How to get started with a competitive positioning strategy

Georgina Guthrie

September 22, 2021

Whether you’re an established company with a new product or a brand-new startup, knowing where you fit in the market is vital.

Without this knowledge, you could end up sinking hundreds, thousands — or even millions of dollars into a product or service that no one actually wants (looking at you, Google Glass). Of course, wasting money on an unwanted venture is the worst-case scenario. You might end up investing and floating, but only just — which isn’t an ideal place to be in either.

Competitive positioning is a way to assess the market, suss out your competition, and work out whether your offering is a viable means of making money. It’s no small task — so here’s a guide to help you through. Let’s get started!

Research part 1: Qualitative research for competitive positioning

Any good positioning strategy begins with plenty of research. This means evaluating your competitors, assessing the market size, and looking for opportunities. This will help you work out whether there’s a market for your product and the potential for sales. That goes for both now and in the future; plus, what factors will influence these things.

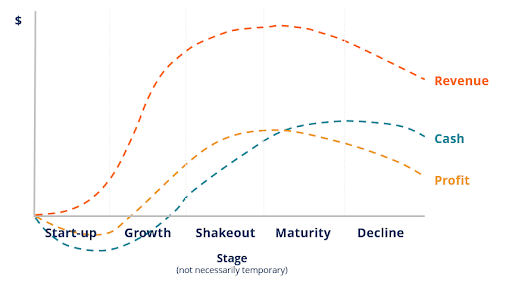

It’s essential to work out which stage of the lifecycle your market is in because that will help you tailor your positioning approach.

For example, if this is a new market, you might need to focus on educating your audience. Or, if you’re entering an established market that already knows about your offering, you might want to focus on competing on price or features.

The bottom line? Your positioning strategy is about finding your space in the market and focusing your efforts on making that space yours.

It’s one of the most important decisions you can make and will form the foundation of your marketing strategy — so it’s important to give it plenty of care and attention. In fact, you shouldn’t enter the market until you’ve figured it out — so this bit should come before anything else. Let’s look at how to conduct market research in a little more detail.

1. Define your market size

During this stage, you’ll want to ask yourself three questions:

- What’s the size of the market

- Who is your audience?

- What does your typical customer look like?

The first step here is in working out how big the market is. You can do this via market data, industry reports, conversations with industry experts, your own knowledge, etc… the more sources you can turn to, the better.

If you’re researching multiple markets, verticals, or sub-markets, you’ll need to repeat this task for each one.

Online resources to get you started:

Offline resources include:

- Professional trade organizations

- Professional industry associations

- Analyst reports

- Chambers of commerce

Top Tip: If you’re short on time — which may happen if the industry moves quickly — consider beginning with broad strokes and estimates, then adding more detail later. You may also want to buy industry reports or consider hiring an external research company. Of course, if you’re entering a new market, you can’t do anything but estimate. In this instance, think about how the market might look five, 10 years ahead.

2. Define your customer

Getting to know your typical customer will help you tailor your marketing strategy.

- For a B2B customer, you’ll want to know the size of your target business, what it does, its annual revenue, the department that makes the decision, key decision-makers, and its geography.

- For B2C, you’ll need to find out things like age, location, marital status, education, income, ethnicity, religion, and other demographic details.

3. Define your market characteristics

Next, you need to figure out what your market currently looks like — and where you think it’s heading. This will be a combination of research and educated guesswork. Here are some questions to ask yourself:

- Is your market growing, stable, or shrinking?

- Are customers actively seeking out your product or service?

- Do customers know how your product will solve their problems?

- What’s currently influencing your market? (trends, legislation, tech breakthroughs, etc.)

- Who are your key decision-makers, and how will their needs change over time?

- What type of problem are you tackling? Does your market know it has a problem? You might want to break this down into percentages:

- First, people/companies actively seeking a solution

- Secondly, people/companies who want a solution,but aren’t actively seeking

- Thirdly, people/companies with a pain point but not looking for a solution

- Lastly, people/companies with no problem who aren’t looking

- Trends: Is the industry moving toward a new type of solution that might mean you could charge more for your product?

4. Define your competitive positioning approach

Based on your knowledge of the market, which approach is best? Here are some general tips:

- Startup: As a pioneer, you need to focus on creating a market for your product. This includes building awareness for the solution rather than promoting your features over other options. Promote your category rather than your product, and get early adopters on your side.

- Growth: Your goal here is to pull ahead of your competitors by building a preference for your product. Focus on why your audience should choose you over your competitors and build a strong brand.

- Maturity: When you’re in a crowded market, price becomes a crucial differentiator because there are fewer differences, feature-wise, in the products/services offered. Your positioning will still show why your products are better, but prices will place a more prominent role.

- Decline: During the phase, your competition decreases as bigger companies leave for new markets. You can either jump ship too, continue to focus on price, or innovate and create new niches to boost your market share.

Research part 2: Qualitative research for competitive positioning

Quantitative research is all about getting to know the numbers. Qualitative research is all about stepping into your audience’s mind — including behaviors, decision-making, attitudes, and needs. These are known as ‘psychographics.’ Understanding what makes your audience tick will play a key role in your messaging.

During this phase, you’ll get to know exactly what your target audience’s problem is and how you’ll be able to solve it.

Qualitative research options in competitive positioning (and their pros and cons)

Qualitative research, unlike quantitative, is more personal. It often involves studying a person, or a handful of people, who represent the ‘average’ customer in your target market. Because it’s in-depth, it tends to be more expensive and time-consuming. You’ll only be able to gather data from a small number of people, which is why it’s necessary to combine it with quantitative data for a fuller picture. Here are two of the most popular options.

Focus groups

Focus groups are a popular B2C method of data collection. It’s best for testing ideas and hearing feedback. Typically, groups are between five and 15 people and can last one or more sessions.

During the session, you’ll be able to hear people’s feedback and get to know far more detailed information than you could gather using a survey.

Here are some pointers for running your own focus group:

- Pre-prepare your questions

- Invite the right mix of people. These should include an average audience persona, as well as the extremities of your range.

- Plan the session structure, including timings, breaks, locations, equipment, lunch, and so on.

- Facilitate the meeting, being sure to ask the right questions, avoid groupthink, and give everyone the space to talk.

- Record your observations, and explain data/security protocols to attendees so they know how you will use their information.

One-on-one interviews

One-on-one interviews take much the same format as a focus group, but they’ll typically be more in-depth. They’re especially useful when getting to know how a person might use your product. As with focus groups, good preparation, structure, and careful questioning will be key to getting the best results.

Analysis

Once you’ve gathered all your data, you’ll need to bring it together and analyze it. This will shape your positioning and approach, so it’s important to give it due care and attention. Here are some ways you can distill your data and turn it into something more tangible:

- Create buyer personas: This is a fictional representation of your typical customer. User personas make it easier to address the specific problems and needs — which improves the quality of your messaging.

- Segment your market: Sometimes, one buyer persona isn’t enough. Splitting your market into smaller subgroups is ideal for those with a more diverse customer base. After segmenting your market, you may want to create buyer personas for each segment.

Here are some typical questions you’ll want to address when creating your user persona(s):

- What are their characteristics (age, location, income, role in the company, etc.) These will vary depending on whether your target audience is B2B or B2C.

-

- How do your prospects currently attempt to solve their problem?

- What do they need to solve their problem?

- How do your competitors solve this problem?

- What do they get from you that they don’t get anywhere else?

- What’s their primary purchase motivation?

- Is there a difference between the way all three groups solve the problem?

- How valuable are you to your customers (from their POV)

- What do your prospects value most?

- What do they currently buy from you? (if anything)

- How will they use your product? (frequency, rate, loyalty, etc.)

- What are their emotional triggers? (e.g., peers, time, status, etc.)

Once you’ve fully defined your segments and/or buyer personas, you’ll have a focused way to talk to your audience. Use this to guide your marketing efforts — it’ll help you speak clearly and consistently to your users.

Perform a competitor landscape analysis

Evaluating your competition will help you further understand your niche, what you’re up against, and what your unique selling points (USPs) are. It should also shine a light on new opportunities — both gaps in the marketplace and areas where your competitors are falling short. Here’s how to get started for your competitive positioning.

1. Research your competition, including:

- Direct competitors are those who sell the same product or service as you

- Secondary competitors are those with something similar, but with slightly different features, or to a different market

- Tertiary competitors are those who sell something completely different, but that could be an alternative if your product isn’t available.

You might already have some names in mind, but you might be able to uncover more if you step into the shoes of your prospects. Do some research in your industry and pretend you’re looking for a service or product like yours. What comes up? These are your competitors.

2. Analyze their products/services and marketing efforts

Here are some features you might want to think about when assessing your competition:

- Product/service features

- Effectiveness

- Price

- Customer service

- Market share

- Innovation

- Distribution channels

- Name recognition

- Cool factor

- Corporate citizenship and environmental responsibility

- Financial strength

Rate your competitors on a scale of 1-10 for their strengths in the above categories. Then, rate yourself. Can you improve your scores in certain areas? Where are your competitors weak across the board — is that an opportunity you can grasp? Analyze the numbers and look out for opportunities along the way.

- Check out our full guide to performing a competitor landscape analysis

3. Run a SWOT analysis

Now it’s time to analyze your competitors’ strengths and weaknesses, as well as your opportunities and threats.

Take a look at what your competitors are doing well and not so well. Do they have a great rewards scheme, but their blog isn’t so good? How about pricing, marketing, customer service? These kinds of things all belong on your SWOT diagram.

- Check out our guide to creating a SWOT chart for hints and tips on how to get started

By looking into where your competitors focus their efforts, you can more easily spot where you fit in, what gaps you can fill, and how you need to compete with those around you.

4. Define your USP

Now it’s time to work out how you can deliver value to your prospects. Are you faster, more complete, or cheaper? During this phase, focus on your brand positioning, pricing, value, distribution, and messaging. You won’t choose all three: Usually, companies aim for one, or a primary one and a secondary one.

Identifying your propositioning will help you shape your marketing decisions, creative, brand, and company ethos.

As part of this exercise, take a look at your competitor’s propositions, and rate their ability to deliver on their promises. Then look at your own ability: Do you stand out, or do you blend in? If you answered yes to the latter, think about how you might change your proposition to ensure you stand out.

Your brand proposition should be something you want to be known for and a guiding light for getting there. Every decision you make should lead toward you achieving this statement.

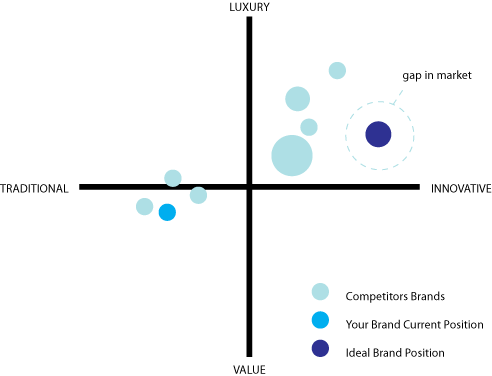

You may want to create a positioning map to help you visualize where you fit in among your competitors.

They’re straightforward to make: Grab paper and pen or open up a blank canvas on your diagramming software (our recommended option) and divide your page into four. Name your X and Y axis with relevant things to your market, then plot your competitors on the page according to how more or less they fit the X and Y axis labels.

Once you’ve visualized where you fit in, you might find you spot a gap you’d prefer to occupy than the space you’re currently in. Or you might find out you’re already in a good space and decide to stay there. If it’s the former, take note and make this a part of your long-term strategy.

Final thoughts

Defining your competitive positioning is a vital part of entering a market. If you skip it, the chances of you sinking large sums of money (not to mention wasting time) skyrocket. Performing a proper analysis of the market and your competitors is a key part of working out whether there’s a market to sell to in the first place. Plus, it also helps you focus on your brand positioning, besides your competitive positioning, and understand what you have to offer in a little more clarity.

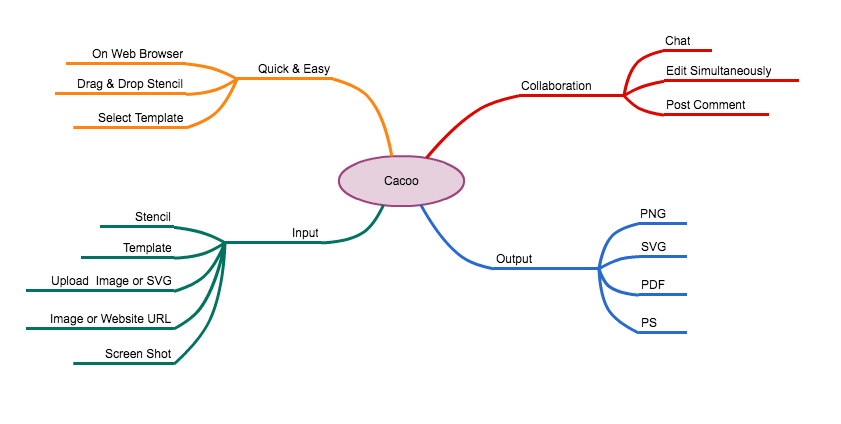

Research is a big job. Using collaboration tools can help bring the team together during your competitive positioning journey. Cloud-based diagramming tools and project management software are particularly helpful here: Simply create a job on your project management platform, then add all the necessary documents and diagrams. Invite relevant team members to view your research, then present it back to the wider team once you’re ready to put your plan into action and start taking your share of the market.