Applying Neuromarketing to Elevate the Digital Banking User Experience

UX Planet

MAY 1, 2025

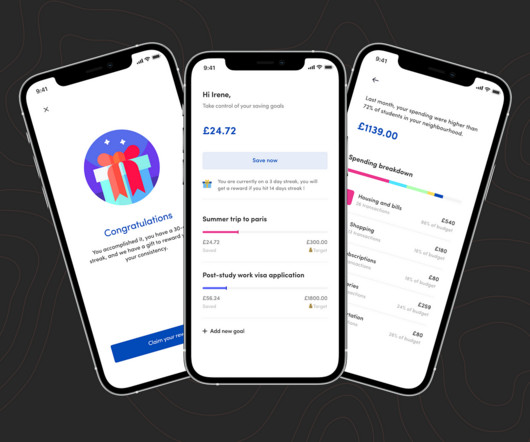

Written by Alex Kreger and UXDA team Digital banking has undergone significant transformation over the past decade, yet many users still experience stress and confusion when managing their finances online. In digital banking, small positive experienceslike celebrating a $5 savingscan have a surprisingly big impact.

Let's personalize your content