Just about every industry has been affected by the COVID-19 pandemic, with some experiencing more dramatic impacts than others. Our colleagues over at Pendo are uniquely positioned to investigate these changes through product usage analytics. Recently, they’ve begun measuring software product usage across 40+ industries and sub-industries, based on an analysis of anonymized data across their customer base. Below, we’ll summarize the key findings by industry.

Banking and financial services

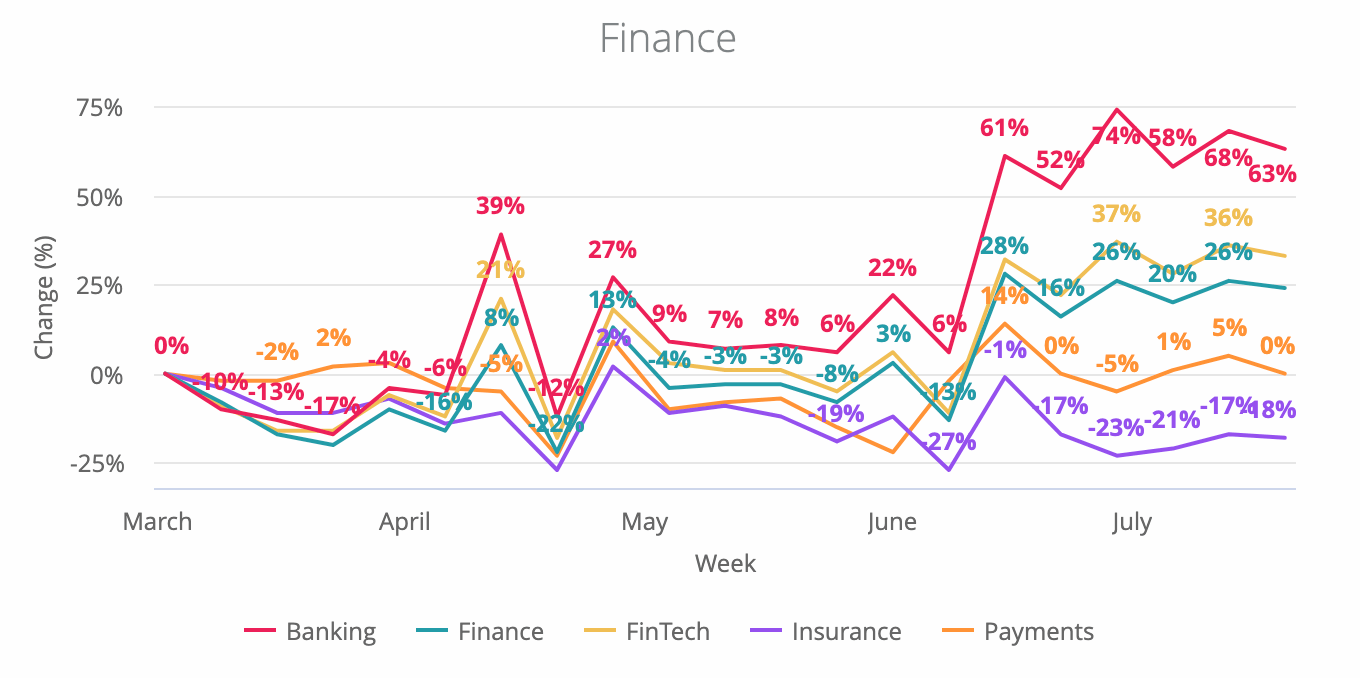

With brick-and-mortar branches closing or operating at limited capacity, many customers have had no choice but to take their business to their bank’s digital experience. This has led to an increase in banking software usage, particularly during the week of April 13. That week, stimulus checks landed in the accounts of millions of Americans, and the banking software industry saw a dramatic increase of 39% from its baseline.

Banking product usage remains up since March 1 (our baseline date), even as stay-at-home orders are lifting in several states. However, other segments of the financial services investment haven’t been so lucky. Finance, payments, fintech, and insurance have seen their usage plateau or slow during the pandemic.

As a result, we expect to see more and more banks making significant investments in digital transformation and improving their online products. In fact, early reports from Key Bank, Bank of America, and Fidelity indicate that this shift to digital banking will continue well into the future.

Edtech and e-learning

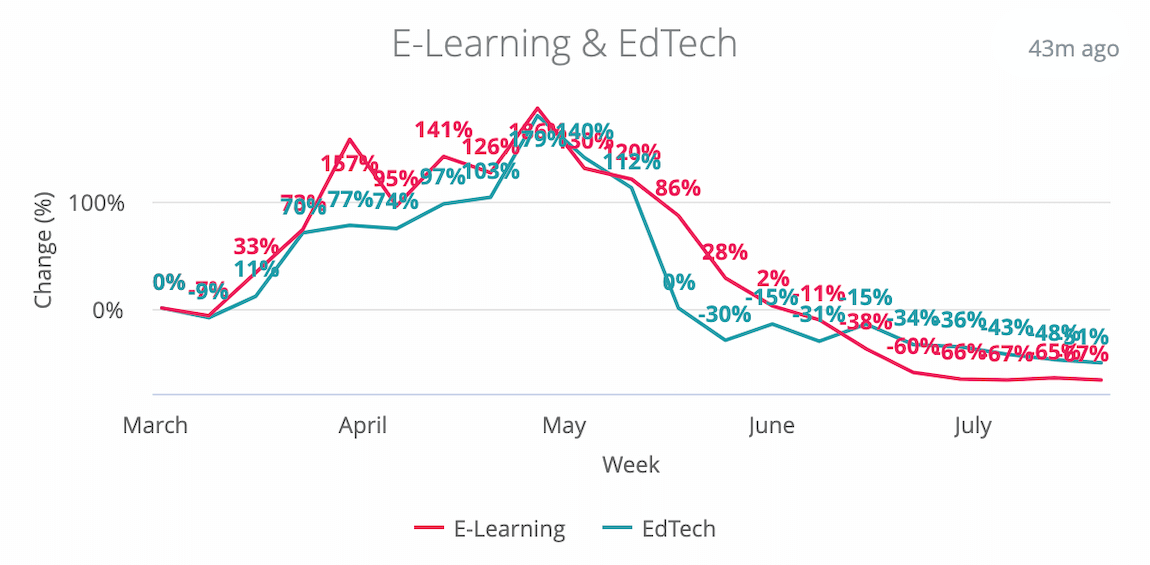

You’d be hard-pressed to find an industry that’s been more positively impacted by the COVID-19 crisis than edtech. Globally, ninety percent of students are out of school (including university students), leading to a massive increase in demand for distance learning tools. At its peak in May, e-learning software product usage increased by a massive 167% from its baseline on March 1.

As we’ve moved into the summer months, product usage has understandably decreased. However, we predict another large usage increase when the new school year begins in September.

Govtech

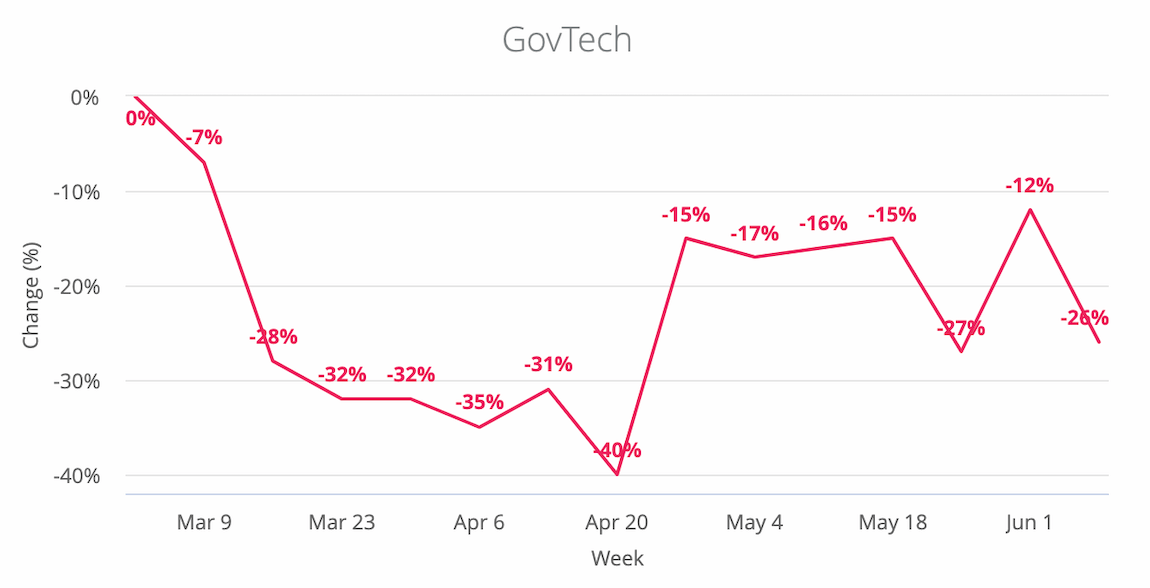

Govtech software powers many of the systems that run city life, from transportation to maintenance. As stay-at-home orders took effect across the US in March and April, usage plummeted by 40% from baseline levels.

Since then, the industry has seen some movement toward pre-COVID usage levels, although recovery has been slow.

Healthcare

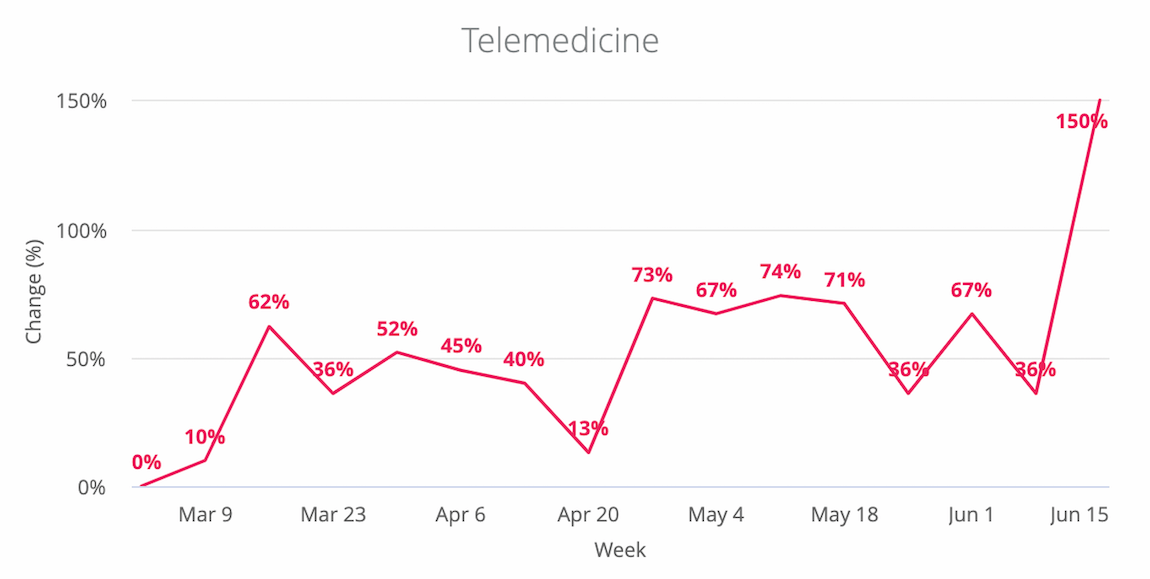

The COVID-19 pandemic has put unprecedented strain on the healthcare industry. To slow the spread of the virus, doctor’s offices have closed or reduced capacity, hospitals have postponed elective procedures, and patients are putting off appointments. As a result, healthcare software product usage rates have decreased, with one exception: telemedicine.

Even after the coronavirus crisis passes, telemedicine may remain popular. Seventy-six percent of telehealth users said they’d definitely use it again.

Manufacturing

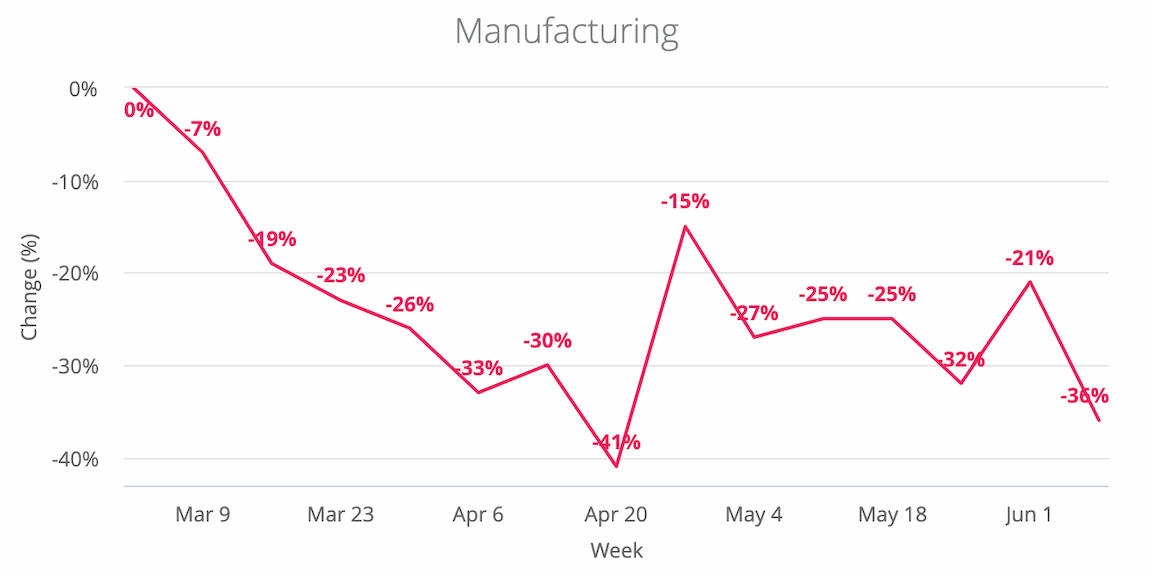

Software providers that support the manufacturing industry have seen a dramatic decrease in usage due to the COVID-19 pandemic.

At its lowest point in April, manufacturing software usage had decreased 41% from its baseline level. Since then, usage rates haven’t even come close to pre-COVID numbers.

Marketing

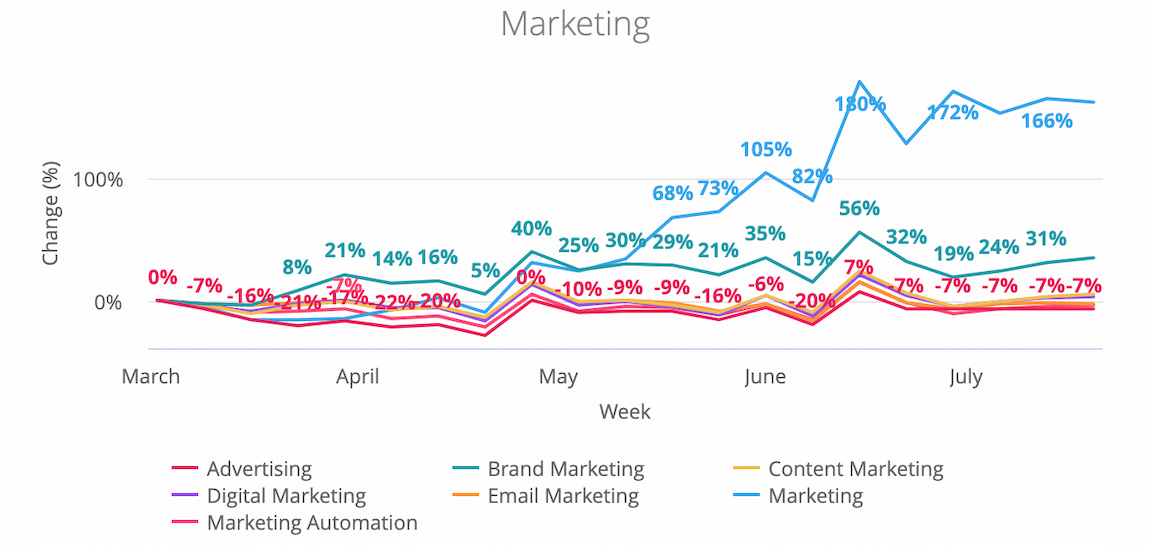

“Marketing” encompasses a wide range of specializations, including advertising, digital marketing, marketing automation, content marketing, and more. And the data shows the very different effects the pandemic has had on these various sub-industries.

With budgets tight, it looks like marketing teams are spending less money on advertising and digital marketing efforts and instead investing their resources on content and brand plays.

Real estate

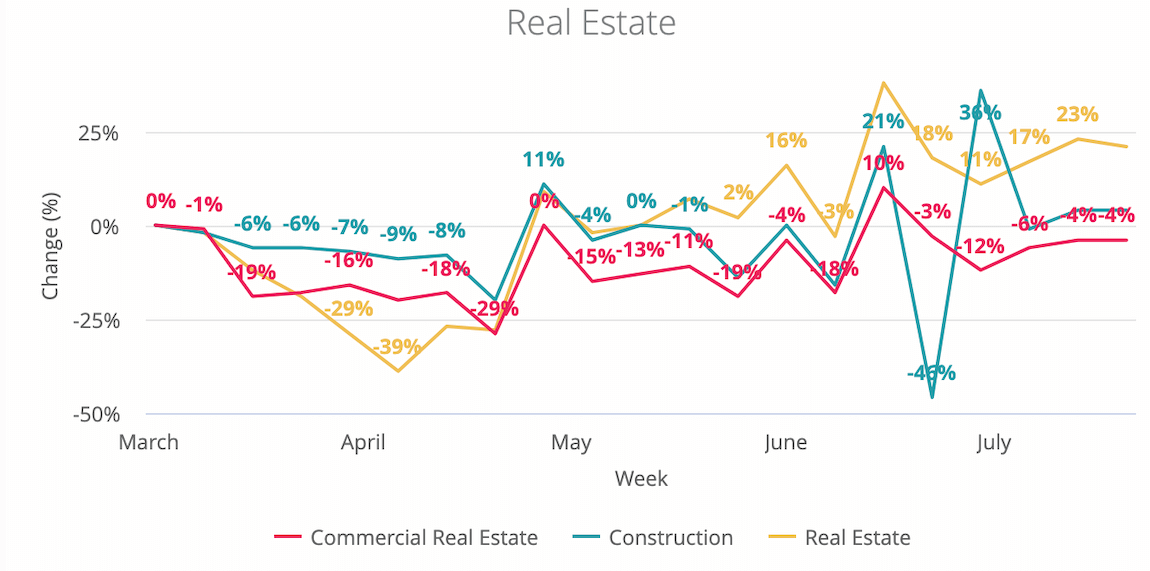

When the COVID-19 crisis first hit and stay-at-home orders went into effect, the real estate industry saw a sharp decrease in software product usage. And in early July, the construction industry saw its most dramatic usage decrease of 46% from pre-COVID levels.

However, things began to turn a corner in May, at least for the real estate segment, as the spring homebuying season began.

Restaurants and hospitality

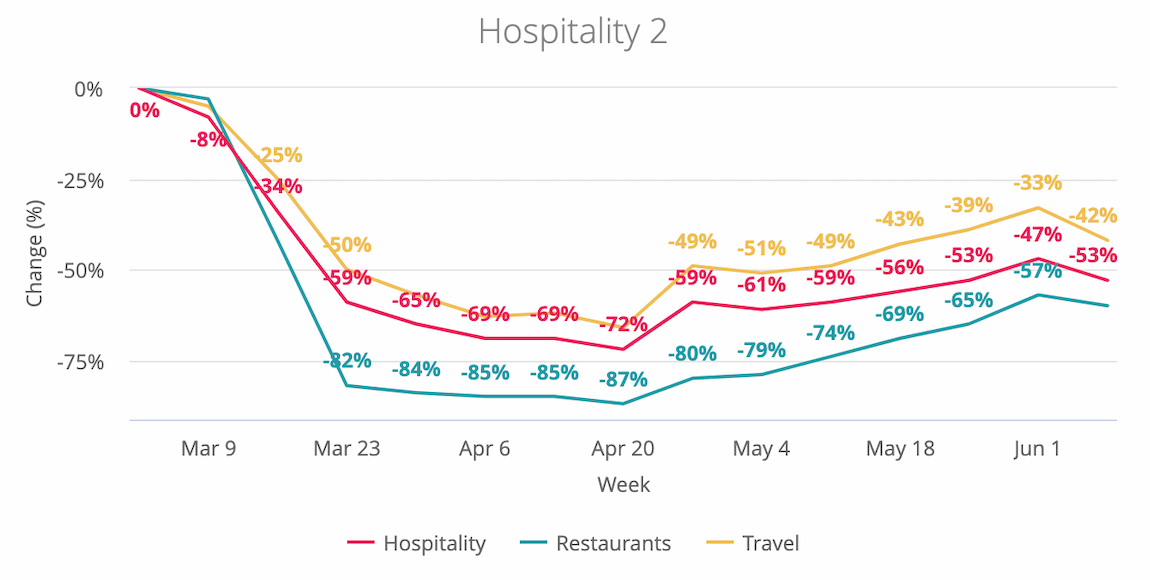

Both the restaurant and hospitality industries have taken massive hits due to the COVID-19 crisis. For example, usage rates dropped by over 70% across hospitality, restaurants, and travel segments by mid-April.

However, as lockdown restrictions have loosened, restaurant and hospitality product usage rates have started to recover, although they remain far below baseline levels.

Shipping and retail/e-commerce

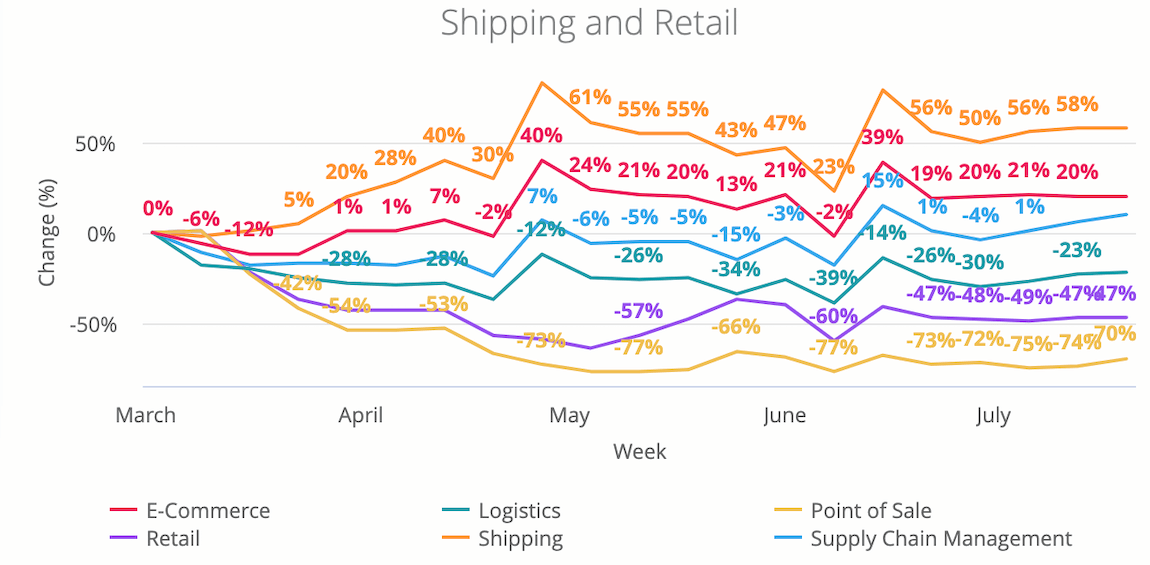

As physical retail locations close or cut back on capacity, e-commerce is attempting to pick up the slack. E-commerce product usage levels remain far above baseline even as some retail restrictions are easing. And e-commerce relies on shipping, which has also seen impressive increases in usage due to the pandemic.

Overall, retail product usage is well below pre-COVID rates, with the growth in e-commerce insufficient to make up for the huge decreases in point of sale and logistics.

For more insights into how the coronavirus pandemic is affecting software product usage across industries, visit the Pendo blog.