your career as a researcher. So, which tools can help you do so?

According to our audience, the most popular UX research tools for quantitative analysis are Qualtrics (17%), SurveyMonkey (11%), and Optimal Workshop (11%). It seems like most people in our audience are leveraging built-in analysis tools instead of seeking out separate quantitative analysis solutions.

As our former VP of Analytics Utsav Kaushish once said, quantitative data isn’t enough.

For a true, holistic understanding of your users, you need to draw insights from a mix of both quantitative and qualitative methods.

Now that we’ve learned which tools are most popular for quantitative analysis, let’s explore the most popular tools for qualitative analysis.

Among the researchers in our audience, the most popular tools used for qualitative analysis were Dovetail (19%), UserTesting (13%), UserZoom (6%), Dscout (5%), and Qualtrics (5%).

📚 Related reading: Qualitative Coding for UX Research Analysis

Once you’ve collected user data and shared the insights with your team, what do you do with that information?

To stretch the value of that data, it helps to organize, tag, and archive it in some kind of research repository.

Although you could technically create a research repository using a general use tool like Google Workspace or Airtable, you’ll probably be able to create a more useful (and scalable) repository using one of the many made-for-research tools available.

Here are the most popular UXR tools for storing data and artifacts.

In our audience, Dovetail was by far the most popular tool for storing user research data and artifacts, used by 19% of researchers. The runner-ups include UserTesting (6%) and EnjoyHQ (5%), which are now owned by the same company, followed by Condens (4%).

Interestingly, most people (59%) reported using multiple tools for this purpose, suggesting that research data is spread across several platforms instead of in one centralized database. Although we didn’t collect this data, we’d be curious to learn more about people’s satisfaction with their archival tools and strategies—we’d guess that a centralized approach would be easier and less frustrating.

For comparison, the ReOps Tools Census lists Dovetail, Confluence, and Condens as the most popular research repository tools among their participants. However, the ReOps Census groups made-for-UXR tools and general use tools in their repository section, whereas we only included made-for-UXR tools here, so it’s difficult to make a 1-1 comparison.

📚 Related Reading: How to Organize, Automate, and Tidy Up Your User Research

In our recent 2023 AI in UX Research Report, we gathered survey responses from over 1,000 User Researchers, ReOps Specialists, and other people who do research, like UX Designers and Product Managers.

The survey asked about topics ranging from researchers’ top ethical concerns about AI to the tools and processes they’re using to incorporate AI into their research.

Many well-known and loved UX research tools have robust AI features built into their platforms. Here are the most common UXR tools with AI-powered features that researchers reported using:

Among the researchers in our audience, the most popular UXR tools with AI-powered features included HotJar (24%), Dscout (20%), Glassbox (20%), Dovetail (20%), and Notion (20%).

AI-specific tools like ChatGPT are becoming more popular and accessible among research professionals.

In our AI in UX Research survey, we distinguished between these AI-only tools and UXR software with built-in AI features to understand the intentional use of AI among researchers.

Here were the most popular AI-specific tools among our audience.

The most widely used AI-specific tool was ChatGPT, with about half (51%) of our audience saying they use it for their research. We weren’t surprised by this, since ChatGPT is one of the most well-known AI tools, causing quite the buzz across nearly every industry.

The number of participants who said they use ChatGPT was more than 3x the number of participants who said they use ClientZen (15%), the second-most popular AI-specific tool in our survey. The runner-ups included Chattermill (14%), Consensus (14%), and Otter.ai (13%).

👉 Learn more about the current state of AI in UX research, including the tools, use cases, ethical concerns, and guardrails in place for incorporating AI into research projects.

The most popular recruiting/panel management tools among our survey participants included User Interviews (53%), Respondent (21%), and HubSpot (11%).

We wanted to dig a bit deeper into the user context for different recruiting tools, to learn:

We compared the top two internal recruiting solutions (User Interviews, used by 27% of our audience and Salesforce, used by 13%) to learn which tool is more likely to be stacked with other solutions for the same purpose.

In our audience, User Interviews users were more likely to use only 1-2 tools for internal recruiting. Specifically, 40% of folks using User Interviews for internal recruiting reported only using 1 tool, compared to 30% of Salesforce users.

This could be because a purpose-built research recruiting and panel management tool like User Interviews provides a more complete solution for researchers, who are therefore less likely to branch out into using multiple tools. Because User Interviews was built for UX research, it’s more likely to meet the specific needs of researchers than a general solution like Salesforce. For example, Research Hub tracks research participation and manages incentives out of the box!

📚 Related reading: How Zendesk’s 200+ Product Org Uses Research Hub for Self-Serve Customer Recruiting

When researchers are recruiting outside their current user base, they reported being most likely to use User Interviews (40%) and Respondent (16%).

We compared these top two external recruiting solutions (User Interviews and Respondent) to learn which tool is more likely to be stacked with other solutions for the same purpose.

In our audience, 35% of folks using User Interviews for external recruiting reported using only 1 tool, compared to 29% of Respondent users who said the same. Overall, Respondent users were more likely to report using multiple tools for this purpose.

We’d wager this is because users are more likely to employ fewer tools for external recruiting when the tool(s) they do use more fully satisfy their needs.

So, it’s no surprise to us that User Interviews customers are more likely to stick with UI for external recruiting—Recruit is the fastest and easiest way to recruit participants for research, providing on-demand access to our network of over 3 million vetted participants.

⭐ Try us out (it's free to get started!) or book a demo to learn more.

As companies scale, research teams, strategies, needs, and processes necessarily evolve.

That means that recruiting solutions that work for small orgs may not hold up the same way in large, enterprise companies.

To understand how tool choices differ between small and large businesses, we looked at the popularity of recruiting/panel management tools across different company sizes.

Among the researchers in our audience, we found that small (1-199 employees) and mid-sized (200-999 employees) companies tend to use a wider range of tools. In contrast, large (1,000+ employees) companies seem to rely on a small handful of tools. The 3 dominant tools in large companies are User Interviews (56%), Respondent (18%), and Salesforce (17%).

In general, it seems like User Interviews is popular across the board, with about half of participants from each company size saying they use User Interviews. Similarly, Salesforce is equally popular across company sizes.

In contrast, Respondent’s user base seems more likely to come from companies with fewer than 200 employees—a plurality (28%) of folks from small companies reported using the tool. TestingTime, Ethnio, and Askable were also more popular at small companies than large companies.

Last year’s UX Research Tools Map included more than 230 tools—yet, it still doesn’t encompass every possible tool that might be relevant to a UX researcher.

(This year, the list has definitely grown—subscribe to our newsletter to be the first to know when the 2023 Tools Map drops!)

New tools and features crop up every year, making it impossible to compile a truly comprehensive list of options for our survey (the list we provide was already really, really long!). As expected, we received some write-in responses suggesting additional tools.

Here are some of the notable and lesser-known tools from each category, which were represented in a small number of responses or write-ins but didn’t make it into the sections above due to relative popularity.

Coda seems to be a rising star in the general purpose category, used as an alternative to better-known tools like Notion or Confluence. According to reviewers on G2, Coda is flexible, easy to learn, and provides a great solution for everyday tasks like document management.

Marvin is also becoming more prominent in the UXR world. They have a multi-use, highly integrated solution for conducting sessions, tagging and analyzing qualitative data, and sharing and storing insights. Plus, about 10% of our audience said they were using Marvin’s AI tools for qualitative analysis in our AI in UX Research survey.

📹 Curious about Marvin? Hear Marvin's CEO and Co-Founder, Prayag Narula, and User Interviews’s Group Product Manager, Paolo Appley, discuss adaptable frameworks and strategies for getting started with continuous research in our recent webinar.

We were a bit surprised to see Discord pop up for video conferencing, since it’s primarily associated with gamer communities. It’s not a standard choice for professional environments, but it seems like it’s being increasingly used for career-related purposes (such as UX communities like the Designer Buddies or the UX Growth Discord groups).

The inclusion of IBM SPSS Statistics in write-in responses suggests the presence of some highly advanced quant researchers in our audience; it’s a powerful statistical analysis tool for solving complex business and research problems.

Finally, we think it’s worth calling out Glean.ly, founded by Daniel Pidcock, one of the developers of the atomic research framework. Still in its beta phase, Glean.ly is the only repository tool built specifically for atomic research. Since most of our audience reported using multiple tools for storing data and artifacts, it seems like people haven’t found the perfect solution for this yet—maybe a tool like Glean.ly can meet that need in the future.

Notable and lesser-known tools from each category

Join over 100,000 subscribers and get the latest articles, reports, podcasts, and special features delivered to your inbox, every week.

User research tool stacks are as unique as the researchers, teams, and companies that use them. This report is by no means an exhaustive list of the UX research tools out there, nor is it an active endorsement for the most popular tools in each category.

(Unless that category is recruiting and panel management, in which case—hello! 👋 There’s a reason that User Interviews is the top-rated tool for the job: it’s literally why we exist!)

That said, considering the choices and behaviors of other experts in your field is a great place to start when evaluating different research solutions. Hopefully, this report gave you a good sense of which UX research tools have already gotten the green light from your peers!

📓 Appendix

1. In our audience, the three most popular general use tools for general use (i.e. not used for research purposes) were Slack (75%), Google Workspace (74%), and Microsoft Suite (67%).

2. We also dug into tool popularity for continuous research, and found that the top three tools for this use case were Dovetail (5%), SurveyMonkey (5%), and UserTesting (5%). Only 3% of our audience said they do not use a video conferencing tool.

3. The three tools with the widest range of usage among our audience are Dscout, UserTesting, and UserZoom. Of these, UserTesting has the fewest people only using it for one use case.

4. We found that User Interviews customers were most likely to use a self-serve recruitment tool as their primary method for recruiting outside users, while Respondent customers were more likely to employ a variety of methods like recruiting agencies, social media, email, and intercept surveys.

5. Looking at tool popularity relative to the number of studies researchers had conducted in the 6 months prior to the survey, we noticed that higher study volume seems to increase with a broader range of tools. However, we’re pretty sure there’s a relationship between company size, team size, and research volume. Thus, it's unclear without deeper analysis how many of the three really matter and which of the three.

Join over 100,000 subscribers and get the latest articles, reports, podcasts, and special features delivered to your inbox, every week.